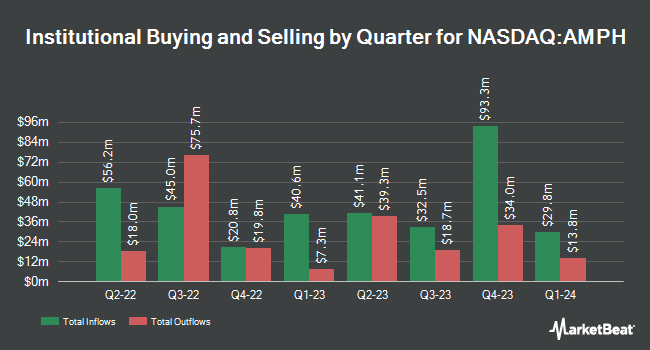

Connor Clark & Lunn Investment Management Ltd. lessened its holdings in Amphastar Pharmaceuticals, Inc. (NASDAQ:AMPH - Free Report) by 19.6% during the third quarter, according to the company in its most recent disclosure with the SEC. The firm owned 83,673 shares of the company's stock after selling 20,448 shares during the quarter. Connor Clark & Lunn Investment Management Ltd. owned about 0.17% of Amphastar Pharmaceuticals worth $4,061,000 at the end of the most recent quarter.

Several other large investors have also recently made changes to their positions in the business. Silvercrest Asset Management Group LLC increased its position in Amphastar Pharmaceuticals by 35.1% during the 1st quarter. Silvercrest Asset Management Group LLC now owns 112,428 shares of the company's stock valued at $4,937,000 after buying an additional 29,182 shares in the last quarter. International Assets Investment Management LLC purchased a new stake in shares of Amphastar Pharmaceuticals in the third quarter worth $11,070,000. Intech Investment Management LLC bought a new position in shares of Amphastar Pharmaceuticals during the second quarter valued at $426,000. Victory Capital Management Inc. raised its position in shares of Amphastar Pharmaceuticals by 10.9% in the 3rd quarter. Victory Capital Management Inc. now owns 218,531 shares of the company's stock worth $10,605,000 after purchasing an additional 21,530 shares during the last quarter. Finally, Los Angeles Capital Management LLC bought a new position in Amphastar Pharmaceuticals in the 3rd quarter worth about $785,000. 65.09% of the stock is currently owned by hedge funds and other institutional investors.

Amphastar Pharmaceuticals Stock Performance

Shares of AMPH stock traded up $0.91 on Friday, reaching $45.46. The stock had a trading volume of 410,772 shares, compared to its average volume of 414,981. The company has a debt-to-equity ratio of 0.82, a quick ratio of 2.61 and a current ratio of 3.43. Amphastar Pharmaceuticals, Inc. has a 1 year low of $36.56 and a 1 year high of $65.92. The stock has a market cap of $2.19 billion, a P/E ratio of 15.15, a price-to-earnings-growth ratio of 0.89 and a beta of 0.82. The company has a 50 day simple moving average of $48.26 and a 200 day simple moving average of $44.45.

Insider Buying and Selling

In other news, EVP Yakob Liawatidewi sold 5,214 shares of Amphastar Pharmaceuticals stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $52.05, for a total transaction of $271,388.70. Following the transaction, the executive vice president now directly owns 74,938 shares of the company's stock, valued at $3,900,522.90. The trade was a 6.51 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, EVP Rong Zhou sold 4,000 shares of the business's stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $48.35, for a total value of $193,400.00. Following the transaction, the executive vice president now owns 118,388 shares of the company's stock, valued at approximately $5,724,059.80. This trade represents a 3.27 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 31,533 shares of company stock valued at $1,571,652. 27.10% of the stock is owned by insiders.

Wall Street Analyst Weigh In

Several research analysts have issued reports on AMPH shares. Wells Fargo & Company began coverage on shares of Amphastar Pharmaceuticals in a report on Friday. They issued an "equal weight" rating and a $55.00 target price for the company. Needham & Company LLC reiterated a "hold" rating on shares of Amphastar Pharmaceuticals in a research note on Thursday, August 8th. StockNews.com cut Amphastar Pharmaceuticals from a "buy" rating to a "hold" rating in a research note on Friday, November 1st. Finally, Piper Sandler reduced their price objective on Amphastar Pharmaceuticals from $71.00 to $66.00 and set an "overweight" rating for the company in a report on Thursday, August 8th. Three investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $60.33.

Check Out Our Latest Report on AMPH

Amphastar Pharmaceuticals Company Profile

(

Free Report)

Amphastar Pharmaceuticals, Inc, a bio-pharmaceutical company, develops, manufactures, markets, and sells generic and proprietary injectable, inhalation, and intranasal products in the United States, China, and France. It offers BAQSIMI, a nasal spray for the treatment of severe hypoglycemia; Primatene Mist, an over-the-counter epinephrine inhalation product for the temporary relief of mild symptoms of intermittent asthma; Enoxaparin, to prevent and treat deep vein thrombosis; REXTOVY and Naloxone for opioid overdose; Glucagon for injection emergency kit; and Cortrosyn, for use as a diagnostic agent in the screening of patients with adrenocortical insufficiency.

Featured Stories

Before you consider Amphastar Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amphastar Pharmaceuticals wasn't on the list.

While Amphastar Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.