American Century Companies Inc. lifted its holdings in SunCoke Energy, Inc. (NYSE:SXC - Free Report) by 11.0% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 3,082,691 shares of the energy company's stock after buying an additional 306,356 shares during the period. American Century Companies Inc. owned about 3.67% of SunCoke Energy worth $32,985,000 at the end of the most recent reporting period.

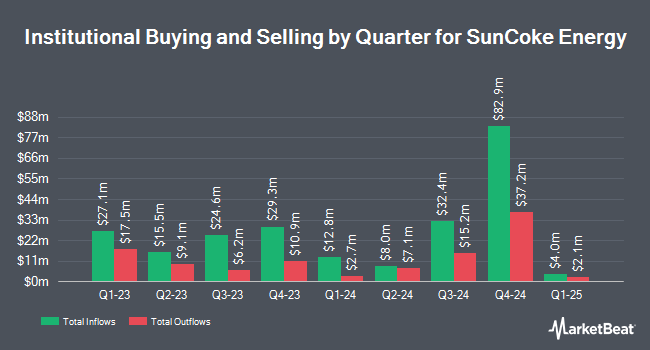

Several other hedge funds have also recently made changes to their positions in SXC. GAMMA Investing LLC increased its stake in SunCoke Energy by 71.3% during the fourth quarter. GAMMA Investing LLC now owns 4,156 shares of the energy company's stock worth $44,000 after acquiring an additional 1,730 shares during the last quarter. KBC Group NV raised its stake in shares of SunCoke Energy by 61.1% in the fourth quarter. KBC Group NV now owns 6,082 shares of the energy company's stock valued at $65,000 after acquiring an additional 2,307 shares during the period. Tocqueville Asset Management L.P. bought a new stake in shares of SunCoke Energy in the 4th quarter worth about $118,000. XTX Topco Ltd purchased a new position in shares of SunCoke Energy during the 3rd quarter worth about $120,000. Finally, Navellier & Associates Inc. boosted its stake in shares of SunCoke Energy by 11.3% during the 4th quarter. Navellier & Associates Inc. now owns 11,323 shares of the energy company's stock worth $121,000 after purchasing an additional 1,152 shares during the period. 90.45% of the stock is currently owned by hedge funds and other institutional investors.

SunCoke Energy Trading Down 0.4 %

SunCoke Energy stock traded down $0.04 during midday trading on Wednesday, reaching $9.24. The stock had a trading volume of 721,550 shares, compared to its average volume of 880,037. SunCoke Energy, Inc. has a 52-week low of $7.47 and a 52-week high of $12.82. The company has a fifty day moving average of $9.41 and a 200 day moving average of $10.04. The firm has a market cap of $779.41 million, a price-to-earnings ratio of 8.25 and a beta of 0.90. The company has a quick ratio of 1.27, a current ratio of 2.22 and a debt-to-equity ratio of 0.71.

SunCoke Energy (NYSE:SXC - Get Free Report) last announced its quarterly earnings data on Thursday, January 30th. The energy company reported $0.28 EPS for the quarter, beating the consensus estimate of $0.24 by $0.04. SunCoke Energy had a return on equity of 14.31% and a net margin of 4.95%. On average, analysts anticipate that SunCoke Energy, Inc. will post 0.71 earnings per share for the current fiscal year.

SunCoke Energy Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, March 3rd. Stockholders of record on Monday, February 17th were paid a dividend of $0.12 per share. This represents a $0.48 annualized dividend and a dividend yield of 5.19%. The ex-dividend date of this dividend was Friday, February 14th. SunCoke Energy's dividend payout ratio is presently 42.86%.

SunCoke Energy Profile

(

Free Report)

SunCoke Energy, Inc operates as an independent producer of coke in the Americas and Brazil. The company operates through three segments: Domestic Coke, Brazil Coke, and Logistics. It offers metallurgical and thermal coal. The company also provides handling and/or mixing services to steel, coke, electric utility, coal producing, and other manufacturing based customers.

Featured Articles

Before you consider SunCoke Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SunCoke Energy wasn't on the list.

While SunCoke Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.