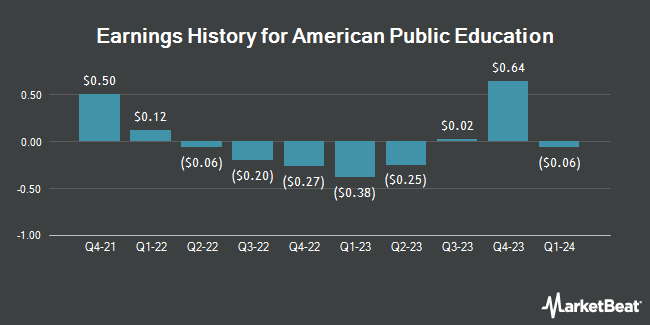

American Public Education (NASDAQ:APEI - Get Free Report) will post its quarterly earnings results after the market closes on Tuesday, November 12th. Analysts expect American Public Education to post earnings of $0.01 per share for the quarter. Investors interested in participating in the company's conference call can do so using this link.

American Public Education (NASDAQ:APEI - Get Free Report) last issued its quarterly earnings data on Tuesday, August 6th. The company reported $0.01 EPS for the quarter, hitting the consensus estimate of $0.01. The company had revenue of $152.90 million during the quarter, compared to analyst estimates of $154.06 million. American Public Education had a return on equity of 6.88% and a net margin of 1.73%. On average, analysts expect American Public Education to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

American Public Education Price Performance

APEI traded down $0.05 on Friday, reaching $17.30. The company had a trading volume of 107,072 shares, compared to its average volume of 92,449. American Public Education has a 52-week low of $5.03 and a 52-week high of $21.04. The company has a market cap of $306.21 million, a price-to-earnings ratio of 69.20, a P/E/G ratio of 2.30 and a beta of 1.24. The company has a debt-to-equity ratio of 0.37, a quick ratio of 2.83 and a current ratio of 2.83. The business has a 50 day simple moving average of $14.88 and a 200 day simple moving average of $16.11.

Insider Activity

In related news, Director Michael David Braner bought 59,179 shares of the stock in a transaction dated Tuesday, August 20th. The stock was bought at an average price of $14.05 per share, with a total value of $831,464.95. Following the purchase, the director now owns 1,788,688 shares in the company, valued at approximately $25,131,066.40. The trade was a 0.00 % increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available at this link. Over the last three months, insiders have purchased 182,287 shares of company stock valued at $2,635,431. 11.38% of the stock is currently owned by insiders.

Analysts Set New Price Targets

Several analysts have recently weighed in on the stock. StockNews.com downgraded shares of American Public Education from a "strong-buy" rating to a "buy" rating in a report on Wednesday, August 7th. Barrington Research reiterated an "outperform" rating and issued a $18.00 price objective on shares of American Public Education in a report on Tuesday, October 29th. B. Riley raised their price objective on American Public Education from $22.00 to $25.00 and gave the company a "buy" rating in a report on Thursday. Finally, Truist Financial cut their target price on American Public Education from $20.00 to $15.00 and set a "hold" rating for the company in a research note on Tuesday, August 13th.

Get Our Latest Report on APEI

About American Public Education

(

Get Free Report)

American Public Education, Inc, together with its subsidiaries, provides online and campus-based postsecondary education and career learning in the United States. It operates through three segments: American Public University System, Rasmussen University, and Hondros College of Nursing. The company offers 184 degree programs and 134 certificate programs in various fields of study, including nursing, national security, military studies, intelligence, homeland security, business, health science, information technology, justice studies, education, and liberal arts; and career learning opportunities in leadership, finance, human resources, and other fields of study critical to the federal government workforce.

Read More

Before you consider American Public Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Public Education wasn't on the list.

While American Public Education currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.