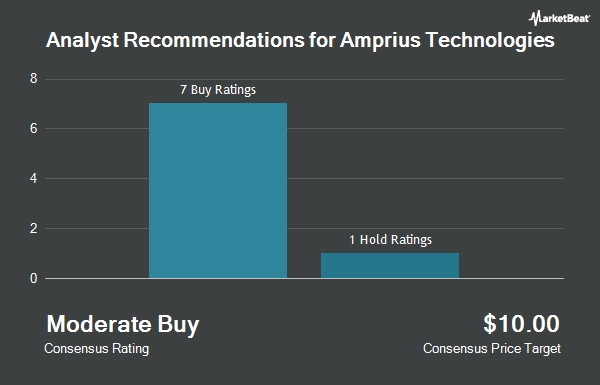

Amprius Technologies, Inc. (NYSE:AMPX - Get Free Report) has been assigned an average rating of "Buy" from the nine ratings firms that are currently covering the stock, Marketbeat reports. One equities research analyst has rated the stock with a hold recommendation, six have assigned a buy recommendation and two have assigned a strong buy recommendation to the company. The average 12-month price objective among brokerages that have updated their coverage on the stock in the last year is $8.17.

Several research firms have recently commented on AMPX. Oppenheimer decreased their price objective on Amprius Technologies from $15.00 to $14.00 and set an "outperform" rating on the stock in a report on Friday, August 9th. Northland Securities lowered their price target on Amprius Technologies from $10.00 to $4.00 and set an "outperform" rating for the company in a research report on Tuesday, August 13th. HC Wainwright reiterated a "buy" rating and issued a $10.00 price target on shares of Amprius Technologies in a research note on Monday, November 11th. Roth Mkm cut their price objective on shares of Amprius Technologies from $10.00 to $6.00 and set a "buy" rating on the stock in a report on Friday, August 9th. Finally, Northland Capmk upgraded shares of Amprius Technologies to a "strong-buy" rating in a report on Wednesday, October 2nd.

Get Our Latest Stock Report on Amprius Technologies

Insider Activity

In other Amprius Technologies news, CFO Sandra Wallach sold 17,158 shares of the business's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $1.96, for a total value of $33,629.68. Following the sale, the chief financial officer now owns 696,142 shares in the company, valued at $1,364,438.32. The trade was a 2.41 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Justin E. Mirro sold 135,000 shares of the business's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $1.00, for a total value of $135,000.00. Following the completion of the sale, the director now owns 1,510,000 shares in the company, valued at $1,510,000. This represents a 8.21 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 435,203 shares of company stock worth $429,850 over the last ninety days. Corporate insiders own 12.80% of the company's stock.

Institutional Trading of Amprius Technologies

Several institutional investors and hedge funds have recently made changes to their positions in AMPX. B. Riley Wealth Advisors Inc. raised its holdings in shares of Amprius Technologies by 84.4% in the second quarter. B. Riley Wealth Advisors Inc. now owns 22,500 shares of the company's stock valued at $29,000 after acquiring an additional 10,300 shares in the last quarter. XTX Topco Ltd acquired a new position in shares of Amprius Technologies during the second quarter worth $72,000. AQR Capital Management LLC purchased a new stake in shares of Amprius Technologies during the 2nd quarter valued at $99,000. Charles Schwab Investment Management Inc. boosted its position in shares of Amprius Technologies by 124.7% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 274,047 shares of the company's stock worth $304,000 after purchasing an additional 152,102 shares in the last quarter. Finally, State Street Corp grew its stake in Amprius Technologies by 4.7% during the 3rd quarter. State Street Corp now owns 286,390 shares of the company's stock worth $318,000 after buying an additional 12,900 shares during the last quarter. 5.04% of the stock is currently owned by institutional investors.

Amprius Technologies Stock Performance

NYSE AMPX traded up $0.31 on Monday, hitting $2.45. The stock had a trading volume of 6,880,289 shares, compared to its average volume of 1,066,972. The firm has a 50-day moving average of $1.52 and a 200-day moving average of $1.30. Amprius Technologies has a 52-week low of $0.61 and a 52-week high of $6.02. The company has a market capitalization of $258.78 million, a price-to-earnings ratio of -5.27 and a beta of 2.42.

Amprius Technologies (NYSE:AMPX - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The company reported ($0.10) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.11) by $0.01. The company had revenue of $7.86 million during the quarter, compared to analyst estimates of $7.70 million. Amprius Technologies had a negative return on equity of 71.39% and a negative net margin of 245.92%. During the same quarter last year, the company earned ($0.10) earnings per share. As a group, research analysts anticipate that Amprius Technologies will post -0.44 earnings per share for the current fiscal year.

Amprius Technologies Company Profile

(

Get Free ReportAmprius Technologies, Inc produces and sells ultra-high energy density lithium-ion batteries for mobility applications. The company offers silicon nanowire anode batteries. Its batteries are primarily used for existing and emerging aviation applications, including unmanned aerial systems, such as drones and high-altitude pseudo satellites.

Recommended Stories

Before you consider Amprius Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amprius Technologies wasn't on the list.

While Amprius Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.