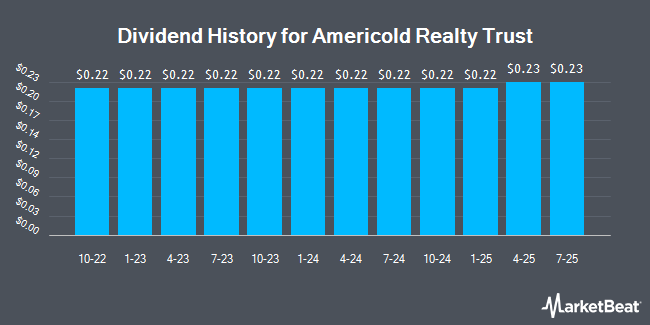

Americold Realty Trust, Inc. (NYSE:COLD - Get Free Report) announced a quarterly dividend on Tuesday, December 17th,RTT News reports. Shareholders of record on Tuesday, December 31st will be paid a dividend of 0.22 per share on Wednesday, January 15th. This represents a $0.88 annualized dividend and a yield of 3.94%.

Americold Realty Trust has increased its dividend payment by an average of 43.2% annually over the last three years. Americold Realty Trust has a payout ratio of 179.6% meaning the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Analysts expect Americold Realty Trust to earn $1.49 per share next year, which means the company should continue to be able to cover its $0.88 annual dividend with an expected future payout ratio of 59.1%.

Americold Realty Trust Price Performance

Shares of Americold Realty Trust stock traded down $0.16 during trading on Tuesday, hitting $22.32. 1,675,607 shares of the company's stock traded hands, compared to its average volume of 2,184,026. Americold Realty Trust has a twelve month low of $21.53 and a twelve month high of $30.59. The company has a debt-to-equity ratio of 0.11, a current ratio of 0.15 and a quick ratio of 0.15. The company has a market cap of $6.34 billion, a PE ratio of -22.10, a PEG ratio of 1.80 and a beta of 0.59. The firm's fifty day moving average price is $24.41 and its 200 day moving average price is $26.68.

Americold Realty Trust (NYSE:COLD - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The company reported ($0.01) earnings per share for the quarter, missing analysts' consensus estimates of $0.34 by ($0.35). Americold Realty Trust had a negative net margin of 10.63% and a negative return on equity of 8.08%. The company had revenue of $674.17 million for the quarter, compared to analyst estimates of $663.87 million. During the same period in the previous year, the firm posted $0.32 earnings per share. The firm's revenue for the quarter was up .9% compared to the same quarter last year. Analysts forecast that Americold Realty Trust will post 1.38 earnings per share for the current year.

Analysts Set New Price Targets

COLD has been the subject of a number of analyst reports. Citigroup cut their price objective on Americold Realty Trust from $30.00 to $25.00 and set a "neutral" rating for the company in a report on Wednesday, December 4th. Wells Fargo & Company boosted their price target on shares of Americold Realty Trust from $24.00 to $30.00 and gave the company an "equal weight" rating in a research report on Wednesday, August 28th. Royal Bank of Canada dropped their price objective on shares of Americold Realty Trust from $33.00 to $30.00 and set an "outperform" rating for the company in a report on Wednesday, November 13th. Robert W. Baird reduced their target price on Americold Realty Trust from $31.00 to $28.00 and set an "outperform" rating on the stock in a report on Friday, November 8th. Finally, Evercore ISI increased their price target on Americold Realty Trust from $33.00 to $34.00 and gave the stock an "outperform" rating in a research report on Wednesday, August 28th. Three equities research analysts have rated the stock with a hold rating and nine have issued a buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $29.17.

View Our Latest Report on COLD

Insider Buying and Selling

In other Americold Realty Trust news, SVP Robert E. Harris sold 1,836 shares of the firm's stock in a transaction dated Thursday, December 5th. The stock was sold at an average price of $22.64, for a total transaction of $41,567.04. Following the transaction, the senior vice president now owns 1,837 shares in the company, valued at approximately $41,589.68. This trade represents a 49.99 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 0.17% of the stock is currently owned by insiders.

About Americold Realty Trust

(

Get Free Report)

Americold is a global leader in temperature-controlled logistics real estate and value added services. Focused on the ownership, operation, acquisition and development of temperature-controlled warehouses, Americold owns and/or operates 245 temperature-controlled warehouses, with approximately 1.5 billion refrigerated cubic feet of storage, in North America, Europe, Asia-Pacific, and South America.

See Also

Before you consider Americold Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Americold Realty Trust wasn't on the list.

While Americold Realty Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.