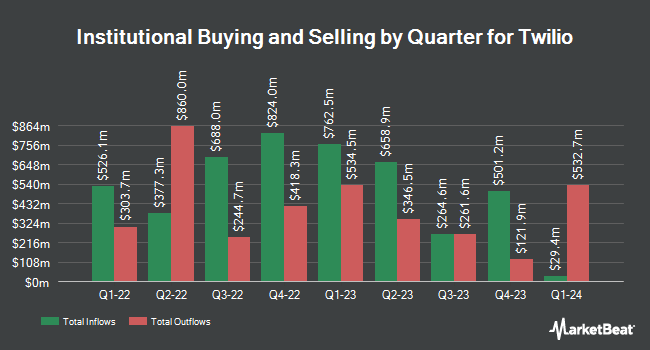

Amundi grew its position in Twilio Inc. (NYSE:TWLO - Free Report) by 53.4% in the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 517,052 shares of the technology company's stock after buying an additional 179,899 shares during the period. Amundi owned approximately 0.34% of Twilio worth $57,424,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds also recently made changes to their positions in TWLO. Pacer Advisors Inc. grew its holdings in shares of Twilio by 18.3% in the 3rd quarter. Pacer Advisors Inc. now owns 2,867,623 shares of the technology company's stock valued at $187,026,000 after buying an additional 444,295 shares during the period. Los Angeles Capital Management LLC lifted its position in Twilio by 1,267.3% in the 4th quarter. Los Angeles Capital Management LLC now owns 454,435 shares of the technology company's stock valued at $49,115,000 after acquiring an additional 421,199 shares in the last quarter. KBC Group NV lifted its position in Twilio by 1,138.4% in the 4th quarter. KBC Group NV now owns 281,174 shares of the technology company's stock valued at $30,389,000 after acquiring an additional 258,469 shares in the last quarter. Raymond James Financial Inc. bought a new stake in Twilio in the 4th quarter valued at $25,778,000. Finally, Franklin Resources Inc. lifted its position in Twilio by 2,412.9% in the 3rd quarter. Franklin Resources Inc. now owns 202,010 shares of the technology company's stock valued at $14,341,000 after acquiring an additional 193,971 shares in the last quarter. Institutional investors and hedge funds own 84.27% of the company's stock.

Insider Activity at Twilio

In other Twilio news, CFO Aidan Viggiano sold 1,391 shares of the stock in a transaction that occurred on Tuesday, February 18th. The shares were sold at an average price of $124.51, for a total transaction of $173,193.41. Following the transaction, the chief financial officer now owns 152,519 shares in the company, valued at $18,990,140.69. This represents a 0.90 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO Khozema Shipchandler sold 10,834 shares of the stock in a transaction that occurred on Monday, January 6th. The stock was sold at an average price of $113.58, for a total transaction of $1,230,525.72. Following the transaction, the chief executive officer now owns 244,971 shares in the company, valued at approximately $27,823,806.18. The trade was a 4.24 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 21,277 shares of company stock worth $2,441,324. Insiders own 4.50% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts recently commented on TWLO shares. Wells Fargo & Company boosted their price objective on shares of Twilio from $140.00 to $155.00 and gave the company an "overweight" rating in a research report on Friday, January 24th. Mizuho boosted their price objective on shares of Twilio from $140.00 to $150.00 and gave the company an "outperform" rating in a research report on Friday, January 24th. The Goldman Sachs Group raised shares of Twilio from a "neutral" rating to a "buy" rating and boosted their price objective for the company from $77.00 to $185.00 in a research report on Monday, January 27th. Tigress Financial boosted their price objective on shares of Twilio from $135.00 to $170.00 and gave the company a "buy" rating in a research report on Tuesday, February 25th. Finally, Morgan Stanley raised shares of Twilio from an "equal weight" rating to an "overweight" rating and boosted their price target for the stock from $144.00 to $160.00 in a research report on Monday, February 24th. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating, sixteen have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $134.26.

View Our Latest Report on TWLO

Twilio Stock Up 1.6 %

Shares of TWLO stock opened at $100.13 on Wednesday. The company has a debt-to-equity ratio of 0.12, a quick ratio of 5.06 and a current ratio of 5.06. The firm's 50-day moving average is $122.90 and its 200-day moving average is $97.21. The stock has a market cap of $15.36 billion, a price-to-earnings ratio of -156.46, a PEG ratio of 4.30 and a beta of 1.47. Twilio Inc. has a 52-week low of $52.51 and a 52-week high of $151.95.

Twilio (NYSE:TWLO - Get Free Report) last announced its quarterly earnings results on Thursday, February 13th. The technology company reported $0.22 EPS for the quarter, missing analysts' consensus estimates of $0.99 by ($0.77). Twilio had a negative net margin of 2.45% and a positive return on equity of 1.38%. The company had revenue of $1.19 billion during the quarter, compared to analyst estimates of $1.19 billion. Sell-side analysts predict that Twilio Inc. will post 1.44 EPS for the current year.

Twilio Company Profile

(

Free Report)

Twilio Inc, together with its subsidiaries, provides customer engagement platform solutions in the United States and internationally. It operates through two segments, Twilio Communications and Twilio Segment. The company provides various application programming interfaces and software solutions for communications between customers and end users, including messaging, voice, email, flex, marketing campaigns, and user identity and authentication.

Recommended Stories

Want to see what other hedge funds are holding TWLO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Twilio Inc. (NYSE:TWLO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Twilio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twilio wasn't on the list.

While Twilio currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.