Algert Global LLC lowered its position in Amkor Technology, Inc. (NASDAQ:AMKR - Free Report) by 39.4% during the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 38,306 shares of the semiconductor company's stock after selling 24,860 shares during the period. Algert Global LLC's holdings in Amkor Technology were worth $1,172,000 at the end of the most recent reporting period.

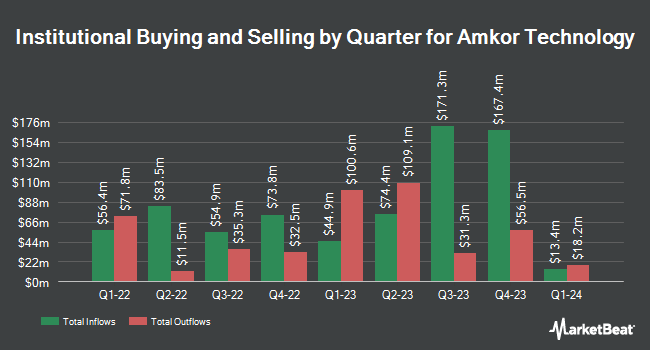

A number of other hedge funds have also recently added to or reduced their stakes in AMKR. Lazard Asset Management LLC bought a new stake in Amkor Technology during the first quarter worth approximately $326,000. Price T Rowe Associates Inc. MD boosted its position in Amkor Technology by 1.9% during the first quarter. Price T Rowe Associates Inc. MD now owns 106,466 shares of the semiconductor company's stock worth $3,434,000 after purchasing an additional 2,018 shares during the period. Public Employees Retirement System of Ohio boosted its position in Amkor Technology by 282.7% during the first quarter. Public Employees Retirement System of Ohio now owns 29,787 shares of the semiconductor company's stock worth $960,000 after purchasing an additional 22,003 shares during the period. Tidal Investments LLC bought a new stake in Amkor Technology during the first quarter worth approximately $584,000. Finally, Virtu Financial LLC bought a new stake in shares of Amkor Technology in the first quarter valued at approximately $504,000. Institutional investors and hedge funds own 42.76% of the company's stock.

Insider Transactions at Amkor Technology

In other Amkor Technology news, CEO Guillaume Marie Jean Rutten sold 10,000 shares of the company's stock in a transaction dated Tuesday, October 15th. The stock was sold at an average price of $31.51, for a total value of $315,100.00. Following the completion of the transaction, the chief executive officer now owns 204,971 shares of the company's stock, valued at $6,458,636.21. This represents a 4.65 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 31.40% of the stock is owned by insiders.

Amkor Technology Stock Performance

AMKR traded up $0.42 during trading on Friday, hitting $26.44. The stock had a trading volume of 511,282 shares, compared to its average volume of 1,314,122. The company has a 50 day moving average price of $28.50 and a 200-day moving average price of $32.51. The firm has a market cap of $6.52 billion, a price-to-earnings ratio of 17.86 and a beta of 1.85. Amkor Technology, Inc. has a one year low of $24.10 and a one year high of $44.86. The company has a debt-to-equity ratio of 0.21, a current ratio of 2.06 and a quick ratio of 1.84.

Amkor Technology (NASDAQ:AMKR - Get Free Report) last released its quarterly earnings results on Monday, October 28th. The semiconductor company reported $0.49 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.50 by ($0.01). The firm had revenue of $1.86 billion during the quarter, compared to the consensus estimate of $1.84 billion. Amkor Technology had a net margin of 5.68% and a return on equity of 8.98%. The business's revenue for the quarter was up 2.2% compared to the same quarter last year. During the same quarter last year, the firm earned $0.54 earnings per share. As a group, research analysts predict that Amkor Technology, Inc. will post 1.42 EPS for the current year.

Amkor Technology Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 23rd. Stockholders of record on Wednesday, December 4th will be issued a dividend of $0.0827 per share. The ex-dividend date of this dividend is Wednesday, December 4th. This represents a $0.33 dividend on an annualized basis and a dividend yield of 1.25%. This is a boost from Amkor Technology's previous quarterly dividend of $0.08. Amkor Technology's payout ratio is 22.30%.

Analyst Upgrades and Downgrades

Several research firms have recently weighed in on AMKR. The Goldman Sachs Group reduced their price objective on Amkor Technology from $36.00 to $32.00 and set a "neutral" rating for the company in a research report on Tuesday, October 29th. JPMorgan Chase & Co. reduced their price objective on Amkor Technology from $48.00 to $42.00 and set an "overweight" rating for the company in a research report on Tuesday, October 29th. Morgan Stanley reduced their price objective on Amkor Technology from $35.00 to $26.00 and set an "equal weight" rating for the company in a research report on Tuesday, October 29th. DA Davidson cut their target price on Amkor Technology from $40.00 to $36.00 and set a "buy" rating for the company in a research note on Tuesday, October 29th. Finally, StockNews.com lowered Amkor Technology from a "buy" rating to a "hold" rating in a research note on Tuesday, October 29th. Four investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $36.29.

Get Our Latest Stock Report on AMKR

Amkor Technology Company Profile

(

Free Report)

Amkor Technology, Inc provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, the Middle East, Africa, and the Asia Pacific. It offers turnkey packaging and test services, including semiconductor wafer bump, wafer probe, wafer back-grind, package design, packaging, system-level and final test, and drop shipment services; flip chip scale package products for smartphones, tablets, and other mobile consumer electronic devices; flip chip stacked chip scale packages that are used to stack memory digital baseband, and as applications processors in mobile devices; flip-chip ball grid array packages for various networking, storage, computing, automotive, and consumer applications; and memory products for system memory or platform data storage.

Further Reading

Before you consider Amkor Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amkor Technology wasn't on the list.

While Amkor Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.