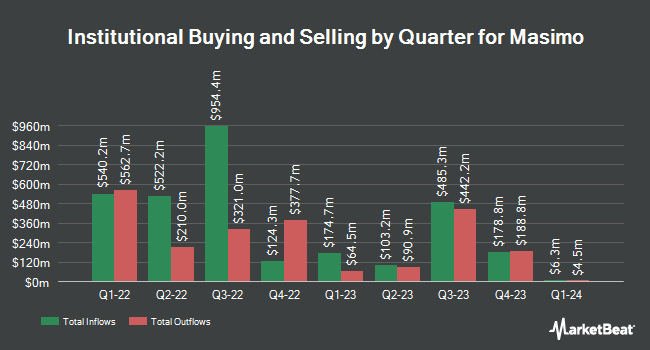

Amundi lifted its holdings in Masimo Co. (NASDAQ:MASI - Free Report) by 363.8% during the 4th quarter, according to its most recent disclosure with the SEC. The institutional investor owned 111,481 shares of the medical equipment provider's stock after acquiring an additional 87,446 shares during the period. Amundi owned approximately 0.21% of Masimo worth $18,818,000 as of its most recent filing with the SEC.

Other hedge funds have also bought and sold shares of the company. Assetmark Inc. boosted its holdings in Masimo by 12.7% in the 3rd quarter. Assetmark Inc. now owns 1,183 shares of the medical equipment provider's stock valued at $158,000 after purchasing an additional 133 shares during the period. Crossmark Global Holdings Inc. raised its position in shares of Masimo by 14.4% in the third quarter. Crossmark Global Holdings Inc. now owns 3,248 shares of the medical equipment provider's stock valued at $433,000 after buying an additional 409 shares in the last quarter. State of New Jersey Common Pension Fund D boosted its stake in shares of Masimo by 1.2% in the third quarter. State of New Jersey Common Pension Fund D now owns 16,736 shares of the medical equipment provider's stock valued at $2,231,000 after buying an additional 194 shares during the period. Oppenheimer Asset Management Inc. acquired a new stake in Masimo during the third quarter worth approximately $478,000. Finally, KBC Group NV increased its stake in Masimo by 17.3% during the 3rd quarter. KBC Group NV now owns 1,280 shares of the medical equipment provider's stock worth $171,000 after acquiring an additional 189 shares during the period. 85.96% of the stock is owned by institutional investors.

Insider Transactions at Masimo

In other news, COO Bilal Muhsin sold 30,000 shares of the stock in a transaction dated Monday, March 10th. The stock was sold at an average price of $167.49, for a total value of $5,024,700.00. Following the completion of the sale, the chief operating officer now owns 24,172 shares of the company's stock, valued at approximately $4,048,568.28. This represents a 55.38 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. 9.70% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

A number of analysts have recently weighed in on MASI shares. Stifel Nicolaus reiterated a "buy" rating and set a $190.00 target price (up from $170.00) on shares of Masimo in a research report on Friday, November 22nd. Piper Sandler upped their price objective on shares of Masimo from $210.00 to $215.00 and gave the stock an "overweight" rating in a research report on Wednesday, February 26th. Wells Fargo & Company increased their price objective on shares of Masimo from $193.00 to $205.00 and gave the stock an "overweight" rating in a research note on Wednesday, February 26th. Needham & Company LLC restated a "hold" rating on shares of Masimo in a research report on Wednesday, February 26th. Finally, Raymond James increased their price target on shares of Masimo from $170.00 to $194.00 and gave the stock an "outperform" rating in a research report on Friday, December 27th. Two equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $194.80.

Read Our Latest Research Report on MASI

Masimo Stock Performance

NASDAQ MASI opened at $165.69 on Friday. Masimo Co. has a fifty-two week low of $101.61 and a fifty-two week high of $194.88. The stock has a market cap of $8.94 billion, a PE ratio of 114.27 and a beta of 1.03. The company has a debt-to-equity ratio of 0.50, a quick ratio of 1.11 and a current ratio of 2.01. The firm's fifty day moving average price is $174.90 and its two-hundred day moving average price is $157.02.

Masimo (NASDAQ:MASI - Get Free Report) last issued its quarterly earnings data on Tuesday, February 25th. The medical equipment provider reported $1.80 earnings per share for the quarter, topping analysts' consensus estimates of $1.42 by $0.38. Masimo had a return on equity of 14.98% and a net margin of 3.85%. The business had revenue of $600.70 million for the quarter, compared to analyst estimates of $593.35 million. On average, equities analysts expect that Masimo Co. will post 4.1 EPS for the current fiscal year.

About Masimo

(

Free Report)

Masimo Corporation develops, manufactures, and markets various patient monitoring technologies, and automation and connectivity solutions worldwide. The company offers masimo signal extraction technology (SET) pulse oximetry with measure-through motion and low perfusion pulse oximetry monitoring to address the primary limitations of conventional pulse oximetry; Masimo rainbow SET platform, including rainbow SET Pulse CO-Oximetry products that allows noninvasive monitoring of carboxyhemoglobin, methemoglobin, hemoglobin concentration, fractional arterial oxygen saturation, oxygen content, pleth variability index, rainbow pleth variability index, respiration rate from the pleth, and oxygen reserve index, as well as acoustic respiration monitoring, SedLine brain function monitoring, NomoLine capnography and gas monitoring, and regional oximetry.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Masimo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masimo wasn't on the list.

While Masimo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.