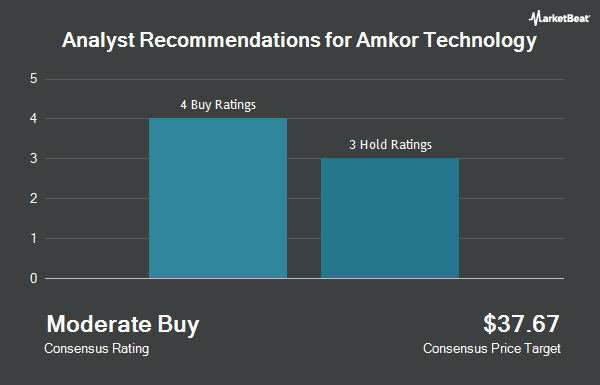

Shares of Amkor Technology, Inc. (NASDAQ:AMKR - Get Free Report) have been given a consensus recommendation of "Moderate Buy" by the ten ratings firms that are currently covering the firm, Marketbeat reports. Five research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. The average 12 month price objective among brokers that have covered the stock in the last year is $31.50.

AMKR has been the subject of a number of recent research reports. Needham & Company LLC reiterated a "buy" rating and set a $34.00 price objective on shares of Amkor Technology in a research note on Tuesday, February 11th. JPMorgan Chase & Co. lowered their price objective on Amkor Technology from $42.00 to $30.00 and set an "overweight" rating for the company in a research note on Tuesday, February 11th. Melius Research cut Amkor Technology from a "strong-buy" rating to a "hold" rating in a research note on Monday, January 6th. Melius cut Amkor Technology from a "buy" rating to a "hold" rating and lowered their price objective for the company from $34.00 to $30.00 in a research note on Monday, January 6th. Finally, B. Riley lowered their price objective on Amkor Technology from $38.00 to $32.00 and set a "buy" rating for the company in a research note on Tuesday, February 11th.

Get Our Latest Stock Analysis on AMKR

Insider Transactions at Amkor Technology

In related news, EVP Kevin Engel sold 5,489 shares of Amkor Technology stock in a transaction on Tuesday, February 25th. The stock was sold at an average price of $21.69, for a total value of $119,056.41. Following the completion of the sale, the executive vice president now owns 1,388 shares of the company's stock, valued at $30,105.72. The trade was a 79.82 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, major shareholder Agnes C. Kim sold 869,565 shares of Amkor Technology stock in a transaction on Monday, February 24th. The stock was sold at an average price of $21.85, for a total value of $18,999,995.25. Following the completion of the sale, the insider now directly owns 10,020,870 shares of the company's stock, valued at $218,956,009.50. The trade was a 7.98 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 31.40% of the company's stock.

Institutional Trading of Amkor Technology

Several large investors have recently modified their holdings of the company. Highland Capital Management LLC grew its holdings in shares of Amkor Technology by 6.6% in the fourth quarter. Highland Capital Management LLC now owns 7,814 shares of the semiconductor company's stock worth $201,000 after acquiring an additional 482 shares during the period. CANADA LIFE ASSURANCE Co grew its holdings in Amkor Technology by 0.5% during the fourth quarter. CANADA LIFE ASSURANCE Co now owns 90,081 shares of the semiconductor company's stock valued at $2,313,000 after purchasing an additional 484 shares during the period. Larson Financial Group LLC grew its holdings in Amkor Technology by 46.3% during the third quarter. Larson Financial Group LLC now owns 1,834 shares of the semiconductor company's stock valued at $56,000 after purchasing an additional 580 shares during the period. Robotti Robert grew its holdings in Amkor Technology by 0.3% during the fourth quarter. Robotti Robert now owns 215,837 shares of the semiconductor company's stock valued at $5,545,000 after purchasing an additional 705 shares during the period. Finally, New York State Teachers Retirement System grew its holdings in Amkor Technology by 2.0% during the fourth quarter. New York State Teachers Retirement System now owns 39,718 shares of the semiconductor company's stock valued at $1,020,000 after purchasing an additional 782 shares during the period. Institutional investors own 42.76% of the company's stock.

Amkor Technology Trading Up 4.0 %

AMKR opened at $20.74 on Monday. The stock has a market cap of $5.12 billion, a PE ratio of 14.50 and a beta of 1.88. The company has a quick ratio of 1.90, a current ratio of 2.11 and a debt-to-equity ratio of 0.22. The business has a 50 day moving average of $23.97 and a 200-day moving average of $26.96. Amkor Technology has a 52 week low of $19.65 and a 52 week high of $44.86.

Amkor Technology (NASDAQ:AMKR - Get Free Report) last released its earnings results on Monday, February 10th. The semiconductor company reported $0.43 EPS for the quarter, beating analysts' consensus estimates of $0.37 by $0.06. Amkor Technology had a return on equity of 8.59% and a net margin of 5.60%. Equities research analysts predict that Amkor Technology will post 1.47 earnings per share for the current fiscal year.

Amkor Technology Cuts Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, April 2nd. Stockholders of record on Thursday, March 13th will be paid a $0.0827 dividend. This represents a $0.33 annualized dividend and a dividend yield of 1.59%. The ex-dividend date of this dividend is Thursday, March 13th. Amkor Technology's dividend payout ratio is currently 23.08%.

Amkor Technology Company Profile

(

Get Free ReportAmkor Technology, Inc provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, the Middle East, Africa, and the Asia Pacific. It offers turnkey packaging and test services, including semiconductor wafer bump, wafer probe, wafer back-grind, package design, packaging, system-level and final test, and drop shipment services; flip chip scale package products for smartphones, tablets, and other mobile consumer electronic devices; flip chip stacked chip scale packages that are used to stack memory digital baseband, and as applications processors in mobile devices; flip-chip ball grid array packages for various networking, storage, computing, automotive, and consumer applications; and memory products for system memory or platform data storage.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Amkor Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amkor Technology wasn't on the list.

While Amkor Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.