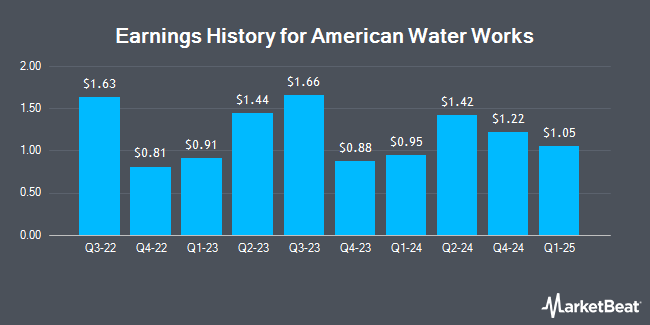

American Water Works (NYSE:AWK - Get Free Report) issued its quarterly earnings results on Wednesday. The utilities provider reported $1.22 earnings per share for the quarter, topping the consensus estimate of $1.13 by $0.09, Zacks reports. American Water Works had a return on equity of 10.33% and a net margin of 22.44%. The firm had revenue of $1.20 billion during the quarter, compared to the consensus estimate of $1.11 billion. American Water Works updated its FY 2025 guidance to 5.650-5.750 EPS.

American Water Works Price Performance

Shares of AWK stock traded up $3.88 during mid-day trading on Friday, reaching $132.55. The stock had a trading volume of 643,580 shares, compared to its average volume of 1,230,737. American Water Works has a 12-month low of $113.34 and a 12-month high of $150.68. The company has a market cap of $25.83 billion, a P/E ratio of 24.57, a price-to-earnings-growth ratio of 2.70 and a beta of 0.72. The business has a 50-day simple moving average of $124.87 and a 200 day simple moving average of $134.83. The company has a current ratio of 0.58, a quick ratio of 0.53 and a debt-to-equity ratio of 1.21.

American Water Works Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Tuesday, March 4th. Stockholders of record on Friday, February 7th will be given a $0.765 dividend. This represents a $3.06 dividend on an annualized basis and a dividend yield of 2.31%. The ex-dividend date is Friday, February 7th. American Water Works's dividend payout ratio is currently 56.77%.

Analysts Set New Price Targets

Several equities research analysts recently weighed in on the company. Wells Fargo & Company increased their price target on American Water Works from $129.00 to $133.00 and gave the stock an "equal weight" rating in a report on Thursday. UBS Group upgraded American Water Works from a "neutral" rating to a "buy" rating and increased their price objective for the stock from $151.00 to $155.00 in a research report on Tuesday, November 19th. Finally, JPMorgan Chase & Co. cut their price objective on American Water Works from $147.00 to $128.00 and set a "neutral" rating for the company in a research report on Tuesday, January 28th. Three research analysts have rated the stock with a sell rating, four have given a hold rating and two have given a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $140.57.

Get Our Latest Stock Analysis on AWK

About American Water Works

(

Get Free Report)

American Water Works Company, Inc, through its subsidiaries, provides water and wastewater services in the United States. It offers water and wastewater services to approximately 1,700 communities in 14 states serving approximately 3.5 million active customers. The company serves residential customers; commercial customers, including food and beverage providers, commercial property developers and proprietors, and energy suppliers; fire service and private fire customers; industrial customers, such as large-scale manufacturers, mining, and production operations; public authorities comprising government buildings and other public sector facilities, such as schools and universities; and other utilities and community water and wastewater systems.

Featured Articles

Before you consider American Water Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Water Works wasn't on the list.

While American Water Works currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.