The Goldman Sachs Group restated their neutral rating on shares of American Airlines Group (NASDAQ:AAL - Free Report) in a research note released on Friday morning, Marketbeat.com reports. The brokerage currently has a $15.00 target price on the airline's stock.

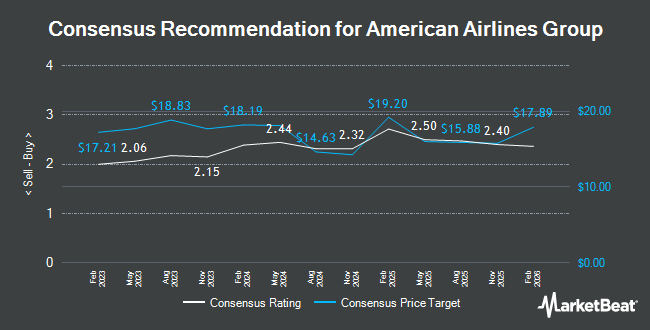

Several other analysts have also recently weighed in on the stock. Evercore ISI upped their price objective on shares of American Airlines Group from $10.00 to $12.00 and gave the stock an "in-line" rating in a research note on Thursday, October 3rd. Bank of America raised their price target on shares of American Airlines Group from $9.00 to $10.00 and gave the company an "underperform" rating in a report on Friday, October 25th. Sanford C. Bernstein lowered American Airlines Group from an "outperform" rating to a "market perform" rating and decreased their price objective for the company from $18.00 to $12.00 in a research report on Monday, July 22nd. Jefferies Financial Group increased their price objective on shares of American Airlines Group from $10.00 to $11.00 and gave the company a "hold" rating in a report on Wednesday, October 2nd. Finally, BNP Paribas upgraded American Airlines Group to a "hold" rating in a report on Thursday, September 19th. One investment analyst has rated the stock with a sell rating, ten have given a hold rating and six have given a buy rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $13.96.

View Our Latest Research Report on American Airlines Group

American Airlines Group Trading Up 0.9 %

NASDAQ:AAL traded up $0.13 during mid-day trading on Friday, hitting $14.39. The company's stock had a trading volume of 22,698,541 shares, compared to its average volume of 34,316,820. American Airlines Group has a fifty-two week low of $9.07 and a fifty-two week high of $16.15. The company has a market capitalization of $9.46 billion, a price-to-earnings ratio of 43.21, a P/E/G ratio of 0.25 and a beta of 1.39. The stock has a fifty day moving average of $12.14 and a 200-day moving average of $11.76.

American Airlines Group (NASDAQ:AAL - Get Free Report) last issued its quarterly earnings data on Thursday, October 24th. The airline reported $0.30 earnings per share for the quarter, topping the consensus estimate of $0.16 by $0.14. The firm had revenue of $13.65 billion for the quarter, compared to analysts' expectations of $13.50 billion. American Airlines Group had a net margin of 0.51% and a negative return on equity of 18.62%. The company's quarterly revenue was up 1.2% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.38 earnings per share. On average, equities analysts anticipate that American Airlines Group will post 1.49 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Several institutional investors have recently made changes to their positions in AAL. Beaird Harris Wealth Management LLC increased its holdings in shares of American Airlines Group by 51.3% during the 1st quarter. Beaird Harris Wealth Management LLC now owns 2,345 shares of the airline's stock worth $36,000 after acquiring an additional 795 shares during the last quarter. Blue Trust Inc. increased its holdings in shares of American Airlines Group by 56.2% during the 3rd quarter. Blue Trust Inc. now owns 2,533 shares of the airline's stock worth $29,000 after acquiring an additional 911 shares during the last quarter. UMB Bank n.a. increased its holdings in shares of American Airlines Group by 404.3% during the 2nd quarter. UMB Bank n.a. now owns 2,824 shares of the airline's stock worth $32,000 after acquiring an additional 2,264 shares during the last quarter. Sentry Investment Management LLC acquired a new position in shares of American Airlines Group during the 2nd quarter worth approximately $36,000. Finally, ORG Partners LLC acquired a new position in shares of American Airlines Group during the 2nd quarter worth approximately $36,000. Institutional investors and hedge funds own 52.44% of the company's stock.

American Airlines Group Company Profile

(

Get Free Report)

American Airlines Group Inc, through its subsidiaries, operates as a network air carrier. The company provides scheduled air transportation services for passengers and cargo through its hubs in Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, DC, as well as through partner gateways in London, Doha, Madrid, Seattle/Tacoma, Sydney, and Tokyo.

Featured Stories

Before you consider American Airlines Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Airlines Group wasn't on the list.

While American Airlines Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.