Amundi purchased a new stake in GameStop Corp. (NYSE:GME - Free Report) in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 161,781 shares of the company's stock, valued at approximately $5,332,000.

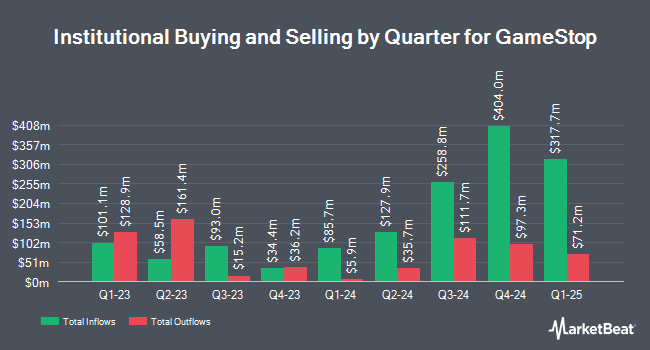

Other hedge funds also recently made changes to their positions in the company. Charles Schwab Investment Management Inc. boosted its position in shares of GameStop by 22.6% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 3,502,910 shares of the company's stock valued at $80,322,000 after purchasing an additional 646,488 shares during the period. Foundations Investment Advisors LLC purchased a new stake in GameStop in the fourth quarter valued at approximately $878,000. Swiss National Bank boosted its holdings in shares of GameStop by 46.0% in the third quarter. Swiss National Bank now owns 790,528 shares of the company's stock valued at $18,127,000 after acquiring an additional 249,100 shares during the period. Algert Global LLC grew its position in shares of GameStop by 270.5% during the third quarter. Algert Global LLC now owns 150,526 shares of the company's stock worth $3,452,000 after acquiring an additional 109,900 shares during the last quarter. Finally, Retirement Systems of Alabama increased its holdings in shares of GameStop by 41.7% in the 3rd quarter. Retirement Systems of Alabama now owns 471,156 shares of the company's stock valued at $10,804,000 after acquiring an additional 138,597 shares during the period. Hedge funds and other institutional investors own 29.21% of the company's stock.

Analyst Ratings Changes

Separately, Wedbush reiterated an "underperform" rating and set a $10.00 price target on shares of GameStop in a research note on Friday, December 6th.

Check Out Our Latest Research Report on GameStop

GameStop Stock Up 1.2 %

NYSE:GME traded up $0.28 during midday trading on Monday, reaching $23.33. The stock had a trading volume of 1,472,353 shares, compared to its average volume of 19,392,905. The stock has a market cap of $10.42 billion, a P/E ratio of 129.51 and a beta of -0.29. GameStop Corp. has a 12-month low of $9.95 and a 12-month high of $64.83. The firm has a fifty day simple moving average of $26.65 and a two-hundred day simple moving average of $25.60.

Insider Buying and Selling at GameStop

In other GameStop news, insider Daniel William Moore sold 895 shares of the firm's stock in a transaction on Friday, January 3rd. The stock was sold at an average price of $31.07, for a total value of $27,807.65. Following the completion of the sale, the insider now owns 31,385 shares of the company's stock, valued at approximately $975,131.95. This trade represents a 2.77 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, General Counsel Mark Haymond Robinson sold 1,577 shares of the company's stock in a transaction on Friday, January 3rd. The stock was sold at an average price of $31.07, for a total transaction of $48,997.39. Following the transaction, the general counsel now directly owns 42,350 shares in the company, valued at approximately $1,315,814.50. This trade represents a 3.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 12.28% of the stock is owned by corporate insiders.

GameStop Profile

(

Free Report)

GameStop Corp., a specialty retailer, provides games and entertainment products through its stores and ecommerce platforms in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, and virtual reality products; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads.

Featured Stories

Before you consider GameStop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GameStop wasn't on the list.

While GameStop currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.