GSA Capital Partners LLP lifted its stake in Amicus Therapeutics, Inc. (NASDAQ:FOLD - Free Report) by 163.8% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 133,800 shares of the biopharmaceutical company's stock after acquiring an additional 83,081 shares during the quarter. GSA Capital Partners LLP's holdings in Amicus Therapeutics were worth $1,429,000 as of its most recent filing with the Securities & Exchange Commission.

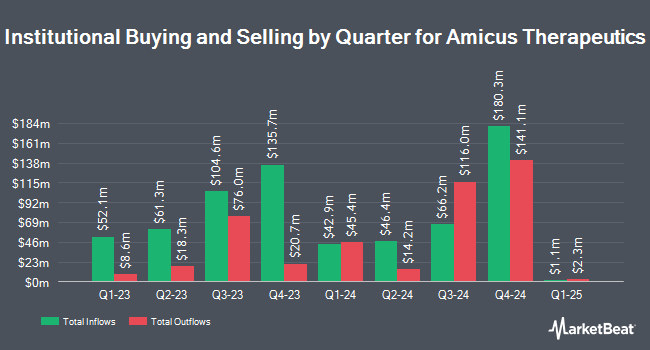

A number of other large investors have also recently made changes to their positions in FOLD. SG Americas Securities LLC purchased a new position in shares of Amicus Therapeutics in the first quarter worth approximately $291,000. Swiss National Bank boosted its holdings in shares of Amicus Therapeutics by 2.3% in the first quarter. Swiss National Bank now owns 434,300 shares of the biopharmaceutical company's stock worth $5,116,000 after buying an additional 9,900 shares during the last quarter. Sei Investments Co. boosted its holdings in shares of Amicus Therapeutics by 9.5% in the first quarter. Sei Investments Co. now owns 222,715 shares of the biopharmaceutical company's stock worth $2,624,000 after buying an additional 19,366 shares during the last quarter. ProShare Advisors LLC lifted its holdings in Amicus Therapeutics by 10.7% during the first quarter. ProShare Advisors LLC now owns 72,845 shares of the biopharmaceutical company's stock valued at $858,000 after purchasing an additional 7,068 shares in the last quarter. Finally, Orion Portfolio Solutions LLC lifted its holdings in Amicus Therapeutics by 9.0% during the first quarter. Orion Portfolio Solutions LLC now owns 152,187 shares of the biopharmaceutical company's stock valued at $1,793,000 after purchasing an additional 12,559 shares in the last quarter.

Amicus Therapeutics Stock Down 1.1 %

Shares of FOLD traded down $0.11 during mid-day trading on Thursday, hitting $10.26. 802,551 shares of the company traded hands, compared to its average volume of 2,719,387. The business has a 50 day moving average of $11.07 and a 200 day moving average of $10.61. The company has a market capitalization of $3.07 billion, a PE ratio of -30.50 and a beta of 0.68. The company has a quick ratio of 2.42, a current ratio of 3.15 and a debt-to-equity ratio of 2.18. Amicus Therapeutics, Inc. has a 1-year low of $9.02 and a 1-year high of $14.57.

Insider Activity at Amicus Therapeutics

In related news, CEO Bradley L. Campbell sold 7,500 shares of the firm's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $11.71, for a total transaction of $87,825.00. Following the completion of the transaction, the chief executive officer now owns 886,654 shares of the company's stock, valued at $10,382,718.34. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. In related news, CEO Bradley L. Campbell sold 7,901 shares of Amicus Therapeutics stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $12.50, for a total value of $98,762.50. Following the completion of the transaction, the chief executive officer now owns 886,654 shares in the company, valued at $11,083,175. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Bradley L. Campbell sold 7,500 shares of Amicus Therapeutics stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $11.71, for a total value of $87,825.00. Following the completion of the transaction, the chief executive officer now owns 886,654 shares of the company's stock, valued at approximately $10,382,718.34. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 30,401 shares of company stock worth $352,038 over the last quarter. Insiders own 2.20% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have recently issued reports on FOLD. Bank of America lifted their price objective on shares of Amicus Therapeutics from $13.00 to $15.00 and gave the company a "buy" rating in a research report on Thursday, October 17th. StockNews.com cut shares of Amicus Therapeutics from a "buy" rating to a "hold" rating in a research report on Friday, November 8th. Cantor Fitzgerald lifted their price objective on shares of Amicus Therapeutics from $20.00 to $21.00 and gave the company an "overweight" rating in a research report on Thursday, November 7th. Guggenheim lifted their price objective on shares of Amicus Therapeutics from $13.00 to $15.00 and gave the company a "buy" rating in a research report on Thursday, November 7th. Finally, Jefferies Financial Group began coverage on shares of Amicus Therapeutics in a research report on Friday, September 6th. They set a "buy" rating and a $18.00 price objective on the stock. Two investment analysts have rated the stock with a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $17.63.

Check Out Our Latest Stock Analysis on FOLD

About Amicus Therapeutics

(

Free Report)

Amicus Therapeutics, Inc, a biotechnology company, focuses on discovering, developing, and delivering medicines for rare diseases. Its commercial product and product candidates include Galafold, an oral precision medicine for the treatment of adults with a confirmed diagnosis of Fabry disease and an amenable galactosidase alpha gene variant; and Pombiliti + Opfolda, for the treatment of late onset.

See Also

Before you consider Amicus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amicus Therapeutics wasn't on the list.

While Amicus Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.