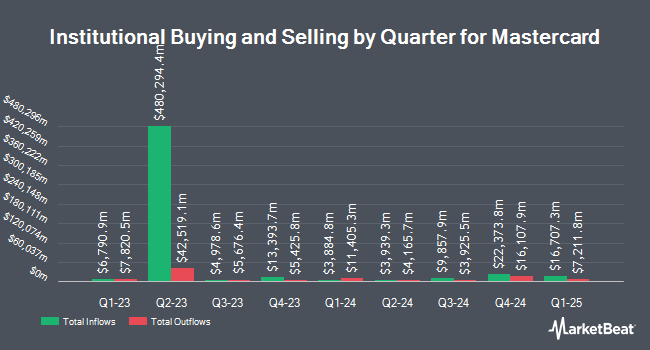

American Trust raised its holdings in Mastercard Incorporated (NYSE:MA - Free Report) by 13.8% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 11,157 shares of the credit services provider's stock after buying an additional 1,352 shares during the quarter. American Trust's holdings in Mastercard were worth $5,509,000 at the end of the most recent quarter.

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Goldstein Advisors LLC grew its holdings in shares of Mastercard by 1.3% in the third quarter. Goldstein Advisors LLC now owns 1,516 shares of the credit services provider's stock valued at $749,000 after acquiring an additional 20 shares in the last quarter. Community Bank N.A. grew its holdings in shares of Mastercard by 0.9% in the third quarter. Community Bank N.A. now owns 2,190 shares of the credit services provider's stock valued at $1,081,000 after acquiring an additional 20 shares in the last quarter. Raab & Moskowitz Asset Management LLC grew its holdings in shares of Mastercard by 1.5% in the third quarter. Raab & Moskowitz Asset Management LLC now owns 1,398 shares of the credit services provider's stock valued at $690,000 after acquiring an additional 20 shares in the last quarter. McLean Asset Management Corp grew its holdings in shares of Mastercard by 1.3% in the third quarter. McLean Asset Management Corp now owns 1,677 shares of the credit services provider's stock valued at $834,000 after acquiring an additional 21 shares in the last quarter. Finally, Oldfather Financial Services LLC grew its holdings in shares of Mastercard by 2.6% in the third quarter. Oldfather Financial Services LLC now owns 827 shares of the credit services provider's stock valued at $408,000 after acquiring an additional 21 shares in the last quarter. Institutional investors and hedge funds own 97.28% of the company's stock.

Mastercard Price Performance

MA traded down $3.41 during trading on Friday, reaching $529.00. The stock had a trading volume of 1,608,085 shares, compared to its average volume of 2,454,107. The stock has a market cap of $485.53 billion, a PE ratio of 40.02, a PEG ratio of 2.38 and a beta of 1.10. The company has a debt-to-equity ratio of 2.36, a quick ratio of 1.29 and a current ratio of 1.29. Mastercard Incorporated has a one year low of $411.60 and a one year high of $536.75. The business has a 50-day moving average of $516.61 and a 200-day moving average of $480.61.

Mastercard (NYSE:MA - Get Free Report) last released its earnings results on Thursday, October 31st. The credit services provider reported $3.89 EPS for the quarter, beating analysts' consensus estimates of $3.73 by $0.16. The business had revenue of $7.37 billion for the quarter, compared to analysts' expectations of $7.27 billion. Mastercard had a return on equity of 178.27% and a net margin of 45.26%. The firm's revenue was up 12.8% on a year-over-year basis. During the same quarter in the prior year, the firm earned $3.39 earnings per share. As a group, equities research analysts anticipate that Mastercard Incorporated will post 14.47 EPS for the current fiscal year.

Mastercard Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, November 8th. Investors of record on Wednesday, October 9th were paid a $0.66 dividend. The ex-dividend date of this dividend was Wednesday, October 9th. This represents a $2.64 dividend on an annualized basis and a yield of 0.50%. Mastercard's dividend payout ratio is presently 19.97%.

Analyst Ratings Changes

Several equities analysts have recently issued reports on MA shares. Macquarie upped their target price on Mastercard from $505.00 to $565.00 and gave the company an "outperform" rating in a report on Friday, November 1st. Compass Point initiated coverage on Mastercard in a research note on Wednesday, September 4th. They issued a "neutral" rating and a $525.00 price objective on the stock. Keefe, Bruyette & Woods upped their price objective on Mastercard from $580.00 to $618.00 and gave the company an "outperform" rating in a research note on Monday. Morgan Stanley upped their price objective on Mastercard from $544.00 to $564.00 and gave the company an "overweight" rating in a research note on Thursday, November 14th. Finally, TD Cowen upped their price objective on Mastercard from $533.00 to $567.00 and gave the company a "buy" rating in a research note on Friday, November 15th. Four equities research analysts have rated the stock with a hold rating, twenty-three have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $559.28.

Get Our Latest Stock Report on Mastercard

Insider Activity

In other news, CMO Venkata R. Madabhushi sold 4,685 shares of the firm's stock in a transaction dated Friday, September 20th. The stock was sold at an average price of $489.86, for a total transaction of $2,294,994.10. Following the transaction, the chief marketing officer now directly owns 15,031 shares of the company's stock, valued at approximately $7,363,085.66. This trade represents a 23.76 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders own 0.10% of the company's stock.

About Mastercard

(

Free Report)

Mastercard Incorporated, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. The company offers integrated products and value-added services for account holders, merchants, financial institutions, digital partners, businesses, governments, and other organizations, such as programs that enable issuers to provide consumers with credits to defer payments; payment products and solutions that allow its customers to access funds in deposit and other accounts; prepaid programs services; and commercial credit, debit, and prepaid payment products and solutions.

Featured Articles

Before you consider Mastercard, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mastercard wasn't on the list.

While Mastercard currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.