Amer Sports (NYSE:AS - Get Free Report) had its target price upped by equities research analysts at UBS Group from $27.00 to $37.00 in a research report issued to clients and investors on Tuesday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. UBS Group's price target points to a potential upside of 28.74% from the company's previous close.

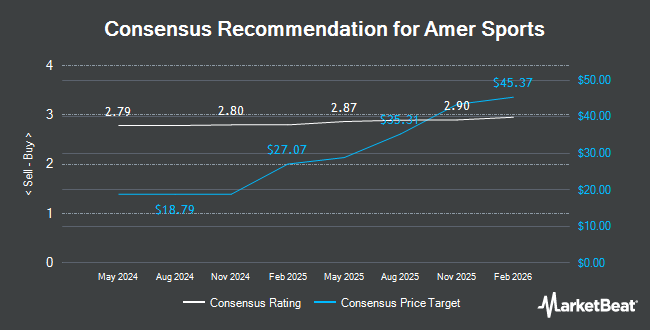

Several other equities research analysts have also issued reports on the stock. Wells Fargo & Company lifted their price target on shares of Amer Sports from $19.00 to $20.00 and gave the company an "equal weight" rating in a research note on Wednesday, November 20th. Robert W. Baird increased their price objective on Amer Sports from $24.00 to $30.00 and gave the company an "outperform" rating in a report on Monday, December 9th. Hsbc Global Res downgraded shares of Amer Sports from a "strong-buy" rating to a "hold" rating in a report on Monday. The Goldman Sachs Group upped their price target on shares of Amer Sports from $24.00 to $28.00 and gave the stock a "buy" rating in a research report on Tuesday, December 10th. Finally, Morgan Stanley boosted their price objective on shares of Amer Sports from $15.00 to $19.00 and gave the stock an "equal weight" rating in a research note on Wednesday, November 20th. Five analysts have rated the stock with a hold rating, ten have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $24.79.

Check Out Our Latest Stock Analysis on Amer Sports

Amer Sports Trading Up 3.9 %

Shares of Amer Sports stock traded up $1.09 during trading on Tuesday, hitting $28.74. 3,333,352 shares of the company were exchanged, compared to its average volume of 1,922,698. The firm's fifty day moving average price is $21.39 and its 200 day moving average price is $16.21. The firm has a market capitalization of $15.70 billion and a P/E ratio of -208.21. Amer Sports has a 1-year low of $10.11 and a 1-year high of $29.43. The company has a debt-to-equity ratio of 0.58, a current ratio of 1.62 and a quick ratio of 0.77.

Institutional Inflows and Outflows

Hedge funds have recently added to or reduced their stakes in the business. Signaturefd LLC acquired a new stake in Amer Sports during the third quarter worth about $49,000. Quarry LP acquired a new stake in shares of Amer Sports during the 3rd quarter worth approximately $61,000. CWM LLC purchased a new position in shares of Amer Sports during the 3rd quarter valued at approximately $73,000. Amalgamated Bank acquired a new position in shares of Amer Sports in the 2nd quarter valued at $83,000. Finally, Virtu Financial LLC purchased a new stake in Amer Sports during the third quarter worth $167,000. 40.25% of the stock is owned by institutional investors and hedge funds.

Amer Sports Company Profile

(

Get Free Report)

Amer Sports, Inc designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, China, and the Asia Pacific. It operates through three segments: Technical Apparel, Outdoor Performance, and Ball & Racquet Sports.

Read More

Before you consider Amer Sports, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amer Sports wasn't on the list.

While Amer Sports currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.