Amicus Therapeutics (NASDAQ:FOLD - Get Free Report) had its target price hoisted by research analysts at Guggenheim from $13.00 to $15.00 in a note issued to investors on Thursday,Benzinga reports. The brokerage currently has a "buy" rating on the biopharmaceutical company's stock. Guggenheim's price objective would suggest a potential upside of 37.36% from the company's current price.

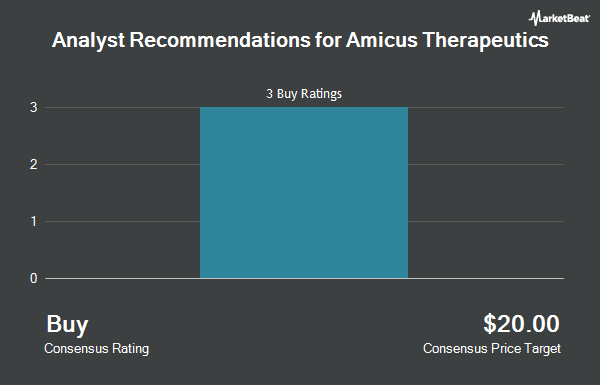

Several other analysts also recently weighed in on FOLD. Bank of America lifted their target price on Amicus Therapeutics from $13.00 to $15.00 and gave the company a "buy" rating in a research note on Thursday, October 17th. Needham & Company LLC reiterated a "hold" rating on shares of Amicus Therapeutics in a research report on Thursday. Cantor Fitzgerald raised their price objective on Amicus Therapeutics from $20.00 to $21.00 and gave the stock an "overweight" rating in a research report on Thursday. StockNews.com cut shares of Amicus Therapeutics from a "buy" rating to a "hold" rating in a report on Thursday, October 31st. Finally, Jefferies Financial Group initiated coverage on Amicus Therapeutics in a research note on Friday, September 6th. They set a "buy" rating and a $18.00 price target for the company. Two research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $17.50.

View Our Latest Research Report on Amicus Therapeutics

Amicus Therapeutics Trading Down 2.8 %

FOLD traded down $0.32 during midday trading on Thursday, hitting $10.92. The company's stock had a trading volume of 2,648,803 shares, compared to its average volume of 2,723,998. The firm has a market cap of $3.24 billion, a P/E ratio of -27.95 and a beta of 0.68. The firm has a 50-day moving average price of $11.15 and a two-hundred day moving average price of $10.61. Amicus Therapeutics has a 52-week low of $9.02 and a 52-week high of $14.57. The company has a current ratio of 2.75, a quick ratio of 2.26 and a debt-to-equity ratio of 2.93.

Amicus Therapeutics (NASDAQ:FOLD - Get Free Report) last announced its earnings results on Thursday, August 8th. The biopharmaceutical company reported ($0.05) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.05). The business had revenue of $126.67 million for the quarter, compared to analyst estimates of $121.21 million. Amicus Therapeutics had a negative return on equity of 41.47% and a negative net margin of 26.23%. The company's revenue for the quarter was up 34.0% compared to the same quarter last year. During the same period in the previous year, the company earned ($0.15) earnings per share. On average, research analysts anticipate that Amicus Therapeutics will post -0.06 earnings per share for the current year.

Insider Activity at Amicus Therapeutics

In other Amicus Therapeutics news, CEO Bradley L. Campbell sold 7,500 shares of Amicus Therapeutics stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $11.71, for a total transaction of $87,825.00. Following the completion of the transaction, the chief executive officer now directly owns 886,654 shares of the company's stock, valued at $10,382,718.34. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Over the last ninety days, insiders sold 22,500 shares of company stock valued at $253,275. Insiders own 2.20% of the company's stock.

Institutional Investors Weigh In On Amicus Therapeutics

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Janus Henderson Group PLC increased its stake in shares of Amicus Therapeutics by 20.1% in the first quarter. Janus Henderson Group PLC now owns 13,814,514 shares of the biopharmaceutical company's stock valued at $162,713,000 after buying an additional 2,307,385 shares during the period. William Blair Investment Management LLC boosted its holdings in shares of Amicus Therapeutics by 12.8% in the 2nd quarter. William Blair Investment Management LLC now owns 13,003,363 shares of the biopharmaceutical company's stock worth $128,993,000 after buying an additional 1,477,084 shares during the last quarter. Fiera Capital Corp increased its position in Amicus Therapeutics by 1.1% in the second quarter. Fiera Capital Corp now owns 5,280,442 shares of the biopharmaceutical company's stock worth $52,382,000 after buying an additional 58,113 shares during the last quarter. Massachusetts Financial Services Co. MA lifted its stake in shares of Amicus Therapeutics by 14.3% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 3,020,536 shares of the biopharmaceutical company's stock valued at $29,964,000 after buying an additional 378,999 shares in the last quarter. Finally, Victory Capital Management Inc. boosted its holdings in Amicus Therapeutics by 17.9% in the 2nd quarter. Victory Capital Management Inc. now owns 2,273,959 shares of the biopharmaceutical company's stock valued at $22,558,000 after purchasing an additional 345,117 shares during the period.

Amicus Therapeutics Company Profile

(

Get Free Report)

Amicus Therapeutics, Inc, a biotechnology company, focuses on discovering, developing, and delivering medicines for rare diseases. Its commercial product and product candidates include Galafold, an oral precision medicine for the treatment of adults with a confirmed diagnosis of Fabry disease and an amenable galactosidase alpha gene variant; and Pombiliti + Opfolda, for the treatment of late onset.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Amicus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amicus Therapeutics wasn't on the list.

While Amicus Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.