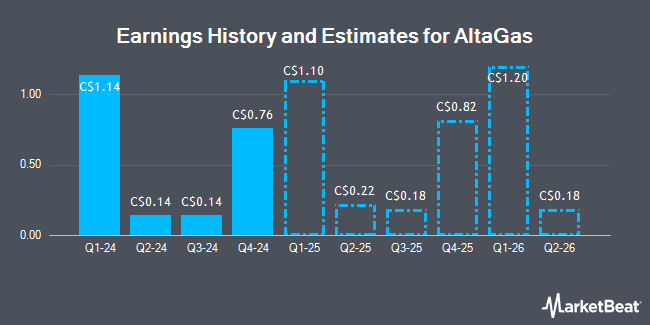

AltaGas Ltd. (TSE:ALA - Free Report) - Analysts at National Bank Financial issued their FY2026 earnings per share estimates for shares of AltaGas in a report released on Monday, January 6th. National Bank Financial analyst P. Kenny anticipates that the company will earn $2.48 per share for the year. The consensus estimate for AltaGas' current full-year earnings is $2.30 per share. National Bank Financial also issued estimates for AltaGas' FY2027 earnings at $2.89 EPS.

Other equities analysts have also recently issued research reports about the stock. Scotiabank raised their target price on shares of AltaGas from C$38.00 to C$39.00 and gave the stock an "outperform" rating in a report on Thursday, October 24th. JPMorgan Chase & Co. cut AltaGas from an "overweight" rating to a "neutral" rating and increased their price target for the stock from C$36.00 to C$37.00 in a research report on Wednesday, October 23rd. CIBC boosted their price objective on AltaGas from C$40.00 to C$42.00 and gave the company an "outperform" rating in a research report on Thursday. Royal Bank of Canada increased their target price on AltaGas from C$37.00 to C$40.00 and gave the stock an "outperform" rating in a research report on Thursday, October 3rd. Finally, Jefferies Financial Group raised their target price on AltaGas from C$37.00 to C$39.00 and gave the company a "buy" rating in a research note on Monday, September 30th. One research analyst has rated the stock with a hold rating and nine have issued a buy rating to the company. According to data from MarketBeat.com, AltaGas currently has a consensus rating of "Moderate Buy" and a consensus price target of C$38.30.

View Our Latest Analysis on ALA

AltaGas Stock Performance

Shares of AltaGas stock traded down C$0.18 during trading hours on Thursday, reaching C$33.94. The company's stock had a trading volume of 1,028,592 shares, compared to its average volume of 792,229. AltaGas has a one year low of C$26.91 and a one year high of C$35.77. The company's 50 day simple moving average is C$33.62 and its 200 day simple moving average is C$33.06. The company has a debt-to-equity ratio of 115.50, a quick ratio of 0.44 and a current ratio of 0.85. The stock has a market cap of C$10.09 billion, a P/E ratio of 23.41, a price-to-earnings-growth ratio of -4.97 and a beta of 1.23.

AltaGas Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Tuesday, December 31st. Stockholders of record on Tuesday, December 31st were issued a $0.298 dividend. This represents a $1.19 annualized dividend and a dividend yield of 3.51%. The ex-dividend date of this dividend was Monday, December 16th. AltaGas's payout ratio is currently 82.07%.

Insider Activity at AltaGas

In related news, Senior Officer Vernon Dai-Chung Yu bought 7,600 shares of the firm's stock in a transaction dated Friday, December 13th. The stock was bought at an average cost of C$32.97 per share, for a total transaction of C$250,549.20. 0.58% of the stock is currently owned by company insiders.

About AltaGas

(

Get Free Report)

AltaGas Ltd. operates as an energy infrastructure company in North America. The company operates through Utilities and Midstream segments. The Utilities segment owns and operates franchised, cost-of-service, rate-regulated natural gas distribution and storage utilities in Maryland, Virginia, Delaware, Pennsylvania, Ohio, and the District of Columbia serving approximately 1.6 million customers.

Read More

Before you consider AltaGas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AltaGas wasn't on the list.

While AltaGas currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.