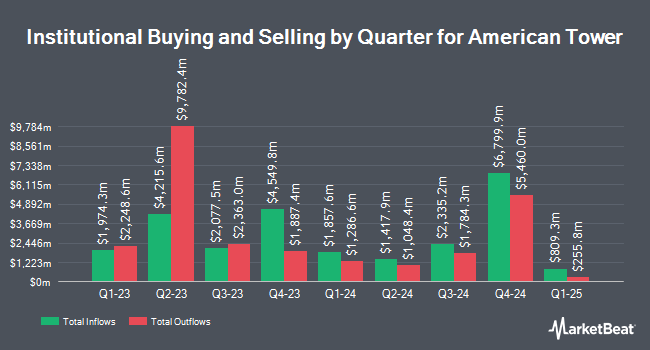

Caprock Group LLC increased its stake in American Tower Co. (NYSE:AMT - Free Report) by 46.8% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 11,051 shares of the real estate investment trust's stock after purchasing an additional 3,524 shares during the quarter. Caprock Group LLC's holdings in American Tower were worth $2,570,000 at the end of the most recent quarter.

A number of other hedge funds also recently added to or reduced their stakes in AMT. Ameriprise Financial Inc. increased its position in American Tower by 41.8% during the second quarter. Ameriprise Financial Inc. now owns 6,395,906 shares of the real estate investment trust's stock worth $1,243,333,000 after purchasing an additional 1,885,421 shares during the last quarter. Pathway Financial Advisers LLC increased its holdings in American Tower by 23,224.1% during the 3rd quarter. Pathway Financial Advisers LLC now owns 997,337 shares of the real estate investment trust's stock worth $231,941,000 after purchasing an additional 993,061 shares during the last quarter. International Assets Investment Management LLC boosted its stake in American Tower by 22,242.7% during the 3rd quarter. International Assets Investment Management LLC now owns 778,865 shares of the real estate investment trust's stock valued at $1,811,330,000 after acquiring an additional 775,379 shares during the last quarter. Swedbank AB bought a new stake in shares of American Tower in the 1st quarter valued at approximately $123,861,000. Finally, Massachusetts Financial Services Co. MA boosted its stake in American Tower by 16.3% in the second quarter. Massachusetts Financial Services Co. MA now owns 3,310,893 shares of the real estate investment trust's stock valued at $643,571,000 after acquiring an additional 464,429 shares during the period. 92.69% of the stock is owned by hedge funds and other institutional investors.

American Tower Trading Down 0.1 %

Shares of NYSE:AMT traded down $0.27 during midday trading on Wednesday, hitting $200.88. 2,219,411 shares of the stock traded hands, compared to its average volume of 2,323,926. The business's 50 day moving average is $220.88 and its two-hundred day moving average is $211.37. The stock has a market capitalization of $93.87 billion, a PE ratio of 84.88, a P/E/G ratio of 1.31 and a beta of 0.84. The company has a quick ratio of 0.69, a current ratio of 0.69 and a debt-to-equity ratio of 3.27. American Tower Co. has a one year low of $170.46 and a one year high of $243.56.

American Tower (NYSE:AMT - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The real estate investment trust reported $0.89 earnings per share for the quarter, missing the consensus estimate of $2.45 by ($1.56). American Tower had a net margin of 10.05% and a return on equity of 22.01%. The firm had revenue of $2.52 billion for the quarter, compared to the consensus estimate of $2.77 billion. During the same period in the previous year, the firm posted $2.58 earnings per share. The business's revenue was down 10.5% compared to the same quarter last year. As a group, research analysts forecast that American Tower Co. will post 10.08 earnings per share for the current year.

American Tower Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, October 25th. Investors of record on Wednesday, October 9th were paid a $1.62 dividend. The ex-dividend date of this dividend was Wednesday, October 9th. This represents a $6.48 annualized dividend and a dividend yield of 3.23%. American Tower's payout ratio is currently 273.42%.

Analyst Ratings Changes

Several analysts recently commented on AMT shares. Scotiabank lowered their target price on American Tower from $248.00 to $236.00 and set a "sector outperform" rating on the stock in a research report on Wednesday, October 30th. Deutsche Bank Aktiengesellschaft upped their target price on American Tower from $212.00 to $235.00 and gave the stock a "buy" rating in a research report on Wednesday, August 14th. TD Cowen raised their price target on shares of American Tower from $226.00 to $239.00 and gave the stock a "buy" rating in a research note on Wednesday, July 31st. BMO Capital Markets lowered their price objective on American Tower from $255.00 to $245.00 and set an "outperform" rating for the company in a research report on Wednesday, October 30th. Finally, Barclays dropped their target price on shares of American Tower from $255.00 to $251.00 and set an "overweight" rating on the stock in a report on Monday. Four research analysts have rated the stock with a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $235.54.

Check Out Our Latest Research Report on AMT

About American Tower

(

Free Report)

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 224,000 communications sites and a highly interconnected footprint of U.S. data center facilities.

Featured Stories

Before you consider American Tower, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Tower wasn't on the list.

While American Tower currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.