Groupama Asset Managment boosted its holdings in shares of American Water Works Company, Inc. (NYSE:AWK - Free Report) by 4,227.0% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 711,927 shares of the utilities provider's stock after buying an additional 695,474 shares during the quarter. Groupama Asset Managment owned approximately 0.37% of American Water Works worth $104,000 at the end of the most recent reporting period.

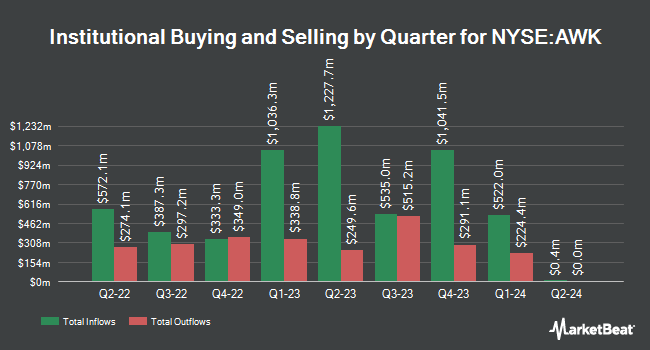

Several other institutional investors and hedge funds have also recently bought and sold shares of the business. Lake Street Advisors Group LLC increased its holdings in shares of American Water Works by 4.2% during the 3rd quarter. Lake Street Advisors Group LLC now owns 1,858 shares of the utilities provider's stock worth $272,000 after acquiring an additional 75 shares during the last quarter. IHT Wealth Management LLC increased its holdings in shares of American Water Works by 1.2% in the third quarter. IHT Wealth Management LLC now owns 6,424 shares of the utilities provider's stock valued at $938,000 after purchasing an additional 76 shares during the last quarter. Miracle Mile Advisors LLC raised its position in shares of American Water Works by 2.9% in the third quarter. Miracle Mile Advisors LLC now owns 2,790 shares of the utilities provider's stock valued at $408,000 after purchasing an additional 79 shares during the period. Invesco LLC lifted its stake in shares of American Water Works by 3.4% during the 3rd quarter. Invesco LLC now owns 2,467 shares of the utilities provider's stock worth $361,000 after buying an additional 82 shares during the last quarter. Finally, Asset Dedication LLC boosted its holdings in shares of American Water Works by 1.6% during the 2nd quarter. Asset Dedication LLC now owns 5,415 shares of the utilities provider's stock worth $699,000 after buying an additional 85 shares during the period. Institutional investors own 86.58% of the company's stock.

Analysts Set New Price Targets

Several research firms have weighed in on AWK. Wolfe Research raised shares of American Water Works to a "hold" rating in a report on Wednesday, September 18th. UBS Group upgraded American Water Works from a "neutral" rating to a "buy" rating and increased their target price for the stock from $151.00 to $155.00 in a research note on Tuesday, November 19th. Royal Bank of Canada restated an "outperform" rating and issued a $164.00 price target on shares of American Water Works in a research note on Thursday, September 19th. Bank of America reaffirmed an "underperform" rating and issued a $140.00 price objective on shares of American Water Works in a report on Friday, September 20th. Finally, Jefferies Financial Group began coverage on American Water Works in a report on Monday, October 7th. They set an "underperform" rating and a $124.00 target price for the company. Four research analysts have rated the stock with a sell rating, three have issued a hold rating and two have issued a buy rating to the company. According to data from MarketBeat, American Water Works presently has an average rating of "Hold" and a consensus price target of $142.29.

Read Our Latest Analysis on AWK

American Water Works Price Performance

Shares of AWK traded up $0.26 during trading hours on Tuesday, hitting $130.98. 838,061 shares of the company were exchanged, compared to its average volume of 1,209,812. The company has a quick ratio of 0.53, a current ratio of 0.58 and a debt-to-equity ratio of 1.21. American Water Works Company, Inc. has a fifty-two week low of $113.34 and a fifty-two week high of $150.68. The company has a market cap of $25.53 billion, a price-to-earnings ratio of 25.94, a P/E/G ratio of 3.08 and a beta of 0.70. The firm's fifty day moving average is $137.42 and its 200 day moving average is $137.87.

American Water Works Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, March 4th. Investors of record on Friday, February 7th will be given a dividend of $0.765 per share. The ex-dividend date is Friday, February 7th. This represents a $3.06 annualized dividend and a dividend yield of 2.34%. American Water Works's dividend payout ratio is 60.59%.

American Water Works Company Profile

(

Free Report)

American Water Works Company, Inc, through its subsidiaries, provides water and wastewater services in the United States. It offers water and wastewater services to approximately 1,700 communities in 14 states serving approximately 3.5 million active customers. The company serves residential customers; commercial customers, including food and beverage providers, commercial property developers and proprietors, and energy suppliers; fire service and private fire customers; industrial customers, such as large-scale manufacturers, mining, and production operations; public authorities comprising government buildings and other public sector facilities, such as schools and universities; and other utilities and community water and wastewater systems.

See Also

Before you consider American Water Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Water Works wasn't on the list.

While American Water Works currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.