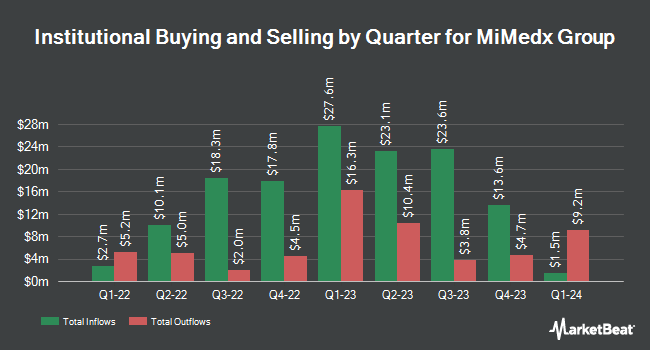

American Century Companies Inc. boosted its position in shares of MiMedx Group, Inc. (NASDAQ:MDXG - Free Report) by 28.2% during the 4th quarter, according to its most recent 13F filing with the SEC. The fund owned 199,069 shares of the company's stock after purchasing an additional 43,795 shares during the quarter. American Century Companies Inc. owned about 0.14% of MiMedx Group worth $1,915,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also bought and sold shares of MDXG. Geode Capital Management LLC grew its holdings in MiMedx Group by 1.6% during the third quarter. Geode Capital Management LLC now owns 2,794,358 shares of the company's stock valued at $16,518,000 after purchasing an additional 44,254 shares during the period. Charles Schwab Investment Management Inc. grew its stake in shares of MiMedx Group by 6.9% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,435,397 shares of the company's stock valued at $8,483,000 after acquiring an additional 92,726 shares during the period. Bank of New York Mellon Corp increased its holdings in MiMedx Group by 0.7% in the 4th quarter. Bank of New York Mellon Corp now owns 504,007 shares of the company's stock worth $4,849,000 after acquiring an additional 3,300 shares in the last quarter. Disciplined Growth Investors Inc. MN increased its holdings in MiMedx Group by 0.8% in the 3rd quarter. Disciplined Growth Investors Inc. MN now owns 355,387 shares of the company's stock worth $2,100,000 after acquiring an additional 2,737 shares in the last quarter. Finally, Wellington Management Group LLP raised its stake in MiMedx Group by 11.8% during the 3rd quarter. Wellington Management Group LLP now owns 317,274 shares of the company's stock worth $1,875,000 after acquiring an additional 33,461 shares during the period. 79.15% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, CAO William Frank Iv Hulse sold 54,596 shares of MiMedx Group stock in a transaction that occurred on Thursday, March 13th. The shares were sold at an average price of $7.89, for a total transaction of $430,762.44. Following the completion of the sale, the chief accounting officer now owns 440,178 shares of the company's stock, valued at approximately $3,473,004.42. The trade was a 11.03 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, insider Kimberly Maersk-Moller sold 4,106 shares of MiMedx Group stock in a transaction on Thursday, March 13th. The shares were sold at an average price of $7.89, for a total value of $32,396.34. Following the sale, the insider now directly owns 310,836 shares of the company's stock, valued at approximately $2,452,496.04. This trade represents a 1.30 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 144,018 shares of company stock valued at $1,130,312 over the last ninety days. 1.30% of the stock is owned by insiders.

MiMedx Group Price Performance

NASDAQ:MDXG traded down $0.02 during trading hours on Friday, reaching $6.84. The stock had a trading volume of 1,143,100 shares, compared to its average volume of 697,029. The company has a debt-to-equity ratio of 0.10, a quick ratio of 3.53 and a current ratio of 4.10. The stock has a market capitalization of $1.01 billion, a PE ratio of 12.44 and a beta of 1.74. MiMedx Group, Inc. has a 52 week low of $5.47 and a 52 week high of $10.14. The company has a 50 day moving average price of $7.86 and a two-hundred day moving average price of $8.00.

MiMedx Group (NASDAQ:MDXG - Get Free Report) last released its quarterly earnings data on Wednesday, February 26th. The company reported $0.07 EPS for the quarter, meeting the consensus estimate of $0.07. MiMedx Group had a net margin of 23.86% and a return on equity of 26.21%. The business had revenue of $92.91 million during the quarter, compared to analyst estimates of $89.42 million. As a group, sell-side analysts anticipate that MiMedx Group, Inc. will post 0.3 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several brokerages have recently commented on MDXG. StockNews.com upgraded shares of MiMedx Group from a "buy" rating to a "strong-buy" rating in a research report on Friday, April 4th. Cantor Fitzgerald reiterated an "overweight" rating and set a $13.00 target price on shares of MiMedx Group in a research report on Thursday, February 27th.

Read Our Latest Analysis on MiMedx Group

MiMedx Group Profile

(

Free Report)

MiMedx Group, Inc develops and distributes placental tissue allografts for various sectors of healthcare. It processes the human placental tissues utilizing its patented and proprietary PURION process to produce allografts that retains the tissue's inherent biological properties and regulatory proteins.

Featured Articles

Before you consider MiMedx Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MiMedx Group wasn't on the list.

While MiMedx Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.