Barclays PLC trimmed its position in American Homes 4 Rent (NYSE:AMH - Free Report) by 19.7% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 346,801 shares of the real estate investment trust's stock after selling 84,989 shares during the period. Barclays PLC owned approximately 0.09% of American Homes 4 Rent worth $13,313,000 at the end of the most recent quarter.

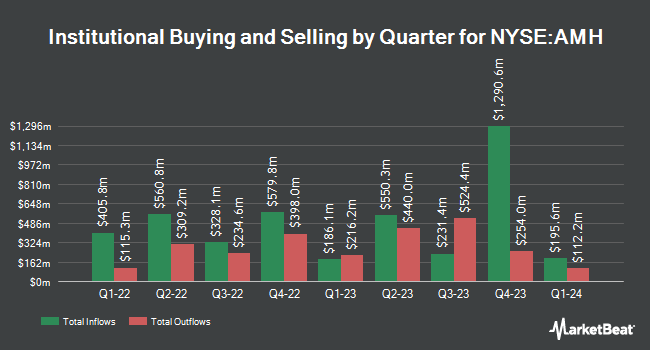

Several other institutional investors and hedge funds also recently modified their holdings of the company. Janus Henderson Group PLC lifted its stake in American Homes 4 Rent by 2,150.3% in the 3rd quarter. Janus Henderson Group PLC now owns 1,935,007 shares of the real estate investment trust's stock valued at $74,276,000 after acquiring an additional 1,849,020 shares in the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. lifted its position in shares of American Homes 4 Rent by 783.3% in the third quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 1,107,227 shares of the real estate investment trust's stock worth $42,507,000 after purchasing an additional 981,872 shares in the last quarter. FMR LLC lifted its position in shares of American Homes 4 Rent by 12.9% in the third quarter. FMR LLC now owns 8,225,592 shares of the real estate investment trust's stock worth $315,780,000 after purchasing an additional 937,116 shares in the last quarter. Marshall Wace LLP acquired a new position in American Homes 4 Rent during the second quarter worth $17,367,000. Finally, Van Lanschot Kempen Investment Management N.V. grew its position in American Homes 4 Rent by 39.3% in the second quarter. Van Lanschot Kempen Investment Management N.V. now owns 1,437,568 shares of the real estate investment trust's stock valued at $53,420,000 after purchasing an additional 405,468 shares in the last quarter. 91.87% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, Director Douglas N. Benham bought 3,286 shares of the business's stock in a transaction dated Thursday, December 5th. The stock was purchased at an average cost of $24.49 per share, for a total transaction of $80,474.14. Following the transaction, the director now owns 41,946 shares in the company, valued at $1,027,257.54. The trade was a 8.50 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, COO Bryan Smith sold 40,000 shares of the stock in a transaction on Monday, December 9th. The stock was sold at an average price of $37.80, for a total value of $1,512,000.00. Following the sale, the chief operating officer now directly owns 125,580 shares in the company, valued at approximately $4,746,924. This trade represents a 24.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 6.32% of the stock is owned by insiders.

American Homes 4 Rent Stock Performance

AMH stock traded up $0.07 during mid-day trading on Monday, hitting $37.44. 1,784,082 shares of the company were exchanged, compared to its average volume of 2,526,948. American Homes 4 Rent has a 1-year low of $33.75 and a 1-year high of $41.41. The stock has a market capitalization of $13.83 billion, a PE ratio of 39.00, a price-to-earnings-growth ratio of 3.33 and a beta of 0.78. The business has a 50 day simple moving average of $37.51 and a 200-day simple moving average of $37.61. The company has a current ratio of 0.58, a quick ratio of 0.58 and a debt-to-equity ratio of 0.59.

American Homes 4 Rent (NYSE:AMH - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The real estate investment trust reported $0.20 earnings per share for the quarter, missing the consensus estimate of $0.43 by ($0.23). American Homes 4 Rent had a return on equity of 4.76% and a net margin of 21.51%. The firm had revenue of $445.06 million for the quarter, compared to analyst estimates of $443.81 million. During the same period in the previous year, the business posted $0.41 earnings per share. The business's revenue for the quarter was up 5.5% on a year-over-year basis. On average, equities analysts forecast that American Homes 4 Rent will post 1.77 earnings per share for the current year.

American Homes 4 Rent Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, December 13th will be paid a $0.26 dividend. The ex-dividend date of this dividend is Friday, December 13th. This represents a $1.04 annualized dividend and a dividend yield of 2.78%. American Homes 4 Rent's dividend payout ratio (DPR) is presently 108.33%.

Wall Street Analyst Weigh In

Several equities research analysts have commented on the stock. JPMorgan Chase & Co. boosted their price target on shares of American Homes 4 Rent from $38.00 to $43.00 and gave the stock a "neutral" rating in a research report on Monday, September 16th. StockNews.com lowered American Homes 4 Rent from a "hold" rating to a "sell" rating in a report on Tuesday, December 3rd. Wells Fargo & Company upgraded American Homes 4 Rent from an "equal weight" rating to an "overweight" rating and raised their price target for the company from $36.00 to $42.00 in a research note on Monday, August 26th. JMP Securities reiterated a "market outperform" rating and set a $41.00 price objective on shares of American Homes 4 Rent in a research note on Wednesday, December 11th. Finally, The Goldman Sachs Group assumed coverage on shares of American Homes 4 Rent in a research note on Wednesday, September 4th. They issued a "buy" rating and a $48.00 target price for the company. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and thirteen have assigned a buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $41.56.

View Our Latest Stock Analysis on American Homes 4 Rent

American Homes 4 Rent Profile

(

Free Report)

AMH NYSE: AMH is a leading large-scale integrated owner, operator and developer of single-family rental homes. We're an internally managed Maryland real estate investment trust (REIT) focused on acquiring, developing, renovating, leasing and managing homes as rental properties. Our goal is to simplify the experience of leasing a home and deliver peace of mind to households across the country.

Recommended Stories

Before you consider American Homes 4 Rent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Homes 4 Rent wasn't on the list.

While American Homes 4 Rent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.