American Century Companies Inc. trimmed its stake in Heartland Express, Inc. (NASDAQ:HTLD - Free Report) by 31.5% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 1,530,391 shares of the transportation company's stock after selling 702,868 shares during the period. American Century Companies Inc. owned approximately 1.95% of Heartland Express worth $17,171,000 at the end of the most recent reporting period.

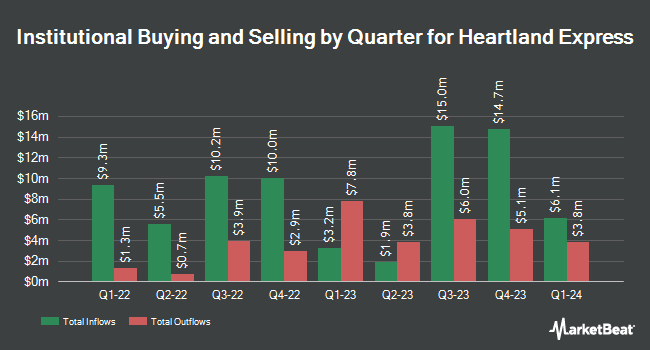

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. Barclays PLC lifted its position in Heartland Express by 326.4% in the third quarter. Barclays PLC now owns 83,848 shares of the transportation company's stock worth $1,029,000 after buying an additional 64,185 shares during the last quarter. Y Intercept Hong Kong Ltd purchased a new stake in shares of Heartland Express in the fourth quarter valued at $288,000. JPMorgan Chase & Co. lifted its holdings in shares of Heartland Express by 159.9% in the 3rd quarter. JPMorgan Chase & Co. now owns 127,153 shares of the transportation company's stock worth $1,561,000 after acquiring an additional 78,237 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its stake in shares of Heartland Express by 5.4% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 898,289 shares of the transportation company's stock worth $10,079,000 after purchasing an additional 45,732 shares during the period. Finally, Jane Street Group LLC grew its holdings in Heartland Express by 175.5% during the 3rd quarter. Jane Street Group LLC now owns 104,085 shares of the transportation company's stock valued at $1,278,000 after purchasing an additional 66,311 shares during the last quarter. Hedge funds and other institutional investors own 53.45% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Barclays dropped their target price on Heartland Express from $11.00 to $9.00 and set an "underweight" rating for the company in a research report on Wednesday.

View Our Latest Report on Heartland Express

Heartland Express Stock Down 0.7 %

NASDAQ HTLD traded down $0.06 on Friday, reaching $8.51. 624,657 shares of the stock traded hands, compared to its average volume of 405,324. Heartland Express, Inc. has a 12 month low of $8.18 and a 12 month high of $13.67. The company has a market cap of $668.46 million, a price-to-earnings ratio of -23.00 and a beta of 0.80. The company has a fifty day moving average price of $10.29 and a 200-day moving average price of $11.19. The company has a debt-to-equity ratio of 0.23, a quick ratio of 1.17 and a current ratio of 1.08.

Heartland Express (NASDAQ:HTLD - Get Free Report) last released its quarterly earnings data on Tuesday, January 28th. The transportation company reported ($0.02) earnings per share for the quarter, topping analysts' consensus estimates of ($0.04) by $0.02. Heartland Express had a negative net margin of 2.84% and a negative return on equity of 3.57%. As a group, research analysts forecast that Heartland Express, Inc. will post 0.17 EPS for the current fiscal year.

Heartland Express Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, April 4th. Stockholders of record on Tuesday, March 25th were paid a dividend of $0.02 per share. The ex-dividend date of this dividend was Tuesday, March 25th. This represents a $0.08 dividend on an annualized basis and a dividend yield of 0.94%. Heartland Express's dividend payout ratio is presently -21.62%.

Heartland Express Company Profile

(

Free Report)

Heartland Express, Inc, together with its subsidiaries, operates as a short-to-medium, and long-haul truckload carrier in the United States and Canada. It primarily provides nationwide asset-based dry van truckload service for shippers; cross-border freight and other transportation services; and temperature-controlled truckload services.

See Also

Before you consider Heartland Express, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Heartland Express wasn't on the list.

While Heartland Express currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.