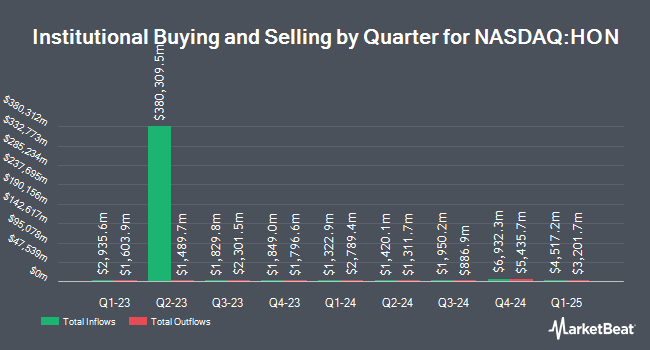

Amundi boosted its holdings in shares of Honeywell International Inc. (NASDAQ:HON - Free Report) by 10.9% in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 399,176 shares of the conglomerate's stock after acquiring an additional 39,298 shares during the quarter. Amundi owned 0.06% of Honeywell International worth $87,887,000 as of its most recent SEC filing.

Other large investors also recently bought and sold shares of the company. Raymond James Financial Inc. purchased a new stake in shares of Honeywell International in the 4th quarter worth $435,786,000. ING Groep NV lifted its holdings in shares of Honeywell International by 884.0% in the 4th quarter. ING Groep NV now owns 1,752,472 shares of the conglomerate's stock worth $395,866,000 after buying an additional 1,574,376 shares during the period. Wellington Management Group LLP lifted its holdings in shares of Honeywell International by 8.4% in the 3rd quarter. Wellington Management Group LLP now owns 17,826,700 shares of the conglomerate's stock worth $3,684,957,000 after buying an additional 1,376,479 shares during the period. Cibc World Market Inc. lifted its holdings in shares of Honeywell International by 320.5% in the 4th quarter. Cibc World Market Inc. now owns 858,336 shares of the conglomerate's stock worth $193,890,000 after buying an additional 654,207 shares during the period. Finally, Bank of New York Mellon Corp lifted its stake in shares of Honeywell International by 10.3% during the 4th quarter. Bank of New York Mellon Corp now owns 6,763,764 shares of the conglomerate's stock worth $1,527,867,000 after purchasing an additional 631,761 shares during the last quarter. Hedge funds and other institutional investors own 75.91% of the company's stock.

Insider Activity

In other news, VP Anne T. Madden sold 28,885 shares of the company's stock in a transaction dated Monday, February 10th. The stock was sold at an average price of $207.89, for a total value of $6,004,902.65. Following the sale, the vice president now owns 41,580 shares in the company, valued at $8,644,066.20. This represents a 40.99 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 0.41% of the company's stock.

Honeywell International Trading Down 2.4 %

Shares of NASDAQ:HON opened at $208.59 on Wednesday. The business's 50-day moving average is $216.15 and its 200 day moving average is $216.53. Honeywell International Inc. has a 1 year low of $189.75 and a 1 year high of $242.77. The firm has a market capitalization of $135.57 billion, a P/E ratio of 23.95, a P/E/G ratio of 2.51 and a beta of 1.08. The company has a debt-to-equity ratio of 1.33, a current ratio of 1.31 and a quick ratio of 1.01.

Honeywell International (NASDAQ:HON - Get Free Report) last announced its quarterly earnings data on Thursday, February 6th. The conglomerate reported $2.47 earnings per share for the quarter, beating analysts' consensus estimates of $2.37 by $0.10. Honeywell International had a return on equity of 35.78% and a net margin of 14.82%. On average, research analysts predict that Honeywell International Inc. will post 10.34 earnings per share for the current fiscal year.

Honeywell International Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, March 14th. Stockholders of record on Friday, February 28th will be issued a $1.13 dividend. This represents a $4.52 dividend on an annualized basis and a dividend yield of 2.17%. The ex-dividend date is Friday, February 28th. Honeywell International's dividend payout ratio is presently 51.89%.

Analyst Upgrades and Downgrades

A number of equities research analysts recently weighed in on HON shares. UBS Group restated a "buy" rating and set a $298.00 price objective (up from $215.00) on shares of Honeywell International in a research note on Wednesday, November 13th. StockNews.com cut Honeywell International from a "buy" rating to a "hold" rating in a research note on Monday, December 23rd. Bank of America upped their price objective on Honeywell International from $220.00 to $240.00 and gave the stock a "neutral" rating in a research note on Thursday, November 14th. Barclays decreased their price objective on Honeywell International from $260.00 to $251.00 and set an "overweight" rating for the company in a research note on Monday, February 10th. Finally, Deutsche Bank Aktiengesellschaft upgraded Honeywell International from a "hold" rating to a "buy" rating and upped their price objective for the stock from $236.00 to $260.00 in a research note on Friday, February 7th. Ten analysts have rated the stock with a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus price target of $249.38.

Get Our Latest Stock Analysis on Honeywell International

About Honeywell International

(

Free Report)

Honeywell International Inc engages in the aerospace technologies, building automation, energy and sustainable solutions, and industrial automation businesses in the United States, Europe, and internationally. The company's Aerospace segment offers auxiliary power units, propulsion engines, integrated avionics, environmental control and electric power systems, engine controls, flight safety, communications, navigation hardware, data and software applications, radar and surveillance systems, aircraft lighting, advanced systems and instruments, satellite and space components, and aircraft wheels and brakes; spare parts; repair, overhaul, and maintenance services; and thermal systems, as well as wireless connectivity services.

See Also

Want to see what other hedge funds are holding HON? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Honeywell International Inc. (NASDAQ:HON - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Honeywell International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Honeywell International wasn't on the list.

While Honeywell International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report