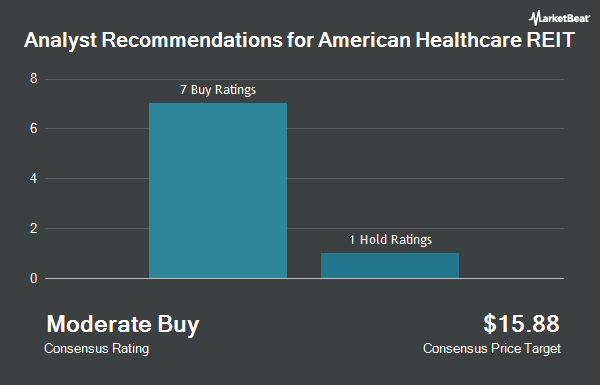

American Healthcare REIT, Inc. (NYSE:AHR - Get Free Report) has earned a consensus recommendation of "Moderate Buy" from the eight brokerages that are presently covering the company, Marketbeat Ratings reports. One investment analyst has rated the stock with a hold recommendation and seven have given a buy recommendation to the company. The average 1-year target price among brokers that have covered the stock in the last year is $23.00.

Several research analysts have issued reports on the company. Colliers Securities upgraded American Healthcare REIT from a "hold" rating to a "moderate buy" rating in a research report on Sunday, October 13th. Truist Financial increased their price target on shares of American Healthcare REIT from $22.00 to $27.00 and gave the company a "buy" rating in a report on Friday, September 20th. JMP Securities boosted their price objective on shares of American Healthcare REIT from $18.00 to $30.00 and gave the stock a "market outperform" rating in a report on Friday, September 20th. Bank of America increased their target price on shares of American Healthcare REIT from $27.00 to $31.00 and gave the company a "buy" rating in a report on Tuesday, September 24th. Finally, KeyCorp boosted their price target on American Healthcare REIT from $16.00 to $27.00 and gave the stock an "overweight" rating in a research note on Monday, September 16th.

Get Our Latest Stock Report on AHR

American Healthcare REIT Trading Down 0.9 %

Shares of AHR stock traded down $0.23 during trading hours on Friday, reaching $26.08. 1,382,283 shares of the company's stock were exchanged, compared to its average volume of 1,307,242. The company has a debt-to-equity ratio of 0.60, a quick ratio of 0.29 and a current ratio of 0.29. The company's 50 day moving average is $24.85 and its two-hundred day moving average is $18.94. American Healthcare REIT has a 1 year low of $12.63 and a 1 year high of $27.21.

American Healthcare REIT Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, October 18th. Investors of record on Friday, September 20th were paid a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 3.83%. The ex-dividend date of this dividend was Friday, September 20th.

Institutional Trading of American Healthcare REIT

A number of large investors have recently made changes to their positions in AHR. Foundry Partners LLC purchased a new position in shares of American Healthcare REIT during the third quarter valued at approximately $314,000. Intech Investment Management LLC acquired a new position in American Healthcare REIT in the 3rd quarter valued at $333,000. EverSource Wealth Advisors LLC purchased a new position in shares of American Healthcare REIT during the 3rd quarter worth $3,557,000. Hilton Capital Management LLC acquired a new stake in shares of American Healthcare REIT during the third quarter worth $4,777,000. Finally, Avior Wealth Management LLC purchased a new stake in shares of American Healthcare REIT in the third quarter valued at $65,000. Institutional investors and hedge funds own 16.68% of the company's stock.

American Healthcare REIT Company Profile

(

Get Free ReportFormed by the successful merger of Griffin-American Healthcare REIT III and Griffin-American Healthcare REIT IV, as well as the acquisition of the business and operations of American Healthcare Investors, American Healthcare REIT is one of the larger healthcare-focused real estate investment trusts globally with assets totaling approximately $4.2 billion in gross investment value.

Read More

Before you consider American Healthcare REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Healthcare REIT wasn't on the list.

While American Healthcare REIT currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.