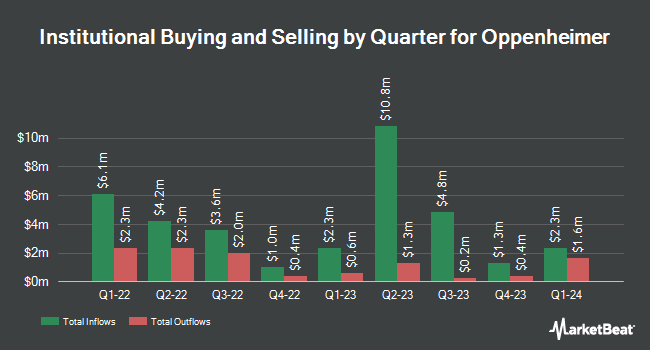

American Century Companies Inc. lifted its holdings in shares of Oppenheimer Holdings Inc. (NYSE:OPY - Free Report) by 16.0% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 193,956 shares of the financial services provider's stock after purchasing an additional 26,686 shares during the quarter. American Century Companies Inc. owned approximately 1.88% of Oppenheimer worth $12,431,000 as of its most recent SEC filing.

Several other hedge funds also recently modified their holdings of OPY. BNP Paribas Financial Markets boosted its holdings in Oppenheimer by 3,146.5% in the third quarter. BNP Paribas Financial Markets now owns 3,214 shares of the financial services provider's stock worth $164,000 after purchasing an additional 3,115 shares in the last quarter. Charles Schwab Investment Management Inc. bought a new stake in shares of Oppenheimer during the 4th quarter worth about $224,000. Metis Global Partners LLC acquired a new position in shares of Oppenheimer during the 4th quarter valued at about $234,000. Quadrature Capital Ltd bought a new position in shares of Oppenheimer in the 3rd quarter valued at approximately $290,000. Finally, Jane Street Group LLC acquired a new stake in Oppenheimer in the 3rd quarter worth approximately $319,000. Institutional investors and hedge funds own 32.26% of the company's stock.

Oppenheimer Stock Performance

Oppenheimer stock traded down $3.36 on Friday, reaching $53.13. 30,363 shares of the stock were exchanged, compared to its average volume of 33,469. The company has a current ratio of 1.29, a quick ratio of 0.80 and a debt-to-equity ratio of 0.13. Oppenheimer Holdings Inc. has a twelve month low of $36.93 and a twelve month high of $73.12. The firm has a fifty day moving average price of $63.49 and a two-hundred day moving average price of $60.63. The stock has a market cap of $559.16 million, a PE ratio of 8.34 and a beta of 1.10.

Oppenheimer (NYSE:OPY - Get Free Report) last announced its earnings results on Friday, January 31st. The financial services provider reported $0.92 earnings per share for the quarter. Oppenheimer had a return on equity of 8.76% and a net margin of 5.00%.

Oppenheimer Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, February 28th. Investors of record on Friday, February 14th were given a dividend of $0.18 per share. This represents a $0.72 dividend on an annualized basis and a yield of 1.36%. The ex-dividend date was Friday, February 14th. Oppenheimer's dividend payout ratio (DPR) is currently 11.30%.

Analyst Ratings Changes

Separately, StockNews.com lowered shares of Oppenheimer from a "strong-buy" rating to a "buy" rating in a research report on Monday, February 3rd.

Get Our Latest Report on Oppenheimer

About Oppenheimer

(

Free Report)

Oppenheimer Holdings Inc operates as a middle-market investment bank and full-service broker-dealer in the Americas, Europe, the Middle East, and Asia. The company provides brokerage services covering corporate equity and debt securities, money market instruments, exchange-traded options and futures contracts, municipal bonds, mutual funds, exchange-traded funds, and unit investment trusts; financial and wealth planning services; and margin lending services.

Featured Stories

Before you consider Oppenheimer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oppenheimer wasn't on the list.

While Oppenheimer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.