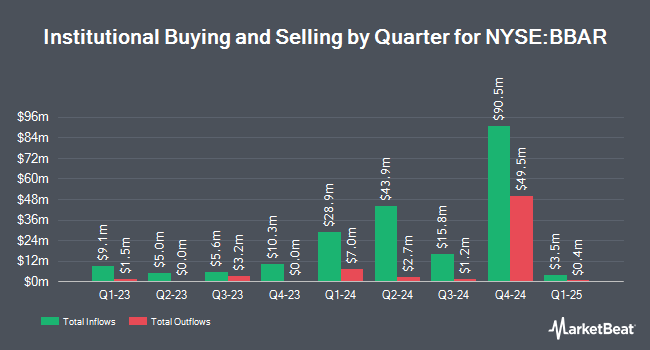

Amundi bought a new position in Banco BBVA Argentina S.A. (NYSE:BBAR - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm bought 20,781 shares of the bank's stock, valued at approximately $396,000.

A number of other institutional investors have also recently bought and sold shares of BBAR. PointState Capital LP raised its stake in Banco BBVA Argentina by 14.2% during the third quarter. PointState Capital LP now owns 1,664,893 shares of the bank's stock worth $17,265,000 after purchasing an additional 206,399 shares during the period. Sagil Capital LLP purchased a new position in shares of Banco BBVA Argentina in the 3rd quarter worth $2,131,000. TT International Asset Management LTD acquired a new position in Banco BBVA Argentina in the fourth quarter valued at $3,261,000. Mirabella Financial Services LLP purchased a new stake in Banco BBVA Argentina during the third quarter valued at about $1,155,000. Finally, Systrade AG acquired a new stake in Banco BBVA Argentina during the fourth quarter worth about $1,334,000.

Wall Street Analysts Forecast Growth

BBAR has been the topic of several research analyst reports. StockNews.com lowered Banco BBVA Argentina from a "buy" rating to a "hold" rating in a research note on Tuesday, December 24th. Morgan Stanley raised shares of Banco BBVA Argentina from an "underweight" rating to an "overweight" rating and set a $27.00 price target on the stock in a research report on Monday, December 16th.

Get Our Latest Stock Analysis on Banco BBVA Argentina

Banco BBVA Argentina Stock Down 0.0 %

NYSE:BBAR traded down $0.01 during mid-day trading on Monday, hitting $19.01. The company had a trading volume of 389,661 shares, compared to its average volume of 839,154. Banco BBVA Argentina S.A. has a 1 year low of $7.05 and a 1 year high of $25.01. The business has a fifty day simple moving average of $20.25 and a 200-day simple moving average of $16.90. The company has a current ratio of 0.99, a quick ratio of 0.99 and a debt-to-equity ratio of 0.09. The firm has a market capitalization of $3.88 billion, a price-to-earnings ratio of 9.90 and a beta of 1.41.

About Banco BBVA Argentina

(

Free Report)

Banco BBVA Argentina SA provides various banking products and services to individuals and companies in Argentina. The company provides retail banking products and services, such as checking and savings accounts, time deposits, credit cards financing, consumer and pledge loans, mortgages, insurance, and investment products to individuals; and small and medium-sized companies products and services, including financing products, factoring, checking accounts, time deposits, transactional and payroll services, insurance, and investment products to private-sector companies.

Read More

Before you consider Banco BBVA Argentina, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banco BBVA Argentina wasn't on the list.

While Banco BBVA Argentina currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.