Amundi lifted its stake in shares of Roivant Sciences Ltd. (NASDAQ:ROIV - Free Report) by 15.0% during the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 337,515 shares of the company's stock after acquiring an additional 44,019 shares during the period. Amundi's holdings in Roivant Sciences were worth $3,719,000 at the end of the most recent reporting period.

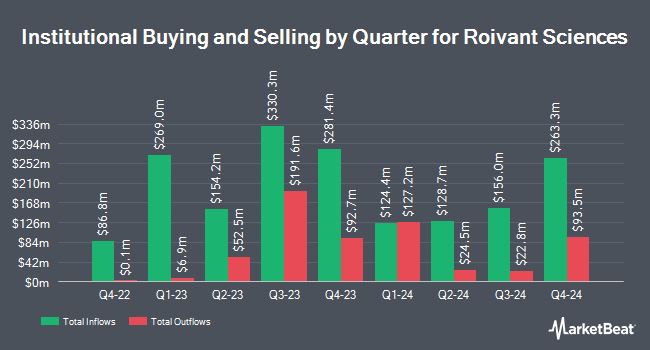

A number of other institutional investors also recently modified their holdings of ROIV. GAMMA Investing LLC increased its stake in Roivant Sciences by 57.0% during the 4th quarter. GAMMA Investing LLC now owns 3,548 shares of the company's stock valued at $42,000 after purchasing an additional 1,288 shares in the last quarter. PNC Financial Services Group Inc. increased its stake in Roivant Sciences by 27.0% during the 4th quarter. PNC Financial Services Group Inc. now owns 7,079 shares of the company's stock valued at $84,000 after purchasing an additional 1,507 shares in the last quarter. Victory Capital Management Inc. increased its stake in Roivant Sciences by 6.1% during the 4th quarter. Victory Capital Management Inc. now owns 27,494 shares of the company's stock valued at $325,000 after purchasing an additional 1,588 shares in the last quarter. M&T Bank Corp increased its stake in Roivant Sciences by 16.3% during the 4th quarter. M&T Bank Corp now owns 13,194 shares of the company's stock valued at $156,000 after purchasing an additional 1,851 shares in the last quarter. Finally, US Bancorp DE increased its stake in Roivant Sciences by 146.5% during the 3rd quarter. US Bancorp DE now owns 3,278 shares of the company's stock valued at $38,000 after purchasing an additional 1,948 shares in the last quarter. Institutional investors and hedge funds own 64.76% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts have commented on ROIV shares. Cantor Fitzgerald upgraded shares of Roivant Sciences to a "strong-buy" rating in a research note on Tuesday, March 4th. HC Wainwright restated a "buy" rating and set a $18.00 price target on shares of Roivant Sciences in a research note on Tuesday, February 11th. One analyst has rated the stock with a hold rating, five have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, Roivant Sciences presently has a consensus rating of "Buy" and an average target price of $18.08.

Read Our Latest Stock Report on ROIV

Roivant Sciences Price Performance

Shares of NASDAQ ROIV traded up $0.03 during trading on Thursday, hitting $10.97. The stock had a trading volume of 13,423,270 shares, compared to its average volume of 5,582,168. Roivant Sciences Ltd. has a 12 month low of $9.80 and a 12 month high of $13.06. The company has a market capitalization of $7.83 billion, a PE ratio of -73.13 and a beta of 1.26. The firm has a fifty day moving average of $10.78 and a two-hundred day moving average of $11.48.

Roivant Sciences (NASDAQ:ROIV - Get Free Report) last posted its earnings results on Monday, February 10th. The company reported ($0.20) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.24) by $0.04. Roivant Sciences had a negative net margin of 119.54% and a negative return on equity of 14.05%. On average, equities analysts expect that Roivant Sciences Ltd. will post -0.92 earnings per share for the current fiscal year.

Insider Activity at Roivant Sciences

In related news, CAO Rakhi Kumar sold 227,500 shares of the stock in a transaction dated Thursday, February 13th. The shares were sold at an average price of $10.43, for a total transaction of $2,372,825.00. Following the completion of the transaction, the chief accounting officer now owns 163,264 shares in the company, valued at approximately $1,702,843.52. This represents a 58.22 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, COO Eric Venker sold 100,000 shares of the stock in a transaction dated Thursday, February 20th. The shares were sold at an average price of $10.65, for a total transaction of $1,065,000.00. Following the transaction, the chief operating officer now owns 896,869 shares of the company's stock, valued at approximately $9,551,654.85. The trade was a 10.03 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 1,975,586 shares of company stock worth $22,640,661. 7.90% of the stock is owned by company insiders.

About Roivant Sciences

(

Free Report)

Roivant Sciences Ltd., a commercial-stage biopharmaceutical company, engages in the development and commercialization of medicines for inflammation and immunology areas. The company provides Vants, a model to develop and commercialize its medicines and technologies focusing on biopharmaceutical businesses, discovery-stage companies, and health technology startups.

See Also

Before you consider Roivant Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roivant Sciences wasn't on the list.

While Roivant Sciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.