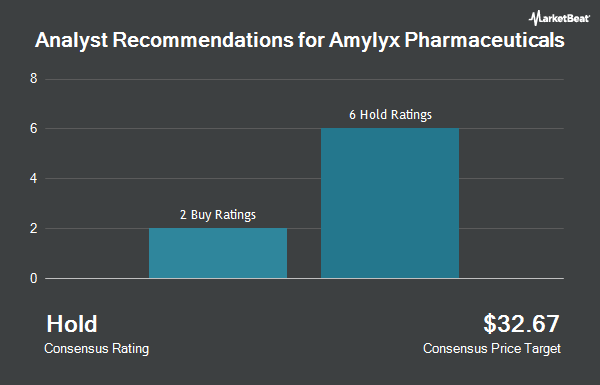

Shares of Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX - Get Free Report) have been given an average recommendation of "Moderate Buy" by the nine brokerages that are currently covering the company, Marketbeat.com reports. Five investment analysts have rated the stock with a hold rating, three have given a buy rating and one has given a strong buy rating to the company. The average 12-month price target among analysts that have covered the stock in the last year is $7.33.

Several analysts have recently issued reports on AMLX shares. Baird R W upgraded shares of Amylyx Pharmaceuticals from a "hold" rating to a "strong-buy" rating in a research report on Monday, November 18th. Leerink Partners set a $4.00 price objective on Amylyx Pharmaceuticals and gave the company a "market perform" rating in a research note on Friday, October 18th. Robert W. Baird raised Amylyx Pharmaceuticals from a "neutral" rating to an "outperform" rating and boosted their target price for the company from $3.00 to $11.00 in a research report on Monday, November 18th. Bank of America upgraded Amylyx Pharmaceuticals from a "neutral" rating to a "buy" rating and raised their price target for the stock from $4.20 to $10.00 in a research report on Wednesday, October 23rd. Finally, HC Wainwright reiterated a "buy" rating and set a $12.00 price objective on shares of Amylyx Pharmaceuticals in a research report on Thursday, December 5th.

Get Our Latest Stock Analysis on AMLX

Insider Activity at Amylyx Pharmaceuticals

In other Amylyx Pharmaceuticals news, insider Camille L. Bedrosian sold 11,442 shares of Amylyx Pharmaceuticals stock in a transaction on Monday, September 30th. The stock was sold at an average price of $3.20, for a total transaction of $36,614.40. Following the completion of the sale, the insider now directly owns 143,801 shares of the company's stock, valued at $460,163.20. The trade was a 7.37 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO Justin B. Klee sold 18,589 shares of the stock in a transaction on Monday, September 30th. The stock was sold at an average price of $3.20, for a total value of $59,484.80. Following the transaction, the chief executive officer now directly owns 3,120,569 shares in the company, valued at $9,985,820.80. The trade was a 0.59 % decrease in their position. The disclosure for this sale can be found here. 11.70% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Amylyx Pharmaceuticals

Several hedge funds have recently modified their holdings of AMLX. Barclays PLC raised its stake in Amylyx Pharmaceuticals by 91.1% in the third quarter. Barclays PLC now owns 84,572 shares of the company's stock worth $274,000 after buying an additional 40,319 shares in the last quarter. Geode Capital Management LLC increased its holdings in shares of Amylyx Pharmaceuticals by 17.5% in the 3rd quarter. Geode Capital Management LLC now owns 551,039 shares of the company's stock valued at $1,786,000 after acquiring an additional 82,173 shares during the period. Walleye Capital LLC raised its position in shares of Amylyx Pharmaceuticals by 986.5% in the 3rd quarter. Walleye Capital LLC now owns 670,594 shares of the company's stock worth $2,173,000 after acquiring an additional 608,874 shares in the last quarter. Alpha Wave Global LP purchased a new stake in shares of Amylyx Pharmaceuticals during the 3rd quarter worth $2,169,000. Finally, FMR LLC boosted its position in Amylyx Pharmaceuticals by 292.0% during the third quarter. FMR LLC now owns 221,001 shares of the company's stock valued at $716,000 after purchasing an additional 164,622 shares in the last quarter. Hedge funds and other institutional investors own 95.84% of the company's stock.

Amylyx Pharmaceuticals Trading Up 2.3 %

AMLX traded up $0.09 during trading hours on Friday, hitting $4.05. The company's stock had a trading volume of 550,776 shares, compared to its average volume of 1,921,250. Amylyx Pharmaceuticals has a 12 month low of $1.58 and a 12 month high of $19.95. The business's 50-day moving average price is $5.09 and its 200-day moving average price is $3.22. The stock has a market cap of $277.62 million, a price-to-earnings ratio of -1.06 and a beta of -0.68.

Amylyx Pharmaceuticals Company Profile

(

Get Free ReportAmylyx Pharmaceuticals, Inc, a commercial-stage biotechnology company, engages in the discovery and development of treatment for amyotrophic lateral sclerosis (ALS) and neurodegenerative diseases. The company's products include RELYVRIO, a dual UPR-Bax apoptosis inhibitor composed of sodium phenylbutyrate and taurursodiol for the treatment of ALS in adults in the United States and marketed as ALBRIOZA for the treatment of ALS in Canada.

See Also

Before you consider Amylyx Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amylyx Pharmaceuticals wasn't on the list.

While Amylyx Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.