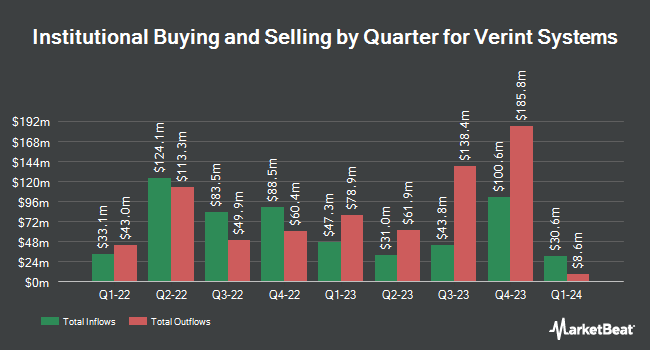

American Capital Management Inc. lowered its holdings in Verint Systems Inc. (NASDAQ:VRNT - Free Report) by 94.9% in the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 60,758 shares of the technology company's stock after selling 1,133,425 shares during the quarter. American Capital Management Inc. owned approximately 0.10% of Verint Systems worth $1,539,000 at the end of the most recent reporting period.

Other hedge funds have also recently modified their holdings of the company. Victory Capital Management Inc. raised its stake in Verint Systems by 5.9% in the second quarter. Victory Capital Management Inc. now owns 4,143,227 shares of the technology company's stock worth $133,412,000 after buying an additional 232,499 shares in the last quarter. Dimensional Fund Advisors LP raised its position in shares of Verint Systems by 4.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,918,925 shares of the technology company's stock worth $61,792,000 after acquiring an additional 73,441 shares in the last quarter. Fisher Asset Management LLC lifted its stake in shares of Verint Systems by 26.5% during the 3rd quarter. Fisher Asset Management LLC now owns 1,516,409 shares of the technology company's stock worth $38,411,000 after purchasing an additional 317,804 shares during the last quarter. Global Alpha Capital Management Ltd. lifted its stake in shares of Verint Systems by 22.6% during the 3rd quarter. Global Alpha Capital Management Ltd. now owns 1,231,703 shares of the technology company's stock worth $31,199,000 after purchasing an additional 227,000 shares during the last quarter. Finally, Fort Washington Investment Advisors Inc. OH grew its stake in Verint Systems by 35.1% in the second quarter. Fort Washington Investment Advisors Inc. OH now owns 814,959 shares of the technology company's stock valued at $26,242,000 after purchasing an additional 211,570 shares during the last quarter. Hedge funds and other institutional investors own 94.95% of the company's stock.

Verint Systems Stock Performance

Shares of VRNT stock traded up $0.61 during mid-day trading on Friday, reaching $25.20. The stock had a trading volume of 357,990 shares, compared to its average volume of 640,836. The company has a current ratio of 1.41, a quick ratio of 1.36 and a debt-to-equity ratio of 0.49. Verint Systems Inc. has a 1-year low of $21.27 and a 1-year high of $38.17. The firm has a market cap of $1.56 billion, a price-to-earnings ratio of 37.61, a PEG ratio of 1.07 and a beta of 1.25. The business's fifty day moving average is $23.62 and its 200-day moving average is $29.03.

Verint Systems (NASDAQ:VRNT - Get Free Report) last posted its quarterly earnings results on Wednesday, September 4th. The technology company reported $0.49 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.53 by ($0.04). Verint Systems had a return on equity of 16.17% and a net margin of 6.78%. The business had revenue of $210.17 million for the quarter, compared to analysts' expectations of $212.81 million. During the same period in the prior year, the business posted $0.22 earnings per share. The business's quarterly revenue was up .0% compared to the same quarter last year. On average, research analysts forecast that Verint Systems Inc. will post 1.97 earnings per share for the current year.

Analyst Ratings Changes

Several analysts have commented on VRNT shares. Evercore ISI decreased their price target on shares of Verint Systems from $34.00 to $30.00 and set an "in-line" rating for the company in a research report on Thursday, September 5th. Needham & Company LLC restated a "buy" rating and issued a $40.00 target price on shares of Verint Systems in a research note on Wednesday, September 25th. Jefferies Financial Group reduced their price target on Verint Systems from $32.00 to $28.00 and set a "hold" rating on the stock in a research report on Thursday, September 5th. Royal Bank of Canada reissued an "outperform" rating and issued a $36.00 price objective on shares of Verint Systems in a research report on Thursday, September 5th. Finally, Wedbush reaffirmed an "outperform" rating and set a $38.00 target price on shares of Verint Systems in a research report on Thursday, September 26th. Three research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $34.67.

Get Our Latest Stock Analysis on VRNT

Insider Activity at Verint Systems

In other news, CFO Grant A. Highlander sold 3,389 shares of the business's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $25.85, for a total value of $87,605.65. Following the completion of the transaction, the chief financial officer now owns 131,267 shares of the company's stock, valued at $3,393,251.95. The trade was a 2.52 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, insider Peter Fante sold 6,330 shares of the company's stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $25.85, for a total value of $163,630.50. Following the completion of the sale, the insider now owns 91,334 shares in the company, valued at $2,360,983.90. The trade was a 6.48 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 33,811 shares of company stock worth $874,014 over the last three months. Company insiders own 1.70% of the company's stock.

About Verint Systems

(

Free Report)

Verint Systems Inc provides customer engagement solutions worldwide. It offers forecasting and scheduling, channels and routing, knowledge management, fraud and security solutions, quality and compliance, analytics and insights, real-time assistance, self-services, financial compliance, and voice pf the consumer solutions.

Recommended Stories

Before you consider Verint Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verint Systems wasn't on the list.

While Verint Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.