iA Global Asset Management Inc. cut its stake in shares of American Tower Co. (NYSE:AMT - Free Report) by 70.3% during the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 29,290 shares of the real estate investment trust's stock after selling 69,306 shares during the period. iA Global Asset Management Inc.'s holdings in American Tower were worth $6,812,000 at the end of the most recent reporting period.

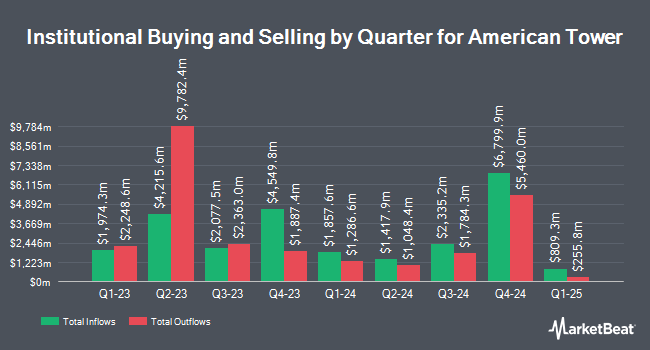

Several other large investors have also recently added to or reduced their stakes in the stock. FMR LLC grew its stake in American Tower by 25.4% in the third quarter. FMR LLC now owns 10,642,133 shares of the real estate investment trust's stock valued at $2,474,934,000 after purchasing an additional 2,152,646 shares in the last quarter. Ameriprise Financial Inc. grew its stake in shares of American Tower by 41.8% in the 2nd quarter. Ameriprise Financial Inc. now owns 6,395,906 shares of the real estate investment trust's stock valued at $1,243,333,000 after buying an additional 1,885,421 shares in the last quarter. Adelante Capital Management LLC grew its stake in shares of American Tower by 2,723.4% in the 3rd quarter. Adelante Capital Management LLC now owns 1,203,517 shares of the real estate investment trust's stock valued at $279,890,000 after buying an additional 1,160,890 shares in the last quarter. Pathway Financial Advisers LLC increased its holdings in American Tower by 23,224.1% in the third quarter. Pathway Financial Advisers LLC now owns 997,337 shares of the real estate investment trust's stock worth $231,941,000 after buying an additional 993,061 shares during the last quarter. Finally, International Assets Investment Management LLC raised its position in American Tower by 22,242.7% during the third quarter. International Assets Investment Management LLC now owns 778,865 shares of the real estate investment trust's stock valued at $1,811,330,000 after acquiring an additional 775,379 shares in the last quarter. Institutional investors and hedge funds own 92.69% of the company's stock.

American Tower Stock Performance

Shares of AMT traded down $2.06 during trading hours on Friday, reaching $207.10. 2,677,904 shares of the company traded hands, compared to its average volume of 2,319,693. The company has a debt-to-equity ratio of 3.27, a quick ratio of 0.69 and a current ratio of 0.69. The stock's fifty day moving average is $213.32 and its 200 day moving average is $213.12. American Tower Co. has a 1-year low of $170.46 and a 1-year high of $243.56. The stock has a market cap of $96.78 billion, a P/E ratio of 87.38, a price-to-earnings-growth ratio of 1.38 and a beta of 0.83.

American Tower (NYSE:AMT - Get Free Report) last posted its quarterly earnings results on Tuesday, October 29th. The real estate investment trust reported $0.89 EPS for the quarter, missing the consensus estimate of $2.45 by ($1.56). American Tower had a net margin of 10.05% and a return on equity of 22.01%. The firm had revenue of $2.52 billion during the quarter, compared to analyst estimates of $2.77 billion. During the same period last year, the company earned $2.58 EPS. The company's revenue was down 10.5% on a year-over-year basis. Equities research analysts anticipate that American Tower Co. will post 10.08 earnings per share for the current fiscal year.

American Tower Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Monday, February 3rd. Shareholders of record on Friday, December 27th will be issued a $1.62 dividend. This represents a $6.48 annualized dividend and a yield of 3.13%. The ex-dividend date of this dividend is Friday, December 27th. American Tower's dividend payout ratio (DPR) is presently 273.42%.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on the stock. Scotiabank reduced their price objective on shares of American Tower from $248.00 to $236.00 and set a "sector outperform" rating for the company in a research note on Wednesday, October 30th. BMO Capital Markets decreased their price target on American Tower from $255.00 to $245.00 and set an "outperform" rating for the company in a research note on Wednesday, October 30th. Barclays lowered their price objective on American Tower from $255.00 to $251.00 and set an "overweight" rating on the stock in a report on Monday, November 18th. Deutsche Bank Aktiengesellschaft upped their target price on American Tower from $212.00 to $235.00 and gave the stock a "buy" rating in a research report on Wednesday, August 14th. Finally, Wells Fargo & Company lowered shares of American Tower from an "overweight" rating to an "equal weight" rating and dropped their price target for the company from $245.00 to $230.00 in a research report on Thursday, October 10th. Four research analysts have rated the stock with a hold rating, nine have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, American Tower has a consensus rating of "Moderate Buy" and an average target price of $235.54.

Get Our Latest Report on AMT

About American Tower

(

Free Report)

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 224,000 communications sites and a highly interconnected footprint of U.S. data center facilities.

Featured Articles

Before you consider American Tower, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Tower wasn't on the list.

While American Tower currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.