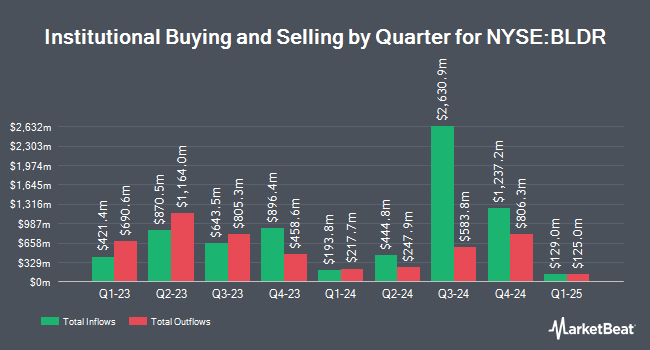

Amundi increased its holdings in shares of Builders FirstSource, Inc. (NYSE:BLDR - Free Report) by 36.0% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 427,966 shares of the company's stock after acquiring an additional 113,333 shares during the period. Amundi owned about 0.37% of Builders FirstSource worth $61,413,000 at the end of the most recent reporting period.

Several other institutional investors have also made changes to their positions in BLDR. Brooklyn Investment Group bought a new position in Builders FirstSource during the 3rd quarter valued at about $28,000. E Fund Management Hong Kong Co. Ltd. bought a new position in Builders FirstSource during the 4th quarter valued at about $33,000. SBI Securities Co. Ltd. bought a new position in Builders FirstSource during the 4th quarter valued at about $34,000. Brown Brothers Harriman & Co. bought a new position in Builders FirstSource during the 3rd quarter valued at about $46,000. Finally, Avion Wealth lifted its holdings in Builders FirstSource by 728.6% during the 4th quarter. Avion Wealth now owns 348 shares of the company's stock valued at $49,000 after purchasing an additional 306 shares during the last quarter. 95.53% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of equities analysts have weighed in on BLDR shares. BMO Capital Markets dropped their target price on shares of Builders FirstSource from $175.00 to $168.00 and set a "market perform" rating for the company in a research note on Monday, February 24th. The Goldman Sachs Group dropped their target price on shares of Builders FirstSource from $200.00 to $180.00 and set a "buy" rating for the company in a research note on Friday, February 21st. StockNews.com downgraded shares of Builders FirstSource from a "buy" rating to a "hold" rating in a research note on Monday, January 13th. Royal Bank of Canada dropped their target price on shares of Builders FirstSource from $167.00 to $162.00 and set an "outperform" rating for the company in a research note on Friday, February 21st. Finally, Benchmark dropped their target price on shares of Builders FirstSource from $200.00 to $170.00 and set a "buy" rating for the company in a research note on Friday, February 21st. Five research analysts have rated the stock with a hold rating, fifteen have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, Builders FirstSource currently has a consensus rating of "Moderate Buy" and a consensus target price of $190.72.

Get Our Latest Stock Report on Builders FirstSource

Builders FirstSource Stock Down 3.9 %

Shares of NYSE BLDR opened at $130.35 on Wednesday. The stock has a market cap of $14.81 billion, a P/E ratio of 14.39, a P/E/G ratio of 0.80 and a beta of 2.19. The firm has a 50 day moving average price of $151.23 and a 200 day moving average price of $168.86. The company has a debt-to-equity ratio of 0.86, a quick ratio of 1.16 and a current ratio of 1.77. Builders FirstSource, Inc. has a 52-week low of $127.45 and a 52-week high of $214.70.

Builders FirstSource (NYSE:BLDR - Get Free Report) last issued its quarterly earnings data on Thursday, February 20th. The company reported $2.31 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.18 by $0.13. The firm had revenue of $3.82 billion during the quarter, compared to analysts' expectations of $3.90 billion. Builders FirstSource had a net margin of 6.57% and a return on equity of 30.54%. Analysts expect that Builders FirstSource, Inc. will post 11.59 EPS for the current year.

Builders FirstSource Company Profile

(

Free Report)

Builders FirstSource, Inc, together with its subsidiaries, manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States. It offers lumber and lumber sheet goods comprising dimensional lumber, plywood, and oriented strand board products that are used in on-site house framing; manufactured products, such as wood floor and roof trusses, floor trusses, wall panels, stairs, and engineered wood products; and windows, and interior and exterior door units, as well as interior trims and custom products comprising intricate mouldings, stair parts, and columns under the Synboard brand name.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Builders FirstSource, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Builders FirstSource wasn't on the list.

While Builders FirstSource currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.