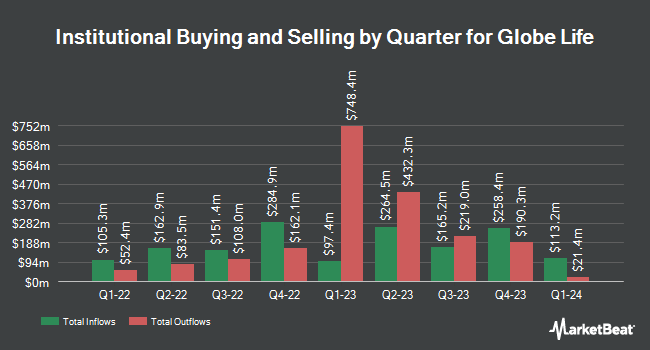

Amundi lifted its stake in Globe Life Inc. (NYSE:GL - Free Report) by 57.6% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 186,112 shares of the company's stock after acquiring an additional 68,004 shares during the period. Amundi owned 0.22% of Globe Life worth $21,239,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Nuance Investments LLC grew its stake in Globe Life by 155.6% during the 3rd quarter. Nuance Investments LLC now owns 1,138,978 shares of the company's stock valued at $120,629,000 after purchasing an additional 693,346 shares during the last quarter. Raymond James Financial Inc. acquired a new position in shares of Globe Life during the fourth quarter valued at approximately $61,238,000. Swedbank AB acquired a new position in shares of Globe Life during the fourth quarter valued at approximately $52,414,000. Proficio Capital Partners LLC grew its position in shares of Globe Life by 11,153.5% in the fourth quarter. Proficio Capital Partners LLC now owns 445,076 shares of the company's stock valued at $49,635,000 after purchasing an additional 441,121 shares in the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its position in Globe Life by 22.3% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,519,675 shares of the company's stock worth $160,949,000 after acquiring an additional 277,108 shares during the period. 81.61% of the stock is currently owned by hedge funds and other institutional investors.

Globe Life Stock Up 3.0 %

Shares of GL stock traded up $3.61 during trading hours on Friday, hitting $125.56. 746,407 shares of the company were exchanged, compared to its average volume of 622,331. The company has a debt-to-equity ratio of 0.50, a quick ratio of 0.05 and a current ratio of 0.05. Globe Life Inc. has a one year low of $38.95 and a one year high of $131.39. The business's 50-day simple moving average is $121.05 and its two-hundred day simple moving average is $112.25. The stock has a market capitalization of $10.53 billion, a price-to-earnings ratio of 10.51 and a beta of 0.77.

Globe Life (NYSE:GL - Get Free Report) last issued its quarterly earnings results on Wednesday, February 5th. The company reported $3.14 EPS for the quarter, topping the consensus estimate of $3.12 by $0.02. Globe Life had a net margin of 18.53% and a return on equity of 22.32%. Sell-side analysts predict that Globe Life Inc. will post 13.87 EPS for the current fiscal year.

Globe Life Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, May 1st. Shareholders of record on Thursday, April 3rd will be issued a $0.27 dividend. The ex-dividend date of this dividend is Thursday, April 3rd. This represents a $1.08 dividend on an annualized basis and a yield of 0.86%. This is a boost from Globe Life's previous quarterly dividend of $0.24. Globe Life's dividend payout ratio (DPR) is currently 9.04%.

Wall Street Analysts Forecast Growth

Several research analysts recently weighed in on GL shares. BMO Capital Markets assumed coverage on Globe Life in a research report on Thursday, January 23rd. They issued a "market perform" rating and a $114.00 price objective for the company. Evercore ISI raised Globe Life from an "in-line" rating to an "outperform" rating and lifted their price target for the stock from $132.00 to $143.00 in a report on Wednesday, January 8th. Morgan Stanley boosted their target price on Globe Life from $125.00 to $126.00 and gave the company an "equal weight" rating in a report on Friday, February 28th. Keefe, Bruyette & Woods boosted their price target on Globe Life from $137.00 to $145.00 and gave the company an "outperform" rating in a research report on Wednesday, February 12th. Finally, Wells Fargo & Company boosted their price target on Globe Life from $126.00 to $141.00 and gave the company an "overweight" rating in a research report on Wednesday, February 19th. Five equities research analysts have rated the stock with a hold rating, five have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $135.60.

Check Out Our Latest Analysis on GL

Insiders Place Their Bets

In other Globe Life news, CEO Frank M. Svoboda sold 13,448 shares of the firm's stock in a transaction dated Monday, January 6th. The shares were sold at an average price of $112.56, for a total value of $1,513,706.88. Following the transaction, the chief executive officer now owns 18,948 shares of the company's stock, valued at $2,132,786.88. This trade represents a 41.51 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CEO James Matthew Darden sold 24,890 shares of the firm's stock in a transaction dated Tuesday, February 11th. The stock was sold at an average price of $121.52, for a total transaction of $3,024,632.80. Following the completion of the transaction, the chief executive officer now directly owns 38,973 shares in the company, valued at $4,735,998.96. This represents a 38.97 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 61,338 shares of company stock valued at $7,239,630 over the last quarter. Insiders own 1.51% of the company's stock.

Globe Life Company Profile

(

Free Report)

Globe Life Inc, through its subsidiaries, provides various life and supplemental health insurance products, and annuities to lower middle- and middle-income families in the United States. The company operates in four segments: Life Insurance, Supplemental Health Insurance, Annuities, and Investments.

See Also

Before you consider Globe Life, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globe Life wasn't on the list.

While Globe Life currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report