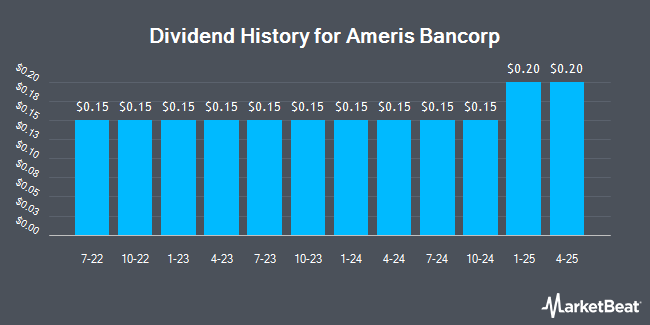

Ameris Bancorp (NASDAQ:ABCB - Get Free Report) announced a quarterly dividend on Thursday, March 20th, RTT News reports. Stockholders of record on Monday, March 31st will be paid a dividend of 0.20 per share by the bank on Monday, April 7th. This represents a $0.80 dividend on an annualized basis and a dividend yield of 1.35%. The ex-dividend date is Monday, March 31st.

Ameris Bancorp Stock Performance

Shares of ABCB traded up $1.63 during mid-day trading on Monday, reaching $59.41. The company's stock had a trading volume of 391,680 shares, compared to its average volume of 342,715. Ameris Bancorp has a 1-year low of $44.23 and a 1-year high of $74.56. The business has a 50-day simple moving average of $63.11 and a two-hundred day simple moving average of $63.98. The company has a current ratio of 1.02, a quick ratio of 1.00 and a debt-to-equity ratio of 0.11. The stock has a market cap of $4.10 billion, a P/E ratio of 11.40 and a beta of 1.02.

Insider Activity at Ameris Bancorp

In other news, insider Douglas D. Strange acquired 1,000 shares of the firm's stock in a transaction that occurred on Wednesday, March 12th. The shares were acquired at an average cost of $56.95 per share, with a total value of $56,950.00. Following the completion of the purchase, the insider now directly owns 19,403 shares of the company's stock, valued at $1,105,000.85. The trade was a 5.43 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 5.50% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

Several brokerages have issued reports on ABCB. Stephens restated an "equal weight" rating and set a $71.00 price objective on shares of Ameris Bancorp in a research report on Friday, January 31st. Keefe, Bruyette & Woods increased their price objective on Ameris Bancorp from $70.00 to $80.00 and gave the stock an "outperform" rating in a research report on Wednesday, December 4th. Finally, Raymond James restated an "outperform" rating and issued a $71.00 price target (up from $67.00) on shares of Ameris Bancorp in a research note on Monday, February 3rd. Two equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to MarketBeat, Ameris Bancorp currently has a consensus rating of "Moderate Buy" and an average target price of $70.50.

Get Our Latest Research Report on Ameris Bancorp

Ameris Bancorp Company Profile

(

Get Free Report)

Ameris Bancorp operates as the bank holding company for Ameris Bank that provides range of banking services to retail and commercial customers. It operates through five segments: Banking Division, Retail Mortgage Division, Warehouse Lending Division, SBA Division, and Premium Finance Division. The company offers commercial and retail checking, regular interest-bearing savings, money market, individual retirement, and certificates of deposit accounts.

Featured Stories

Before you consider Ameris Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ameris Bancorp wasn't on the list.

While Ameris Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.