American Century Companies Inc. raised its holdings in shares of Sibanye Stillwater Limited (NYSE:SBSW - Free Report) by 5.5% in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 1,410,961 shares of the company's stock after buying an additional 73,368 shares during the period. American Century Companies Inc. owned about 0.20% of Sibanye Stillwater worth $4,656,000 at the end of the most recent quarter.

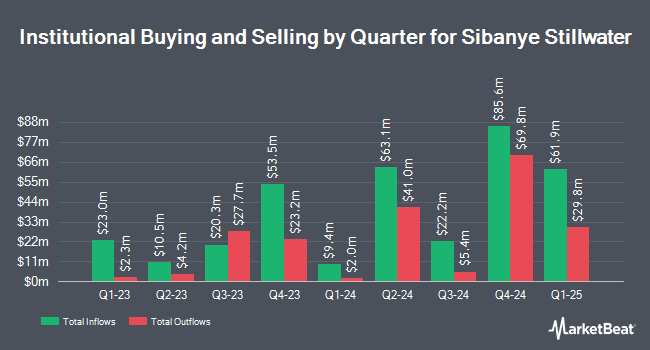

Other institutional investors have also added to or reduced their stakes in the company. Virtu Financial LLC purchased a new stake in Sibanye Stillwater in the fourth quarter worth about $130,000. Cadence Wealth Management LLC increased its holdings in Sibanye Stillwater by 5.2% in the 4th quarter. Cadence Wealth Management LLC now owns 97,466 shares of the company's stock worth $322,000 after acquiring an additional 4,815 shares in the last quarter. Corient Private Wealth LLC raised its stake in Sibanye Stillwater by 373.4% during the 4th quarter. Corient Private Wealth LLC now owns 69,294 shares of the company's stock worth $229,000 after acquiring an additional 54,655 shares during the period. Commonwealth Equity Services LLC lifted its holdings in Sibanye Stillwater by 100.1% during the fourth quarter. Commonwealth Equity Services LLC now owns 75,858 shares of the company's stock valued at $250,000 after purchasing an additional 37,949 shares in the last quarter. Finally, Banco Santander S.A. boosted its position in shares of Sibanye Stillwater by 16.9% in the fourth quarter. Banco Santander S.A. now owns 29,974 shares of the company's stock worth $99,000 after purchasing an additional 4,344 shares during the period. 34.93% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Separately, Royal Bank of Canada upgraded shares of Sibanye Stillwater from a "sector perform" rating to an "outperform" rating and lifted their target price for the company from $4.70 to $5.30 in a research note on Tuesday, March 18th. Five investment analysts have rated the stock with a hold rating and one has assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $5.05.

View Our Latest Report on SBSW

Sibanye Stillwater Price Performance

Shares of Sibanye Stillwater stock traded up $0.08 on Thursday, hitting $3.90. 14,311,842 shares of the company traded hands, compared to its average volume of 6,883,927. The company has a debt-to-equity ratio of 0.71, a quick ratio of 1.04 and a current ratio of 2.09. The business has a 50-day simple moving average of $3.88 and a 200 day simple moving average of $3.98. Sibanye Stillwater Limited has a 52 week low of $3.05 and a 52 week high of $5.91. The stock has a market capitalization of $2.76 billion, a P/E ratio of 7.49 and a beta of 1.08.

About Sibanye Stillwater

(

Free Report)

Sibanye Stillwater Limited, together with its subsidiaries, operates as a precious metals mining company in South Africa, the United States, Europe, and Australia. The company produces gold; platinum group metals (PGMs), including palladium, platinum, rhodium, iridium, and ruthenium; chrome; nickel; and silver, cobalt, and copper.

See Also

Before you consider Sibanye Stillwater, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sibanye Stillwater wasn't on the list.

While Sibanye Stillwater currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.