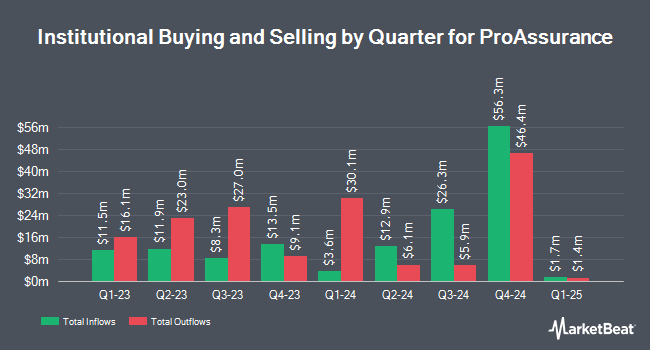

Amundi lifted its position in ProAssurance Co. (NYSE:PRA - Free Report) by 182.3% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 25,634 shares of the insurance provider's stock after acquiring an additional 16,552 shares during the period. Amundi owned approximately 0.05% of ProAssurance worth $389,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors have also bought and sold shares of the company. Barclays PLC raised its holdings in ProAssurance by 307.5% in the third quarter. Barclays PLC now owns 85,117 shares of the insurance provider's stock worth $1,280,000 after purchasing an additional 64,228 shares during the period. State Street Corp raised its stake in ProAssurance by 1.8% during the 3rd quarter. State Street Corp now owns 1,968,754 shares of the insurance provider's stock worth $29,610,000 after buying an additional 34,247 shares during the period. JPMorgan Chase & Co. lifted its holdings in ProAssurance by 34.8% during the third quarter. JPMorgan Chase & Co. now owns 253,175 shares of the insurance provider's stock worth $3,808,000 after acquiring an additional 65,325 shares in the last quarter. FMR LLC grew its stake in ProAssurance by 197.8% in the third quarter. FMR LLC now owns 12,063 shares of the insurance provider's stock valued at $181,000 after acquiring an additional 8,012 shares during the period. Finally, Connor Clark & Lunn Investment Management Ltd. increased its holdings in shares of ProAssurance by 402.1% in the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 68,435 shares of the insurance provider's stock worth $1,029,000 after acquiring an additional 54,806 shares in the last quarter. Institutional investors own 85.58% of the company's stock.

Analyst Upgrades and Downgrades

Separately, StockNews.com cut ProAssurance from a "buy" rating to a "hold" rating in a research note on Friday.

View Our Latest Stock Report on ProAssurance

ProAssurance Stock Up 0.0 %

NYSE PRA traded up $0.01 during trading on Monday, hitting $23.17. The stock had a trading volume of 3,279,583 shares, compared to its average volume of 333,530. ProAssurance Co. has a 12 month low of $10.76 and a 12 month high of $23.29. The company has a debt-to-equity ratio of 0.35, a quick ratio of 0.28 and a current ratio of 0.28. The company's 50-day moving average price is $15.40 and its two-hundred day moving average price is $15.41. The company has a market capitalization of $1.19 billion, a PE ratio of 27.91 and a beta of 0.21.

ProAssurance (NYSE:PRA - Get Free Report) last announced its quarterly earnings data on Monday, February 24th. The insurance provider reported $0.36 EPS for the quarter, topping analysts' consensus estimates of $0.17 by $0.19. The business had revenue of $287.52 million for the quarter, compared to analyst estimates of $274.56 million. ProAssurance had a net margin of 3.71% and a return on equity of 2.65%. As a group, sell-side analysts forecast that ProAssurance Co. will post 0.8 EPS for the current year.

ProAssurance Company Profile

(

Free Report)

ProAssurance Corporation, through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States. The company operates through Specialty Property and Casualty, Workers' Compensation Insurance, and Segregated Portfolio Cell Reinsurance segments. It offers professional liability insurance to healthcare providers and institutions, and attorneys and their firms; medical technology liability insurance to medical technology and life sciences companies; and custom alternative risk solutions, including assumed reinsurance, loss portfolio transfers, and captive cell programs for healthcare professional liability insureds.

Read More

Before you consider ProAssurance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProAssurance wasn't on the list.

While ProAssurance currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.