Amundi decreased its holdings in Mueller Water Products, Inc. (NYSE:MWA - Free Report) by 2.5% in the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 992,394 shares of the industrial products company's stock after selling 25,287 shares during the period. Amundi owned approximately 0.63% of Mueller Water Products worth $21,940,000 as of its most recent SEC filing.

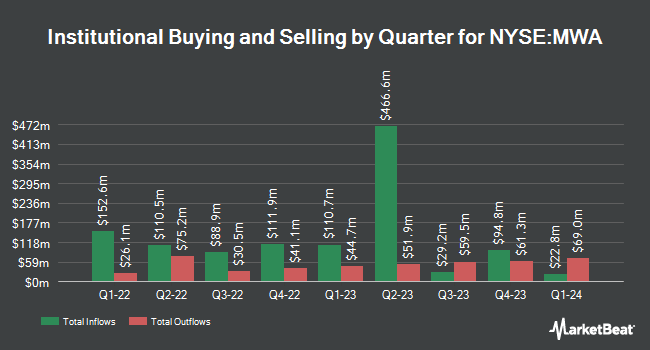

Several other institutional investors have also added to or reduced their stakes in the company. Franklin Resources Inc. raised its holdings in Mueller Water Products by 10.1% in the 3rd quarter. Franklin Resources Inc. now owns 8,618,782 shares of the industrial products company's stock worth $197,456,000 after purchasing an additional 791,569 shares in the last quarter. State Street Corp raised its holdings in Mueller Water Products by 0.3% in the 3rd quarter. State Street Corp now owns 3,931,662 shares of the industrial products company's stock worth $85,317,000 after purchasing an additional 12,438 shares in the last quarter. Geode Capital Management LLC raised its holdings in Mueller Water Products by 2.1% in the 3rd quarter. Geode Capital Management LLC now owns 3,538,901 shares of the industrial products company's stock worth $76,809,000 after purchasing an additional 73,069 shares in the last quarter. Principal Financial Group Inc. raised its holdings in Mueller Water Products by 2,962.3% in the 4th quarter. Principal Financial Group Inc. now owns 3,015,009 shares of the industrial products company's stock worth $67,838,000 after purchasing an additional 2,916,552 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. increased its stake in shares of Mueller Water Products by 0.4% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 1,952,282 shares of the industrial products company's stock worth $43,926,000 after acquiring an additional 7,567 shares in the last quarter. Hedge funds and other institutional investors own 91.68% of the company's stock.

Insiders Place Their Bets

In other news, Director Lydia W. Thomas sold 17,092 shares of Mueller Water Products stock in a transaction that occurred on Tuesday, March 11th. The shares were sold at an average price of $26.77, for a total transaction of $457,552.84. Following the sale, the director now owns 126,689 shares in the company, valued at $3,391,464.53. This trade represents a 11.89 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Brian Slobodow sold 11,132 shares of Mueller Water Products stock in a transaction that occurred on Tuesday, March 4th. The shares were sold at an average price of $24.73, for a total transaction of $275,294.36. Following the sale, the director now owns 7,376 shares in the company, valued at approximately $182,408.48. The trade was a 60.15 % decrease in their position. The disclosure for this sale can be found here. 1.10% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

MWA has been the subject of several research reports. The Goldman Sachs Group increased their price target on shares of Mueller Water Products from $26.00 to $29.00 and gave the stock a "neutral" rating in a research note on Thursday, February 6th. Royal Bank of Canada raised their price objective on shares of Mueller Water Products from $25.00 to $29.00 and gave the company a "sector perform" rating in a research note on Thursday, February 6th. Five analysts have rated the stock with a hold rating and two have given a buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus price target of $25.80.

Check Out Our Latest Report on MWA

Mueller Water Products Stock Performance

MWA opened at $26.36 on Friday. The company has a current ratio of 3.83, a quick ratio of 2.38 and a debt-to-equity ratio of 0.54. The company has a market cap of $4.13 billion, a price-to-earnings ratio of 30.65, a PEG ratio of 1.43 and a beta of 1.39. The company's 50 day moving average is $24.62 and its 200 day moving average is $23.36. Mueller Water Products, Inc. has a 12-month low of $14.81 and a 12-month high of $28.25.

Mueller Water Products (NYSE:MWA - Get Free Report) last posted its quarterly earnings data on Tuesday, February 4th. The industrial products company reported $0.25 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.19 by $0.06. Mueller Water Products had a net margin of 10.05% and a return on equity of 21.18%. During the same period in the prior year, the business earned $0.13 EPS. On average, equities research analysts predict that Mueller Water Products, Inc. will post 1.24 EPS for the current year.

Mueller Water Products Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, February 21st. Shareholders of record on Monday, February 10th were paid a dividend of $0.067 per share. This represents a $0.27 dividend on an annualized basis and a yield of 1.02%. The ex-dividend date was Monday, February 10th. Mueller Water Products's payout ratio is 30.23%.

Mueller Water Products Company Profile

(

Free Report)

Mueller Water Products, Inc manufactures and markets products and services for the transmission, distribution, and measurement of water used by municipalities, and the residential and non-residential construction industries in the United States, Israel, and internationally. It operates in two segments, Water Flow Solutions and Water Management Solutions.

Featured Articles

Want to see what other hedge funds are holding MWA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Mueller Water Products, Inc. (NYSE:MWA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Mueller Water Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Water Products wasn't on the list.

While Mueller Water Products currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report