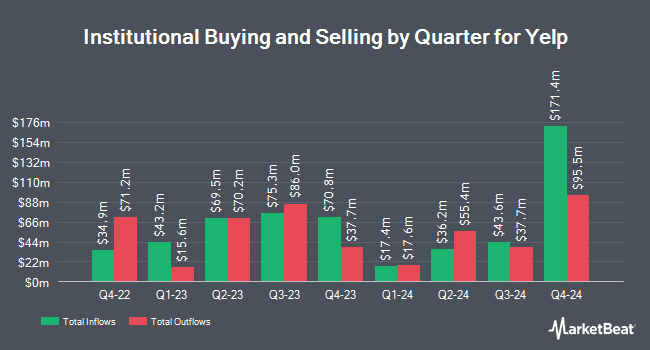

Amundi reduced its stake in shares of Yelp Inc. (NYSE:YELP - Free Report) by 62.4% in the fourth quarter, according to its most recent filing with the SEC. The fund owned 84,227 shares of the local business review company's stock after selling 140,009 shares during the period. Amundi owned approximately 0.13% of Yelp worth $3,287,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in YELP. FMR LLC raised its position in Yelp by 13.7% during the third quarter. FMR LLC now owns 654,059 shares of the local business review company's stock valued at $22,944,000 after purchasing an additional 78,585 shares in the last quarter. Pacer Advisors Inc. raised its stake in shares of Yelp by 1.8% during the third quarter. Pacer Advisors Inc. now owns 2,743,899 shares of the local business review company's stock worth $96,256,000 after acquiring an additional 48,363 shares in the last quarter. Barclays PLC lifted its holdings in shares of Yelp by 347.9% in the 3rd quarter. Barclays PLC now owns 160,363 shares of the local business review company's stock worth $5,627,000 after acquiring an additional 124,561 shares during the last quarter. FORA Capital LLC bought a new stake in shares of Yelp in the 3rd quarter worth approximately $732,000. Finally, Algert Global LLC boosted its stake in shares of Yelp by 7.5% in the 3rd quarter. Algert Global LLC now owns 204,077 shares of the local business review company's stock valued at $7,159,000 after purchasing an additional 14,213 shares in the last quarter. 90.11% of the stock is currently owned by hedge funds and other institutional investors.

Yelp Stock Down 0.2 %

Shares of Yelp stock traded down $0.07 during trading on Thursday, reaching $35.43. 680,348 shares of the stock were exchanged, compared to its average volume of 677,811. The firm has a market cap of $2.30 billion, a price-to-earnings ratio of 18.45, a price-to-earnings-growth ratio of 0.76 and a beta of 1.40. Yelp Inc. has a 1 year low of $32.56 and a 1 year high of $41.72. The stock's fifty day moving average is $37.60 and its 200 day moving average is $36.67.

Yelp (NYSE:YELP - Get Free Report) last posted its earnings results on Thursday, February 13th. The local business review company reported $0.62 EPS for the quarter, topping the consensus estimate of $0.53 by $0.09. Yelp had a net margin of 9.41% and a return on equity of 18.07%. The firm had revenue of $361.95 million during the quarter, compared to analysts' expectations of $350.73 million. Equities analysts forecast that Yelp Inc. will post 2.22 earnings per share for the current year.

Insider Transactions at Yelp

In other news, insider Carmen Amara sold 11,238 shares of Yelp stock in a transaction dated Friday, March 7th. The stock was sold at an average price of $35.00, for a total value of $393,330.00. Following the completion of the transaction, the insider now owns 108,123 shares of the company's stock, valued at $3,784,305. The trade was a 9.42 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CTO Sam Eaton sold 21,989 shares of Yelp stock in a transaction dated Friday, February 21st. The stock was sold at an average price of $35.70, for a total transaction of $785,007.30. Following the completion of the transaction, the chief technology officer now directly owns 153,159 shares of the company's stock, valued at $5,467,776.30. This trade represents a 12.55 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 57,727 shares of company stock valued at $2,083,317 in the last three months. 7.40% of the stock is currently owned by company insiders.

Analyst Upgrades and Downgrades

Separately, Morgan Stanley boosted their price target on shares of Yelp from $34.00 to $35.00 and gave the stock an "underweight" rating in a research note on Monday, January 13th. Two equities research analysts have rated the stock with a sell rating, six have given a hold rating, one has given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $37.17.

Read Our Latest Stock Report on YELP

About Yelp

(

Free Report)

Yelp Inc operates a platform that connects consumers with local businesses in the United States and internationally. The company's platform covers various categories, including restaurants, shopping, beauty and fitness, health, and other categories, as well as home, local, auto, professional, pets, events, real estate, and financial services.

Featured Articles

Before you consider Yelp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yelp wasn't on the list.

While Yelp currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.