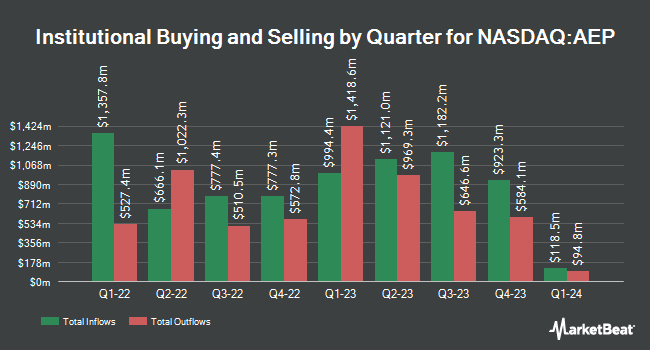

Dynamic Technology Lab Private Ltd raised its holdings in American Electric Power Company, Inc. (NASDAQ:AEP - Free Report) by 274.7% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 31,566 shares of the company's stock after acquiring an additional 23,142 shares during the quarter. Dynamic Technology Lab Private Ltd's holdings in American Electric Power were worth $3,239,000 as of its most recent SEC filing.

A number of other institutional investors have also recently bought and sold shares of AEP. Daiwa Securities Group Inc. grew its position in shares of American Electric Power by 2.2% during the 3rd quarter. Daiwa Securities Group Inc. now owns 155,589 shares of the company's stock worth $15,963,000 after buying an additional 3,331 shares during the period. Marco Investment Management LLC bought a new position in American Electric Power during the 3rd quarter worth approximately $219,000. Hartford Funds Management Co LLC grew its holdings in American Electric Power by 22.3% during the third quarter. Hartford Funds Management Co LLC now owns 14,327 shares of the company's stock valued at $1,470,000 after purchasing an additional 2,617 shares during the period. Summit Trail Advisors LLC increased its stake in American Electric Power by 12.7% in the third quarter. Summit Trail Advisors LLC now owns 4,513 shares of the company's stock valued at $463,000 after purchasing an additional 509 shares in the last quarter. Finally, Centaurus Financial Inc. increased its stake in American Electric Power by 16.7% in the third quarter. Centaurus Financial Inc. now owns 3,110 shares of the company's stock valued at $319,000 after purchasing an additional 445 shares in the last quarter. Institutional investors and hedge funds own 75.24% of the company's stock.

American Electric Power Trading Down 0.2 %

AEP traded down $0.15 during trading on Monday, hitting $97.44. The company's stock had a trading volume of 552,867 shares, compared to its average volume of 3,137,423. The company has a quick ratio of 0.41, a current ratio of 0.57 and a debt-to-equity ratio of 1.47. The firm has a market capitalization of $51.85 billion, a P/E ratio of 19.56, a PEG ratio of 2.82 and a beta of 0.55. The stock's fifty day moving average price is $99.11 and its 200-day moving average price is $95.54. American Electric Power Company, Inc. has a twelve month low of $75.22 and a twelve month high of $105.18.

American Electric Power Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Investors of record on Friday, November 8th will be given a dividend of $0.93 per share. This is a boost from American Electric Power's previous quarterly dividend of $0.88. The ex-dividend date of this dividend is Friday, November 8th. This represents a $3.72 annualized dividend and a dividend yield of 3.82%. American Electric Power's payout ratio is presently 74.55%.

Wall Street Analysts Forecast Growth

Several equities analysts have recently issued reports on the stock. Bank of America boosted their price target on shares of American Electric Power from $97.00 to $98.00 and gave the company an "underperform" rating in a report on Thursday, August 29th. Morgan Stanley decreased their target price on American Electric Power from $109.00 to $104.00 and set an "overweight" rating for the company in a research note on Friday. Scotiabank raised their price target on American Electric Power from $99.00 to $108.00 and gave the stock a "sector outperform" rating in a research report on Tuesday, August 20th. JPMorgan Chase & Co. boosted their price objective on American Electric Power from $108.00 to $112.00 and gave the company an "overweight" rating in a research report on Friday, October 18th. Finally, BMO Capital Markets cut their price target on American Electric Power from $111.00 to $104.00 and set an "outperform" rating on the stock in a report on Thursday, November 7th. Two investment analysts have rated the stock with a sell rating, eight have assigned a hold rating and six have assigned a buy rating to the company's stock. According to data from MarketBeat.com, American Electric Power currently has an average rating of "Hold" and an average price target of $98.00.

Check Out Our Latest Stock Report on American Electric Power

American Electric Power Profile

(

Free Report)

American Electric Power Company, Inc, an electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States. It operates through Vertically Integrated Utilities, Transmission and Distribution Utilities, AEP Transmission Holdco, and Generation & Marketing segments.

See Also

Before you consider American Electric Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Electric Power wasn't on the list.

While American Electric Power currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.