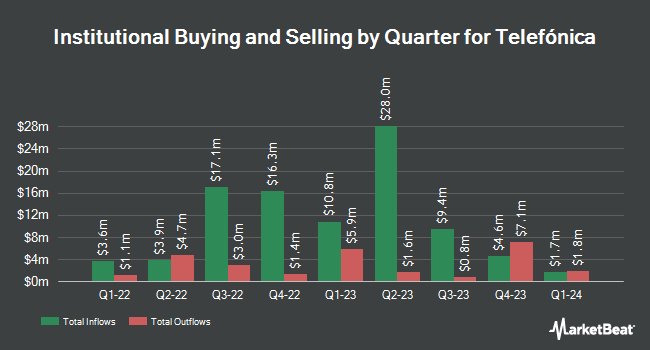

American Century Companies Inc. boosted its holdings in shares of Telefónica, S.A. (NYSE:TEF - Free Report) by 4.9% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 1,429,565 shares of the utilities provider's stock after buying an additional 66,797 shares during the quarter. American Century Companies Inc.'s holdings in Telefónica were worth $5,747,000 at the end of the most recent reporting period.

Other institutional investors have also recently made changes to their positions in the company. Sanctuary Advisors LLC purchased a new stake in Telefónica in the 3rd quarter worth approximately $45,000. Abel Hall LLC purchased a new position in shares of Telefónica in the third quarter valued at approximately $53,000. Carrera Capital Advisors purchased a new stake in shares of Telefónica during the fourth quarter worth $47,000. Callan Family Office LLC acquired a new stake in Telefónica in the 4th quarter valued at about $44,000. Finally, Drive Wealth Management LLC purchased a new position in Telefónica during the fourth quarter worth approximately $45,000. Hedge funds and other institutional investors own 1.14% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, StockNews.com upgraded Telefónica from a "hold" rating to a "buy" rating in a report on Wednesday, March 5th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and one has given a buy rating to the company. Based on data from MarketBeat.com, Telefónica presently has a consensus rating of "Hold".

Check Out Our Latest Stock Analysis on Telefónica

Telefónica Trading Up 2.2 %

TEF traded up $0.10 during mid-day trading on Wednesday, hitting $4.47. 1,834,377 shares of the stock were exchanged, compared to its average volume of 688,556. The company has a market cap of $25.32 billion, a PE ratio of -17.17 and a beta of 0.43. Telefónica, S.A. has a 1-year low of $3.89 and a 1-year high of $4.93. The company has a current ratio of 0.85, a quick ratio of 0.81 and a debt-to-equity ratio of 1.33. The firm's fifty day moving average is $4.45 and its two-hundred day moving average is $4.42.

About Telefónica

(

Free Report)

Telefónica, SA, together with its subsidiaries, provides telecommunications services in Europe and Latin America. The company offers mobile and related services and products, such as mobile voice, value added, mobile data and internet, wholesale, corporate, roaming, fixed wireless, and trunking and paging services.

Recommended Stories

Before you consider Telefónica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Telefónica wasn't on the list.

While Telefónica currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.