Amundi trimmed its holdings in Autodesk, Inc. (NASDAQ:ADSK - Free Report) by 2.4% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 3,132,599 shares of the software company's stock after selling 75,859 shares during the quarter. Amundi owned about 1.46% of Autodesk worth $928,394,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

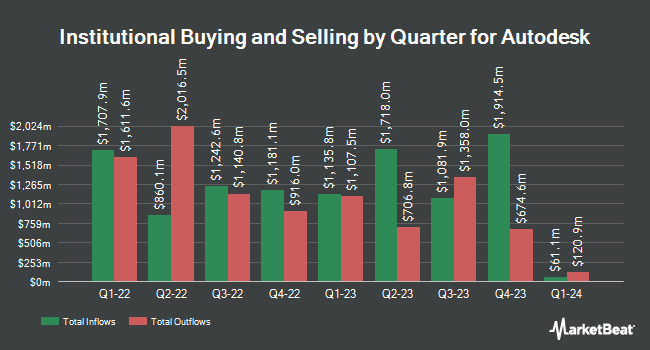

A number of other large investors also recently bought and sold shares of ADSK. Starboard Value LP purchased a new stake in shares of Autodesk during the third quarter valued at approximately $510,189,000. Bank Julius Baer & Co. Ltd Zurich purchased a new stake in Autodesk during the 4th quarter valued at $154,408,000. Massachusetts Financial Services Co. MA increased its holdings in shares of Autodesk by 394.9% in the 3rd quarter. Massachusetts Financial Services Co. MA now owns 567,360 shares of the software company's stock worth $156,296,000 after purchasing an additional 452,728 shares in the last quarter. Raymond James Financial Inc. purchased a new position in shares of Autodesk in the fourth quarter worth $116,828,000. Finally, Franklin Resources Inc. lifted its holdings in shares of Autodesk by 36.5% during the third quarter. Franklin Resources Inc. now owns 1,448,968 shares of the software company's stock valued at $413,405,000 after purchasing an additional 387,309 shares in the last quarter. 90.24% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several research firms recently commented on ADSK. Piper Sandler upgraded Autodesk from a "neutral" rating to an "overweight" rating and lifted their price objective for the stock from $311.00 to $357.00 in a report on Wednesday, January 8th. DA Davidson lifted their price target on shares of Autodesk from $275.00 to $285.00 and gave the stock a "neutral" rating in a research note on Friday, February 28th. Wells Fargo & Company raised their target price on shares of Autodesk from $340.00 to $350.00 and gave the stock an "overweight" rating in a report on Friday, November 22nd. Scotiabank initiated coverage on shares of Autodesk in a research report on Monday, November 18th. They issued a "sector outperform" rating and a $360.00 target price for the company. Finally, Bank of America increased their price target on Autodesk from $325.00 to $335.00 and gave the company a "neutral" rating in a report on Tuesday, February 4th. Seven analysts have rated the stock with a hold rating and sixteen have given a buy rating to the company. According to MarketBeat, Autodesk currently has a consensus rating of "Moderate Buy" and a consensus target price of $338.43.

Check Out Our Latest Analysis on ADSK

Autodesk Price Performance

Shares of Autodesk stock traded up $1.00 during trading hours on Wednesday, hitting $251.85. The company's stock had a trading volume of 2,431,078 shares, compared to its average volume of 1,585,376. The company has a debt-to-equity ratio of 0.76, a quick ratio of 0.65 and a current ratio of 0.65. Autodesk, Inc. has a 12-month low of $195.32 and a 12-month high of $326.62. The business has a 50 day moving average price of $291.33 and a two-hundred day moving average price of $287.90. The company has a market cap of $54.15 billion, a PE ratio of 49.97, a PEG ratio of 2.94 and a beta of 1.51.

About Autodesk

(

Free Report)

Autodesk, Inc provides 3D design, engineering, and entertainment technology solutions worldwide. The company offers AutoCAD Civil 3D, a surveying, design, analysis, and documentation solution for civil engineering, including land development, transportation, and environmental projects; BuildingConnected, a SaaS preconstruction solution; AutoCAD, a software for professional design, drafting, detailing, and visualization; AutoCAD LT, a drafting and detailing software; computer-aided manufacturing (CAM) software for computer numeric control machining, inspection, and modelling for manufacturing; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Industry Collections tools for professionals in architecture, engineering and construction, product design and manufacturing, and media and entertainment collection industries.

Read More

Before you consider Autodesk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autodesk wasn't on the list.

While Autodesk currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.