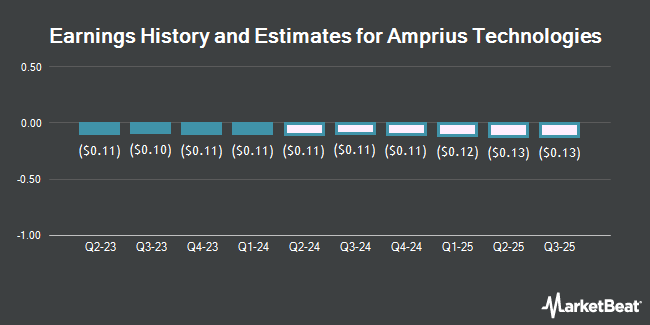

Amprius Technologies (NYSE:AMPX - Get Free Report) updated its FY 2024 earnings guidance on Tuesday. The company provided EPS guidance of -0.460--0.450 for the period, compared to the consensus EPS estimate of -0.430. The company issued revenue guidance of $24.0 million-$24.2 million, compared to the consensus revenue estimate of $20.6 million. Amprius Technologies also updated its Q4 2024 guidance to -0.110--0.100 EPS.

Analyst Upgrades and Downgrades

A number of brokerages recently weighed in on AMPX. HC Wainwright reissued a "buy" rating and issued a $10.00 price target on shares of Amprius Technologies in a research note on Monday, November 11th. Northland Securities lifted their price target on Amprius Technologies from $4.00 to $10.00 and gave the stock an "outperform" rating in a research note on Friday, January 10th. Finally, Cantor Fitzgerald started coverage on Amprius Technologies in a research note on Tuesday, January 21st. They set an "overweight" rating and a $10.00 target price on the stock. Six analysts have rated the stock with a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Buy" and a consensus price target of $9.29.

View Our Latest Analysis on AMPX

Amprius Technologies Stock Performance

Shares of NYSE AMPX traded up $0.01 during trading hours on Friday, hitting $2.00. The stock had a trading volume of 2,217,403 shares, compared to its average volume of 3,492,845. The company has a market capitalization of $211.15 million, a P/E ratio of -4.43 and a beta of 2.56. The firm's 50-day moving average price is $3.11 and its two-hundred day moving average price is $2.04. Amprius Technologies has a 52 week low of $0.61 and a 52 week high of $4.21.

Insider Activity at Amprius Technologies

In related news, CEO Kang Sun sold 34,353 shares of the business's stock in a transaction that occurred on Friday, February 21st. The stock was sold at an average price of $3.13, for a total value of $107,524.89. Following the completion of the sale, the chief executive officer now directly owns 1,282,621 shares in the company, valued at approximately $4,014,603.73. The trade was a 2.61 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CTO Constantin Ionel Stefan sold 9,066 shares of the business's stock in a transaction that occurred on Friday, February 21st. The stock was sold at an average price of $3.13, for a total value of $28,376.58. Following the completion of the sale, the chief technology officer now owns 421,489 shares of the company's stock, valued at approximately $1,319,260.57. This trade represents a 2.11 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 75,088 shares of company stock valued at $235,025. 12.80% of the stock is owned by corporate insiders.

Institutional Investors Weigh In On Amprius Technologies

An institutional investor recently raised its position in Amprius Technologies stock. Bank of America Corp DE raised its holdings in shares of Amprius Technologies, Inc. (NYSE:AMPX - Free Report) by 31.1% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 12,890 shares of the company's stock after buying an additional 3,055 shares during the quarter. Bank of America Corp DE's holdings in Amprius Technologies were worth $36,000 as of its most recent SEC filing. Institutional investors and hedge funds own 5.04% of the company's stock.

Amprius Technologies Company Profile

(

Get Free Report)

Amprius Technologies, Inc produces and sells ultra-high energy density lithium-ion batteries for mobility applications. The company offers silicon nanowire anode batteries. Its batteries are primarily used for existing and emerging aviation applications, including unmanned aerial systems, such as drones and high-altitude pseudo satellites.

Further Reading

Before you consider Amprius Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amprius Technologies wasn't on the list.

While Amprius Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.