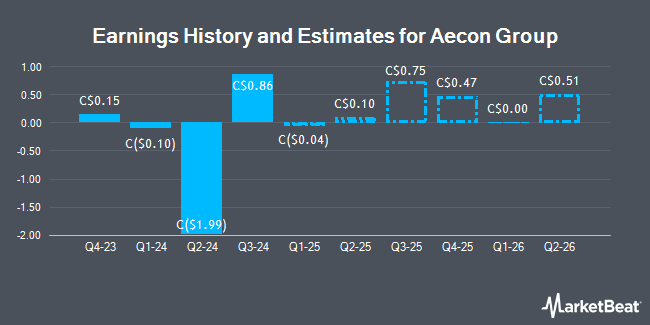

Aecon Group Inc. (TSE:ARE - Free Report) - Stifel Canada dropped their FY2024 earnings per share (EPS) estimates for Aecon Group in a research report issued to clients and investors on Sunday, November 3rd. Stifel Canada analyst I. Gillies now expects that the company will earn ($0.77) per share for the year, down from their previous forecast of ($0.46). Stifel Canada has a "Strong-Buy" rating on the stock. The consensus estimate for Aecon Group's current full-year earnings is $1.38 per share. Stifel Canada also issued estimates for Aecon Group's Q4 2024 earnings at $0.36 EPS, Q1 2025 earnings at ($0.02) EPS, Q2 2025 earnings at $0.14 EPS, Q3 2025 earnings at $0.53 EPS, Q4 2025 earnings at $0.47 EPS, Q1 2026 earnings at $0.30 EPS and Q2 2026 earnings at $0.43 EPS.

A number of other brokerages have also recently weighed in on ARE. Raymond James upped their price objective on shares of Aecon Group from C$24.00 to C$28.00 in a report on Tuesday. Royal Bank of Canada lifted their price objective on Aecon Group from C$13.00 to C$17.00 and gave the company a "sector perform" rating in a research note on Monday, July 29th. Canaccord Genuity Group increased their target price on Aecon Group from C$28.00 to C$33.00 in a research note on Monday. BMO Capital Markets raised their price target on Aecon Group from C$16.50 to C$27.00 in a report on Monday. Finally, CIBC upped their price target on shares of Aecon Group from C$25.00 to C$29.00 in a research note on Monday. Four investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and two have issued a strong buy rating to the company. According to MarketBeat.com, Aecon Group presently has a consensus rating of "Moderate Buy" and an average target price of C$25.94.

Get Our Latest Research Report on Aecon Group

Aecon Group Stock Up 0.9 %

Shares of Aecon Group stock traded up C$0.25 during trading on Wednesday, hitting C$28.85. The company's stock had a trading volume of 454,527 shares, compared to its average volume of 294,695. Aecon Group has a 52 week low of C$10.30 and a 52 week high of C$29.16. The company has a market capitalization of C$1.80 billion, a PE ratio of -105.93, a P/E/G ratio of 18.18 and a beta of 1.13. The company has a fifty day simple moving average of C$21.05 and a two-hundred day simple moving average of C$18.03. The company has a debt-to-equity ratio of 32.86, a quick ratio of 1.27 and a current ratio of 1.35.

Insiders Place Their Bets

In other news, Senior Officer Timothy John Murphy purchased 4,244 shares of the company's stock in a transaction dated Thursday, August 8th. The shares were purchased at an average cost of C$17.66 per share, for a total transaction of C$74,969.84. 0.82% of the stock is currently owned by insiders.

Aecon Group Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Wednesday, October 2nd. Investors of record on Wednesday, October 2nd were issued a $0.19 dividend. This represents a $0.76 annualized dividend and a yield of 2.63%. The ex-dividend date of this dividend was Friday, September 20th. Aecon Group's dividend payout ratio is currently -281.48%.

About Aecon Group

(

Get Free Report)

Aecon Group Inc, together with its subsidiaries, provide construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally. It operates through two segments, Construction and Concessions. The Construction segment focuses on civil infrastructure, urban transportation solutions, nuclear power infrastructure, utility infrastructure, and conventional industrial infrastructure market sectors.

Featured Stories

Before you consider Aecon Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aecon Group wasn't on the list.

While Aecon Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.