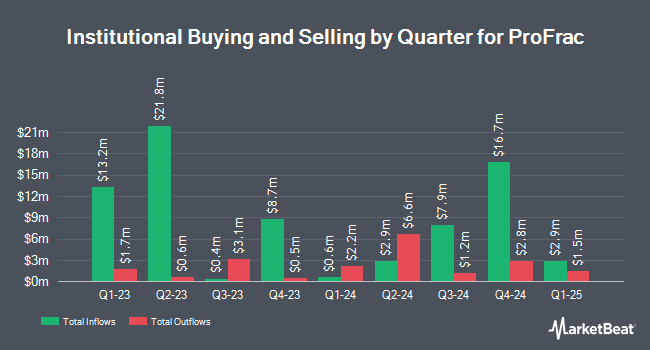

American Century Companies Inc. boosted its stake in shares of ProFrac Holding Corp. (NASDAQ:ACDC - Free Report) by 12.8% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 528,912 shares of the company's stock after acquiring an additional 59,908 shares during the quarter. American Century Companies Inc. owned about 0.33% of ProFrac worth $4,104,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds and other institutional investors also recently modified their holdings of the company. GAMMA Investing LLC boosted its holdings in ProFrac by 110.7% in the 4th quarter. GAMMA Investing LLC now owns 5,749 shares of the company's stock valued at $45,000 after purchasing an additional 3,021 shares in the last quarter. Fortitude Family Office LLC purchased a new stake in shares of ProFrac in the fourth quarter valued at approximately $57,000. AlphaQuest LLC acquired a new position in ProFrac during the fourth quarter worth $66,000. Catalina Capital Group LLC purchased a new position in ProFrac in the fourth quarter worth $79,000. Finally, Stratos Investment Management LLC acquired a new stake in ProFrac in the fourth quarter valued at $84,000. 12.75% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Separately, Stifel Nicolaus upped their target price on shares of ProFrac from $6.00 to $7.00 and gave the stock a "hold" rating in a research report on Monday, March 10th. Two analysts have rated the stock with a sell rating, two have issued a hold rating and one has given a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $7.40.

Read Our Latest Report on ACDC

ProFrac Price Performance

Shares of NASDAQ:ACDC traded down $0.69 on Thursday, hitting $4.61. The company had a trading volume of 1,236,746 shares, compared to its average volume of 735,339. The company has a current ratio of 0.95, a quick ratio of 0.62 and a debt-to-equity ratio of 0.86. The company has a market cap of $738.42 million, a PE ratio of -3.27 and a beta of 1.05. ProFrac Holding Corp. has a 52-week low of $4.00 and a 52-week high of $9.75. The business has a 50 day moving average of $7.09 and a 200 day moving average of $7.31.

Insider Activity at ProFrac

In other news, major shareholder Farris Wilks purchased 338,756 shares of the stock in a transaction dated Wednesday, February 26th. The stock was acquired at an average cost of $6.93 per share, for a total transaction of $2,347,579.08. Following the completion of the acquisition, the insider now directly owns 1,316,534 shares in the company, valued at $9,123,580.62. This represents a 34.65 % increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 2.93% of the stock is currently owned by corporate insiders.

About ProFrac

(

Free Report)

ProFrac Holding Corp. operates as a technology-focused energy services holding company in the United States. It operates through three segments: Stimulation Services, Manufacturing, and Proppant Production. The company offers hydraulic fracturing, well stimulation, in-basin frac sand, and other completion services and complementary products and services to upstream oil and natural gas companies engaged in the exploration and production of unconventional oil and natural gas resources.

Further Reading

Before you consider ProFrac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProFrac wasn't on the list.

While ProFrac currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.