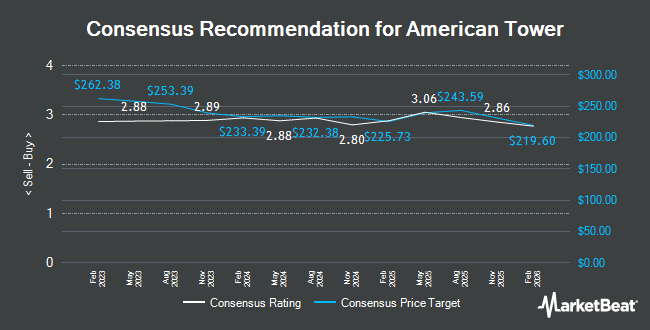

American Tower (NYSE:AMT - Get Free Report) had its price target reduced by equities research analysts at Citigroup from $255.00 to $220.00 in a note issued to investors on Friday,Benzinga reports. The firm currently has a "buy" rating on the real estate investment trust's stock. Citigroup's price target indicates a potential upside of 15.94% from the stock's current price.

Other equities analysts have also recently issued research reports about the stock. Mizuho cut their target price on shares of American Tower from $221.00 to $204.00 and set a "neutral" rating on the stock in a report on Wednesday, January 8th. Scotiabank reduced their price objective on American Tower from $236.00 to $220.00 and set a "sector outperform" rating for the company in a research report on Thursday, January 23rd. The Goldman Sachs Group dropped their target price on American Tower from $260.00 to $234.00 and set a "buy" rating on the stock in a research report on Thursday, December 12th. JMP Securities initiated coverage on shares of American Tower in a report on Monday, January 27th. They set an "outperform" rating and a $225.00 price target for the company. Finally, BMO Capital Markets lowered their price target on shares of American Tower from $255.00 to $245.00 and set an "outperform" rating for the company in a research report on Wednesday, October 30th. Four research analysts have rated the stock with a hold rating, ten have given a buy rating and two have issued a strong buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $225.79.

Read Our Latest Report on American Tower

American Tower Stock Performance

AMT stock traded up $0.37 during trading on Friday, hitting $189.75. 2,301,000 shares of the company's stock traded hands, compared to its average volume of 2,111,813. The stock has a fifty day moving average price of $186.31 and a two-hundred day moving average price of $208.44. The company has a quick ratio of 0.69, a current ratio of 0.69 and a debt-to-equity ratio of 3.27. American Tower has a 52 week low of $170.46 and a 52 week high of $243.56. The stock has a market capitalization of $88.67 billion, a price-to-earnings ratio of 80.06, a price-to-earnings-growth ratio of 1.27 and a beta of 0.84.

Insider Activity

In other news, CFO Rodney M. Smith sold 16,567 shares of the business's stock in a transaction on Thursday, January 16th. The stock was sold at an average price of $181.10, for a total transaction of $3,000,283.70. Following the sale, the chief financial officer now directly owns 62,792 shares of the company's stock, valued at $11,371,631.20. The trade was a 20.88 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Insiders own 0.18% of the company's stock.

Hedge Funds Weigh In On American Tower

A number of institutional investors have recently bought and sold shares of AMT. Fortitude Family Office LLC boosted its holdings in shares of American Tower by 269.0% in the third quarter. Fortitude Family Office LLC now owns 107 shares of the real estate investment trust's stock worth $25,000 after buying an additional 78 shares during the period. Northwest Investment Counselors LLC acquired a new position in American Tower in the 3rd quarter worth approximately $30,000. Hara Capital LLC purchased a new position in American Tower during the 3rd quarter worth approximately $31,000. Legacy Investment Solutions LLC purchased a new stake in shares of American Tower in the third quarter valued at $34,000. Finally, Activest Wealth Management boosted its position in shares of American Tower by 431.0% in the third quarter. Activest Wealth Management now owns 154 shares of the real estate investment trust's stock worth $36,000 after buying an additional 125 shares during the period. Hedge funds and other institutional investors own 92.69% of the company's stock.

American Tower Company Profile

(

Get Free Report)

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 224,000 communications sites and a highly interconnected footprint of U.S. data center facilities.

Recommended Stories

Before you consider American Tower, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Tower wasn't on the list.

While American Tower currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.