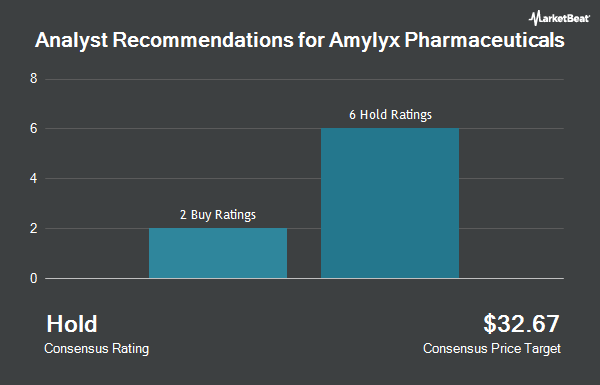

Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX - Get Free Report) has been given an average rating of "Moderate Buy" by the nine analysts that are presently covering the firm, Marketbeat.com reports. Five analysts have rated the stock with a hold recommendation, three have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average twelve-month price objective among brokerages that have covered the stock in the last year is $7.33.

Several brokerages have recently weighed in on AMLX. HC Wainwright reissued a "buy" rating and issued a $12.00 price objective on shares of Amylyx Pharmaceuticals in a research report on Wednesday. Robert W. Baird upgraded shares of Amylyx Pharmaceuticals from a "neutral" rating to an "outperform" rating and upped their price target for the company from $3.00 to $11.00 in a research note on Monday, November 18th. Finally, Baird R W upgraded shares of Amylyx Pharmaceuticals from a "hold" rating to a "strong-buy" rating in a research report on Monday, November 18th.

Check Out Our Latest Report on AMLX

Insider Buying and Selling

In other news, CEO Joshua B. Cohen sold 11,851 shares of the firm's stock in a transaction that occurred on Monday, February 3rd. The shares were sold at an average price of $3.47, for a total transaction of $41,122.97. Following the transaction, the chief executive officer now directly owns 3,201,247 shares of the company's stock, valued at approximately $11,108,327.09. This trade represents a 0.37 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Justin B. Klee sold 7,471 shares of Amylyx Pharmaceuticals stock in a transaction that occurred on Monday, January 6th. The shares were sold at an average price of $4.04, for a total transaction of $30,182.84. Following the completion of the sale, the chief executive officer now owns 3,176,788 shares of the company's stock, valued at approximately $12,834,223.52. The trade was a 0.23 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 27,169 shares of company stock valued at $97,274. 11.70% of the stock is owned by company insiders.

Institutional Trading of Amylyx Pharmaceuticals

Large investors have recently modified their holdings of the stock. FMR LLC raised its stake in Amylyx Pharmaceuticals by 292.0% in the third quarter. FMR LLC now owns 221,001 shares of the company's stock valued at $716,000 after purchasing an additional 164,622 shares in the last quarter. JPMorgan Chase & Co. raised its position in shares of Amylyx Pharmaceuticals by 144.4% in the 3rd quarter. JPMorgan Chase & Co. now owns 140,559 shares of the company's stock valued at $455,000 after buying an additional 83,048 shares in the last quarter. Alpha Wave Global LP bought a new stake in shares of Amylyx Pharmaceuticals during the 3rd quarter worth approximately $2,169,000. Barclays PLC boosted its position in shares of Amylyx Pharmaceuticals by 91.1% during the 3rd quarter. Barclays PLC now owns 84,572 shares of the company's stock worth $274,000 after acquiring an additional 40,319 shares in the last quarter. Finally, Connor Clark & Lunn Investment Management Ltd. increased its stake in Amylyx Pharmaceuticals by 41.6% in the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 880,745 shares of the company's stock valued at $2,854,000 after acquiring an additional 258,818 shares during the last quarter. 95.84% of the stock is owned by institutional investors and hedge funds.

Amylyx Pharmaceuticals Stock Up 11.6 %

Shares of NASDAQ AMLX opened at $3.36 on Thursday. The business's 50 day moving average price is $3.54 and its two-hundred day moving average price is $3.86. The company has a market cap of $230.32 million, a PE ratio of -0.88 and a beta of -0.54. Amylyx Pharmaceuticals has a twelve month low of $1.58 and a twelve month high of $19.32.

Amylyx Pharmaceuticals (NASDAQ:AMLX - Get Free Report) last posted its earnings results on Tuesday, March 4th. The company reported ($0.55) earnings per share for the quarter, missing analysts' consensus estimates of ($0.49) by ($0.06). The company had revenue of ($0.67) million during the quarter. As a group, research analysts anticipate that Amylyx Pharmaceuticals will post -2.2 EPS for the current fiscal year.

Amylyx Pharmaceuticals Company Profile

(

Get Free ReportAmylyx Pharmaceuticals, Inc, a commercial-stage biotechnology company, engages in the discovery and development of treatment for amyotrophic lateral sclerosis (ALS) and neurodegenerative diseases. The company's products include RELYVRIO, a dual UPR-Bax apoptosis inhibitor composed of sodium phenylbutyrate and taurursodiol for the treatment of ALS in adults in the United States and marketed as ALBRIOZA for the treatment of ALS in Canada.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Amylyx Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amylyx Pharmaceuticals wasn't on the list.

While Amylyx Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.