Amundi lowered its position in shares of Harmony Gold Mining Company Limited (NYSE:HMY - Free Report) by 4.6% during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,118,523 shares of the mining company's stock after selling 54,041 shares during the period. Amundi owned approximately 0.18% of Harmony Gold Mining worth $9,630,000 as of its most recent SEC filing.

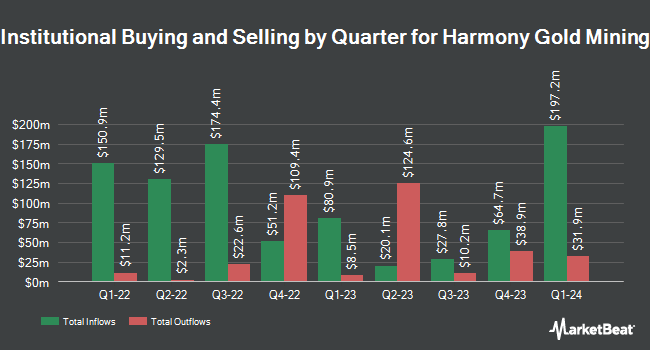

A number of other hedge funds also recently made changes to their positions in HMY. ABC Arbitrage SA bought a new stake in shares of Harmony Gold Mining in the fourth quarter worth $20,229,000. Wellington Management Group LLP lifted its holdings in Harmony Gold Mining by 76.8% during the 3rd quarter. Wellington Management Group LLP now owns 2,676,433 shares of the mining company's stock worth $27,219,000 after buying an additional 1,162,292 shares during the last quarter. Ashton Thomas Private Wealth LLC acquired a new position in shares of Harmony Gold Mining in the 4th quarter worth approximately $2,016,000. Assenagon Asset Management S.A. bought a new stake in shares of Harmony Gold Mining in the 4th quarter valued at approximately $1,804,000. Finally, SBI Securities Co. Ltd. acquired a new stake in shares of Harmony Gold Mining during the 4th quarter valued at approximately $1,478,000. Hedge funds and other institutional investors own 31.79% of the company's stock.

Harmony Gold Mining Stock Performance

Shares of Harmony Gold Mining stock traded up $0.11 during trading on Tuesday, hitting $12.42. 7,492,759 shares of the stock were exchanged, compared to its average volume of 5,054,979. The company has a debt-to-equity ratio of 0.04, a quick ratio of 1.07 and a current ratio of 1.56. Harmony Gold Mining Company Limited has a 12 month low of $7.21 and a 12 month high of $12.75. The stock's fifty day moving average is $10.87 and its 200 day moving average is $10.07. The stock has a market cap of $7.88 billion, a PE ratio of 7.35, a P/E/G ratio of 0.63 and a beta of 1.85.

Harmony Gold Mining Increases Dividend

The firm also recently declared a semi-annual dividend, which will be paid on Monday, April 21st. Stockholders of record on Friday, April 11th will be issued a dividend of $0.1245 per share. This represents a dividend yield of 0.9%. The ex-dividend date of this dividend is Friday, April 11th. This is a boost from Harmony Gold Mining's previous semi-annual dividend of $0.04. Harmony Gold Mining's payout ratio is 11.24%.

Analysts Set New Price Targets

Separately, StockNews.com raised shares of Harmony Gold Mining from a "hold" rating to a "buy" rating in a report on Friday, March 7th.

Check Out Our Latest Stock Report on HMY

Harmony Gold Mining Profile

(

Free Report)

Harmony Gold Mining Company Limited engages in the exploration, extraction, and processing of gold. The company explores for uranium, silver, copper, and molybdenum deposits. It has eight underground operations in the Witwatersrand Basin; an open-pit mine on the Kraaipan Greenstone Belt; and various surface source operations in South Africa.

Further Reading

Before you consider Harmony Gold Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harmony Gold Mining wasn't on the list.

While Harmony Gold Mining currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.