Amundi grew its stake in shares of Arcosa, Inc. (NYSE:ACA - Free Report) by 191.1% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 25,000 shares of the company's stock after acquiring an additional 16,412 shares during the quarter. Amundi owned about 0.05% of Arcosa worth $2,375,000 as of its most recent SEC filing.

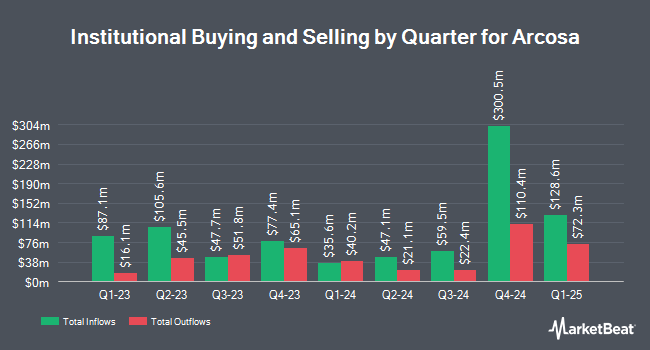

A number of other large investors have also recently made changes to their positions in the stock. Raymond James Financial Inc. bought a new stake in Arcosa in the 4th quarter worth approximately $15,919,000. Jacobs Levy Equity Management Inc. bought a new stake in shares of Arcosa in the third quarter worth $8,327,000. HighTower Advisors LLC increased its position in Arcosa by 969.5% during the third quarter. HighTower Advisors LLC now owns 72,632 shares of the company's stock valued at $6,812,000 after acquiring an additional 65,841 shares during the last quarter. Point72 Asset Management L.P. lifted its stake in shares of Arcosa by 236.8% in the 3rd quarter. Point72 Asset Management L.P. now owns 92,512 shares of the company's stock worth $8,766,000 after purchasing an additional 65,041 shares during the period. Finally, Barclays PLC raised its position in Arcosa by 330.9% in the third quarter. Barclays PLC now owns 81,782 shares of the company's stock worth $7,750,000 after acquiring an additional 62,804 shares during the period. 90.66% of the stock is currently owned by institutional investors.

Arcosa Trading Down 1.9 %

Shares of Arcosa stock traded down $1.57 on Thursday, hitting $80.25. 247,879 shares of the company traded hands, compared to its average volume of 242,404. The company has a current ratio of 3.61, a quick ratio of 2.77 and a debt-to-equity ratio of 0.51. The stock's 50 day moving average price is $93.41 and its 200-day moving average price is $96.33. The company has a market cap of $3.91 billion, a PE ratio of 30.51 and a beta of 0.81. Arcosa, Inc. has a 52 week low of $72.75 and a 52 week high of $113.43.

Arcosa Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, April 30th. Investors of record on Tuesday, April 15th will be paid a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a yield of 0.25%. The ex-dividend date of this dividend is Tuesday, April 15th. Arcosa's dividend payout ratio (DPR) is presently 10.47%.

Wall Street Analysts Forecast Growth

Separately, Oppenheimer lifted their target price on shares of Arcosa from $105.00 to $110.00 and gave the company an "outperform" rating in a research note on Tuesday, January 14th.

Read Our Latest Report on ACA

About Arcosa

(

Free Report)

Arcosa, Inc, together with its subsidiaries, provides infrastructure-related products and solutions for the construction, engineered structures, and transportation markets in the United States. It operates through three segments: Construction Products, Engineered Structures, and Transportation Products.

Featured Stories

Before you consider Arcosa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcosa wasn't on the list.

While Arcosa currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.