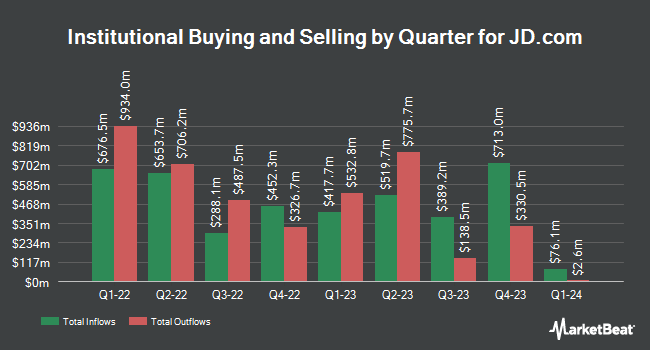

Amundi lifted its position in JD.com, Inc. (NASDAQ:JD - Free Report) by 56.3% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 834,307 shares of the information services provider's stock after purchasing an additional 300,517 shares during the quarter. Amundi owned 0.05% of JD.com worth $28,967,000 at the end of the most recent reporting period.

Other large investors have also modified their holdings of the company. Richardson Financial Services Inc. bought a new stake in JD.com in the fourth quarter valued at $27,000. Brooklyn Investment Group bought a new stake in JD.com in the fourth quarter valued at $34,000. Nisa Investment Advisors LLC grew its position in JD.com by 71.5% in the fourth quarter. Nisa Investment Advisors LLC now owns 1,000 shares of the information services provider's stock valued at $35,000 after acquiring an additional 417 shares during the period. Modus Advisors LLC bought a new stake in JD.com in the fourth quarter valued at $41,000. Finally, Wilmington Savings Fund Society FSB bought a new stake in JD.com in the third quarter valued at $49,000. 15.98% of the stock is currently owned by institutional investors and hedge funds.

JD.com Price Performance

JD.com stock opened at $40.37 on Thursday. The business's 50-day simple moving average is $39.35 and its 200 day simple moving average is $37.07. The stock has a market cap of $63.67 billion, a price-to-earnings ratio of 12.78, a P/E/G ratio of 0.31 and a beta of 0.43. JD.com, Inc. has a 12-month low of $24.13 and a 12-month high of $47.82. The company has a quick ratio of 0.90, a current ratio of 1.17 and a debt-to-equity ratio of 0.18.

JD.com Increases Dividend

The business also recently announced an annual dividend, which will be paid on Tuesday, April 29th. Shareholders of record on Tuesday, April 8th will be paid a $0.76 dividend. This is a positive change from JD.com's previous annual dividend of $0.74. The ex-dividend date of this dividend is Tuesday, April 8th. This represents a yield of 1.7%. JD.com's dividend payout ratio is presently 19.73%.

Wall Street Analyst Weigh In

A number of analysts have weighed in on JD shares. StockNews.com cut JD.com from a "strong-buy" rating to a "buy" rating in a research report on Tuesday, February 11th. Barclays increased their target price on JD.com from $50.00 to $55.00 and gave the stock an "overweight" rating in a report on Friday, February 28th. Sanford C. Bernstein restated an "outperform" rating on shares of JD.com in a report on Friday, March 7th. Citigroup decreased their target price on JD.com from $52.00 to $51.00 and set a "buy" rating on the stock in a report on Friday, November 15th. Finally, Susquehanna restated a "neutral" rating and set a $45.00 target price (up previously from $35.00) on shares of JD.com in a report on Wednesday. Two research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $45.64.

Check Out Our Latest Stock Analysis on JD.com

About JD.com

(

Free Report)

JD.com, Inc operates as a supply chain-based technology and service provider in the People's Republic of China. The company offers computers, communication, and consumer electronics products, as well as home appliances; and general merchandise products comprising food, beverage and fresh produce, baby and maternity products, furniture and household goods, cosmetics and other personal care items, pharmaceutical and healthcare products, industrial products, books, automobile accessories, apparel and footwear, bags, and jewelry.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider JD.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JD.com wasn't on the list.

While JD.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.