Mizuho upgraded shares of Amylyx Pharmaceuticals (NASDAQ:AMLX - Free Report) from a neutral rating to an outperform rating in a report published on Monday, MarketBeat Ratings reports. Mizuho currently has $7.00 target price on the stock, up from their prior target price of $3.00.

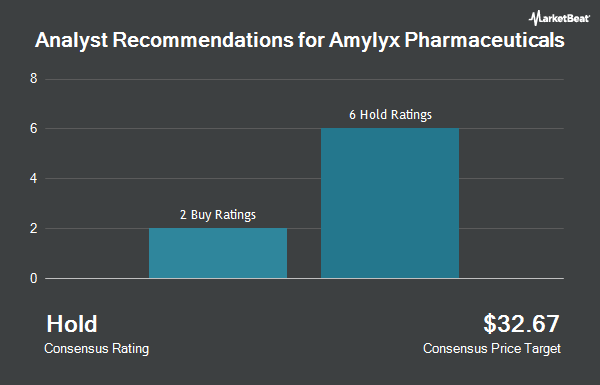

Separately, HC Wainwright reiterated a "buy" rating and issued a $12.00 target price on shares of Amylyx Pharmaceuticals in a report on Wednesday, March 5th. Two analysts have rated the stock with a hold rating, four have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, Amylyx Pharmaceuticals has an average rating of "Moderate Buy" and a consensus price target of $8.00.

Check Out Our Latest Stock Analysis on AMLX

Amylyx Pharmaceuticals Stock Up 4.6 %

Shares of AMLX stock traded up $0.16 during trading hours on Monday, hitting $3.65. 562,243 shares of the company were exchanged, compared to its average volume of 1,314,091. The firm has a fifty day moving average of $3.54 and a 200 day moving average of $4.08. Amylyx Pharmaceuticals has a 1 year low of $1.58 and a 1 year high of $7.27. The firm has a market cap of $323.40 million, a PE ratio of -0.96 and a beta of -0.53.

Amylyx Pharmaceuticals (NASDAQ:AMLX - Get Free Report) last posted its quarterly earnings results on Tuesday, March 4th. The company reported ($0.55) earnings per share for the quarter, missing analysts' consensus estimates of ($0.49) by ($0.06). The business had revenue of ($0.67) million for the quarter. Analysts expect that Amylyx Pharmaceuticals will post -2.2 earnings per share for the current year.

Insider Activity at Amylyx Pharmaceuticals

In related news, Director Bernhardt G. Zeiher purchased 10,000 shares of Amylyx Pharmaceuticals stock in a transaction that occurred on Thursday, March 20th. The shares were purchased at an average cost of $3.70 per share, with a total value of $37,000.00. Following the transaction, the director now owns 10,000 shares of the company's stock, valued at approximately $37,000. The trade was a ∞ increase in their position. The purchase was disclosed in a filing with the SEC, which can be accessed through this link. Also, CFO James M. Frates sold 10,896 shares of the company's stock in a transaction that occurred on Monday, March 31st. The stock was sold at an average price of $3.47, for a total value of $37,809.12. Following the completion of the transaction, the chief financial officer now owns 290,988 shares of the company's stock, valued at approximately $1,009,728.36. This represents a 3.61 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 64,509 shares of company stock worth $222,586. 11.70% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Amylyx Pharmaceuticals

A number of large investors have recently added to or reduced their stakes in AMLX. Blue Trust Inc. boosted its position in Amylyx Pharmaceuticals by 232.1% in the 4th quarter. Blue Trust Inc. now owns 6,987 shares of the company's stock valued at $26,000 after buying an additional 4,883 shares during the last quarter. Fox Run Management L.L.C. acquired a new position in shares of Amylyx Pharmaceuticals in the fourth quarter worth about $45,000. Alpine Global Management LLC purchased a new position in Amylyx Pharmaceuticals in the fourth quarter valued at about $45,000. RPO LLC acquired a new stake in Amylyx Pharmaceuticals during the 4th quarter valued at approximately $46,000. Finally, EntryPoint Capital LLC purchased a new stake in Amylyx Pharmaceuticals during the 4th quarter worth approximately $53,000. 95.84% of the stock is owned by institutional investors and hedge funds.

Amylyx Pharmaceuticals Company Profile

(

Get Free Report)

Amylyx Pharmaceuticals, Inc, a commercial-stage biotechnology company, engages in the discovery and development of treatment for amyotrophic lateral sclerosis (ALS) and neurodegenerative diseases. The company's products include RELYVRIO, a dual UPR-Bax apoptosis inhibitor composed of sodium phenylbutyrate and taurursodiol for the treatment of ALS in adults in the United States and marketed as ALBRIOZA for the treatment of ALS in Canada.

Featured Stories

Before you consider Amylyx Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amylyx Pharmaceuticals wasn't on the list.

While Amylyx Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.