American Healthcare REIT (NYSE:AHR - Get Free Report) had its target price increased by analysts at Royal Bank of Canada from $28.00 to $30.00 in a research note issued on Monday,Benzinga reports. The brokerage presently has an "outperform" rating on the stock. Royal Bank of Canada's price objective would suggest a potential upside of 9.29% from the company's current price.

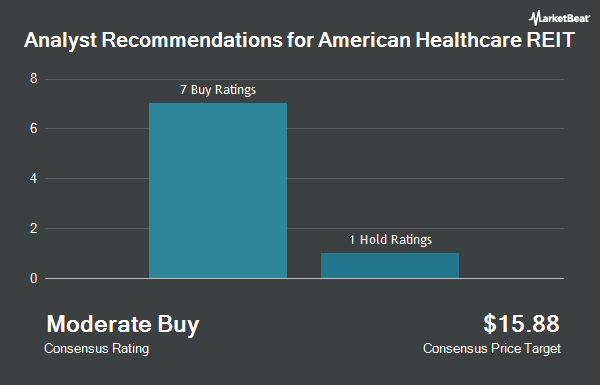

Several other equities research analysts have also commented on the stock. JMP Securities increased their price objective on shares of American Healthcare REIT from $18.00 to $30.00 and gave the company a "market outperform" rating in a research note on Friday, September 20th. Truist Financial increased their price target on American Healthcare REIT from $27.00 to $29.00 and gave the company a "buy" rating in a research report on Friday. Morgan Stanley upped their price objective on American Healthcare REIT from $17.00 to $22.00 and gave the company an "overweight" rating in a research note on Thursday, August 22nd. KeyCorp lifted their target price on American Healthcare REIT from $16.00 to $27.00 and gave the stock an "overweight" rating in a research note on Monday, September 16th. Finally, Bank of America increased their price target on shares of American Healthcare REIT from $27.00 to $31.00 and gave the company a "buy" rating in a research report on Tuesday, September 24th. One analyst has rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $25.13.

View Our Latest Report on American Healthcare REIT

American Healthcare REIT Stock Up 1.0 %

AHR stock traded up $0.27 during mid-day trading on Monday, reaching $27.45. 1,323,062 shares of the company traded hands, compared to its average volume of 1,459,922. The stock has a market cap of $3.61 billion and a price-to-earnings ratio of -57.19. American Healthcare REIT has a fifty-two week low of $12.63 and a fifty-two week high of $27.77. The firm's 50 day moving average price is $25.35 and its 200 day moving average price is $19.43. The company has a quick ratio of 0.29, a current ratio of 0.37 and a debt-to-equity ratio of 0.59.

American Healthcare REIT (NYSE:AHR - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The company reported ($0.03) EPS for the quarter, missing analysts' consensus estimates of $0.32 by ($0.35). American Healthcare REIT had a negative net margin of 1.84% and a negative return on equity of 1.87%. The company had revenue of $523.81 million during the quarter, compared to analysts' expectations of $474.26 million. American Healthcare REIT's quarterly revenue was up 12.8% on a year-over-year basis. As a group, equities research analysts predict that American Healthcare REIT will post 1.41 EPS for the current fiscal year.

Institutional Investors Weigh In On American Healthcare REIT

A number of large investors have recently added to or reduced their stakes in AHR. Mirae Asset Global Investments Co. Ltd. lifted its position in American Healthcare REIT by 34.7% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,537 shares of the company's stock worth $66,000 after buying an additional 654 shares during the last quarter. Kozak & Associates Inc. purchased a new position in American Healthcare REIT in the 3rd quarter worth $28,000. Quarry LP bought a new stake in American Healthcare REIT in the third quarter worth $33,000. Tidemark LLC purchased a new stake in American Healthcare REIT during the third quarter valued at about $44,000. Finally, Kessler Investment Group LLC bought a new position in shares of American Healthcare REIT during the third quarter valued at about $48,000. Hedge funds and other institutional investors own 16.68% of the company's stock.

American Healthcare REIT Company Profile

(

Get Free Report)

Formed by the successful merger of Griffin-American Healthcare REIT III and Griffin-American Healthcare REIT IV, as well as the acquisition of the business and operations of American Healthcare Investors, American Healthcare REIT is one of the larger healthcare-focused real estate investment trusts globally with assets totaling approximately $4.2 billion in gross investment value.

Read More

Before you consider American Healthcare REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Healthcare REIT wasn't on the list.

While American Healthcare REIT currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.